[ad_1]

About the only thing people remember about Jay Gould, the biggest robber of the Robber Barons, is Black Friday, the day in September 1869 when he blew up the stock market – and just about every other market, from metals to grains — in a failed bid to corner gold. It’s because of Black Friday that the Joseph Pulitzer called him “sinister,” the New York Times called him Mephistopheles and Mark Twain called him “the mightiest disaster to ever befall this country.”

Black Friday could have been the end of Gould, a ruthless and cunning stock-price manipulator who couldn’t look people in the eye. Had he not bribed judges to escape creditors and prosecutors, he might have ended up penniless. But he survived and somewhat cleaned up his act. He went on to create a giant fortune by, like Warren Buffett and Berkshire Hathaway

BRK.A,

BRK.B,

buying great businesses and holding on for years.

With the profits he made on telegraph giant Western Union, the Union Pacific transcontinental railroad and other leading companies, Gould accumulated enough wealth to rank high in contemporary lists of all-time richest Americans.

Most great fortunes are made by building giant corporations. Think of Bill Gates and Microsoft

MSFT,

Jeff Bezos and Amazon , Sam Walton and Walmart

WMT,

and, in earlier age, Henry Ford and Ford Motor Co.

F,

Gould is the only fat cat apart from Buffett who did it by being a great investor.

What can we learn from Gould, who was worth more than $80 billion when he died 130 years ago (when calculated as a percentage of GDP, the accepted way to measure wealth across time)? What secrets does he offer about making money on Wall Street?

Well, we can’t bribe judges. We can’t get someone like Boss Tweed, the New York City power broker and one of Gould’s associates, to pass laws at our bidding. Nor can we engage in insider trading, self-dealing, and pump-and-dump trading schemes. Despite being considered morally reprehensible, these tricks were perfectly legal in Gould’s day and routinely practiced.

But we can put some of his techniques to profitable — and legal — use.

-

Get the facts. Gould devoured newspapers, credit reports and tip sheets. He traded gossip all day and, after having dinner at home with his family, went to hotel bars to trade more information at night. A contemporary Gould would be all over Twitter

TWTR,

+0.43% ,

reddit, MarketWatch and other websites, looking for nuggets of information and gauging the mood of the market. - Be patient. Gould said the only stock not plentiful on Wall Street is the stock of patience. He failed in his first attempt to buy Western Union. But he kept his eye on it and eventually won the prize at an agreeable price.

- Know the numbers. Gould didn’t invest on hunches. If he bought a railroad, he knew the price it paid workers, what it paid for coal and how much its competitors charged customers. So much of what passes for analysis today is nothing more than regurgitation of company statements. Such thin research won’t get an investor far.

- Read everything, not just stuff about investing. Gould read the classics. He read Dickens. He read history. His broad knowledge gave him perspective that helped him stay calm under fire.

- Go against the grain. Gould made his first fortune by buying railroad bonds that no one else wanted at 10 cents on the dollar.

- Stay liquid. The panic of 1873 started one of the longest recessions in U.S. history. Gould lost a fortune. But he was never illiquid. As stock prices became ridiculously cheap, he plowed in. Although the panic wiped out some of the biggest names on Wall Street, it was among the best things to ever happen to Gould.

- Work hard, but don’t forget your health. When Gould was a boy growing up on a farm, he rose before dawn to study Latin and algebra by candlelight. By the time he was 15, he was working multiple jobs. He slept so little that he caught typhoid fever, and it almost killed him. Gould suffered respiratory issues the rest of his life and died at age 56, before he had time to whitewash his reputation by, like fellow robber baron Cornelius Vanderbilt, endowing a university or, like Andrew Carnegie, another robber baron, building a concert hall and a nationwide network of libraries.

-

Beware of short squeezes. The trouble with shorting stocks is that potential losses are infinite. Gould would sometimes go short but more often took the other side, buying stocks that were heavily shorted, gobbling up all the supply and charging top dollar when the sellers had to return borrowed shares. Of course, those who shorted Gamestop

GME,

+1.38%

or AMC Entertainment

AMC,

+1.78%

know this lesson already. - Know the law and legal procedure. Even when he didn’t have a judge in his pocket, he fared well in court. Why? Because he knew what was allowed and knew that his adversaries would settle for pennies on the dollar just to be done with him.

Simon & Schuster

But the most important lesson we can learn from Gould is one that his victims learned the hard way: Investors should watch what people do, not what they say.

Gould appreciated that people were gullible. A corporate chieftain might be spewing lies, but his listeners take it to the bank because of a tendency to believe what’s said by people in power. Gould exploited that weakness. He lied all the time, promising rosy profits when he was selling and forecasting collapse when he was buying. Those who believed him suffered the consequences.

Should we believe whatever Elon Musk says about Tesla

TSLA,

? Would Gould?

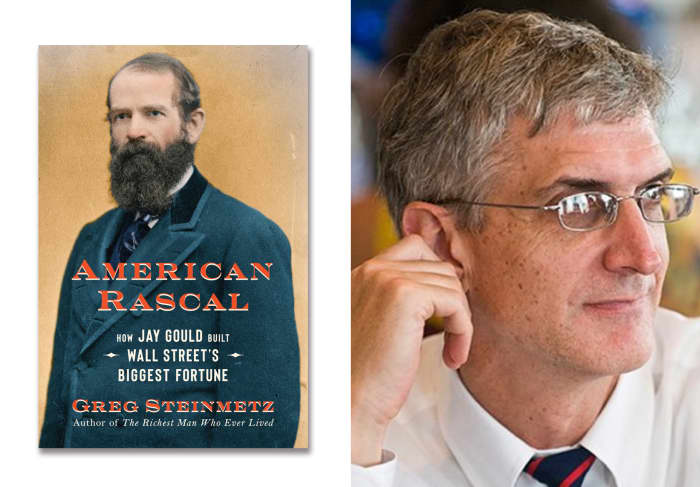

Greg Steinmetz is the author of “American Rascal: How Jay Gould Built Wall Street’s Biggest Fortune”. He is a partner at a money management firm in New York.

More from MarketWatch

To be a better investor, read more good novels

7 money-making lessons from the richest man who ever lived

These 3 tough questions about a company’s CEO can help investors spot opportunities that others miss

Here’s the best way to spot stock-market winners, according to this 25-year tech analyst

[ad_2]

Source link