[ad_1]

After a years-long bull market in growth stocks, the beleaguered value strategy has outperformed this year, as rising interest rates apply pressure on equities.

Below is a screen of large-cap value stocks that have growth characteristics. This may serve as a starting point for your own stock-selection research in a difficult market environment.

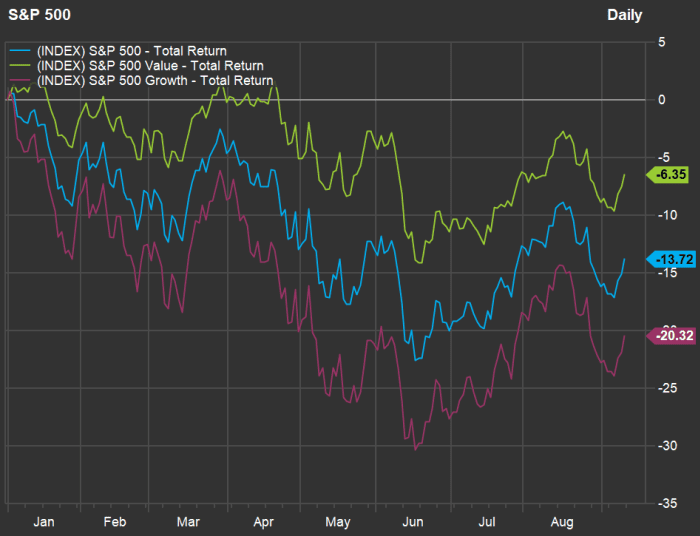

First, let’s look at the this year’s performance of the S&P 500

SPX,

and two of its subsets, the S&P 500 Value Index and the S&P 500 Growth Index, through Sept. 9:

FactSet

You can see that the S&P500 Value Index has held up much better than the S&P 500 Growth Index during 2022.

Companies in the value camp generally are expected to grow less rapidly than those in the growth camp, while the value stocks also tend to trade lower to expected earnings and sales. Mature companies might seem more likely to be considered value stocks. However, there are plenty of examples of mature companies that continue to grow rapidly.

The S&P 500 Value Index is made up of 446 companies drawn from the full S&P 500 that rank highest in a composite score developed by S&P Dow Jones Indices that encompasses valuations to book value, earnings and sales. You can read more about S&P Dow Jones Indices’ value/growth “style basket” methodology here.

Screening value stocks for growth potential

Beginning with the 446 constituents of the S&P 500 Value Index, the initial screen reduced the list of stocks to 432 for which consensus sales and earnings-per-share estimates are available through calendar 2024 among at least five analysts polled by FactSet. We used calendar-year estimates because many companies have fiscal years that don’t match the calendar.

We then went further to screen out any company expected to show a net loss for calendar 2022, 2023 or 2024. This brought the screen down to 422 companies.

Among those 422 companies in the S&P 500 Value Index, here are the 20 with the highest expected two-year compound annual growth rates (CAGR) for sales through 2024:

| Company | Ticker | Two-year estimated sales CAGR through 2024 | Estimated sales – 2022 ($bil.) | Estimated sales – 2023 ($bil.) | Estimated sales – 2024 ($bil.) |

| Take-Two Interactive Software Inc. |

TTWO, |

26.3% | $5,302 | $7,482 | $8,454 |

| SolarEdge Technologies Inc. |

SEDG, |

24.4% | $3,072 | $3,909 | $4,752 |

| Paycom Software Inc. |

PAYC, |

22.4% | $1,355 | $1,663 | $2,031 |

| Ceridian HCM Holding Inc. |

CDAY, |

16.8% | $1,228 | $1,434 | $1,674 |

| Twitter Inc. |

TWTR, |

16.7% | $5,287 | $6,034 | $7,205 |

| Mastercard Inc. Class A |

MA, |

16.0% | $22,260 | $25,814 | $29,929 |

| Prologis Inc. |

PLD, |

15.6% | $4,673 | $5,486 | $6,243 |

| Salesforce Inc. |

CRM, |

15.5% | $30,657 | $35,244 | $40,875 |

| Abiomed Inc. |

ABMD, |

15.3% | $1,123 | $1,292 | $1,494 |

| Incyte Corp. |

INCY, |

14.6% | $3,391 | $3,918 | $4,453 |

| Illumina Inc. |

ILMN, |

14.3% | $4,733 | $5,453 | $6,180 |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

14.1% | $269,039 | $335,270 | $350,527 |

| PayPal Holdings Inc. |

PYPL, |

14.1% | $27,858 | $31,703 | $36,285 |

| Chipotle Mexican Grill Inc. |

CMG, |

13.7% | $8,744 | $9,940 | $11,303 |

| Aptiv PLC |

APTV, |

13.7% | $17,190 | $19,619 | $22,212 |

| Intuitive Surgical Inc. |

ISRG, |

13.6% | $6,212 | $7,004 | $8,019 |

| Celanese Corp. |

CE, |

13.3% | $9,561 | $10,989 | $12,266 |

| Autodesk Inc. |

ADSK, |

13.2% | $4,965 | $5,598 | $6,359 |

| Booking Holdings Inc. |

BKNG, |

12.6% | $16,859 | $19,179 | $21,366 |

| Activision Blizzard Inc. |

ATVI, |

12.5% | $8,016 | $9,612 | $10,146 |

| Source: FactSet | |||||

Click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on MarketWatch quote pages.

A stock screen such as this one highlights only one factor. If you see any company on the list that is of interest, you should then do your own research to form your own opinion about how likely a company is to remain competitive over the next decade.

The company ranking highest on the list is Take-Two Interactive Software Inc.

TTWO,

which develops the Grand Theft Auto videogames through its Rockstar Games label. The most recent release in that series was GTA V, which came out in 2013, but is still actively supported.

Jefferies analyst Andrew Uerkwitz rates Take-Two a “buy” and has included the company on his firm’s “Franchise Picks” list. Take-Two’s expected 26.3% sales CAGR from 2022 through 2024 may reflect the expectation that GTA VI will be released.

In a note to clients on Sept. 9, Uerkwitz made clear that he doesn’t know when the game will be released, but also wrote: “What we do have confidence in is that when it gets announced, we’ll see a rerating in the valuation and consistent stock appreciation as excitement and anticipation builds.”

“We will happily wait patiently,” he added.

Many analysts agree with him, as you can see on this summary of analysts’ opinions of the group:

| Company | Ticker | Share “buy” ratings | Share neutral ratings | Share “sell” ratings | Closing price – Sept. 9 | Consensus price target | Implied 12-month upside potential |

| Take-Two Interactive Software Inc. |

TTWO, |

74% | 26% | 0% | $127.78 | $164.08 | 28% |

| SolarEdge Technologies Inc. |

SEDG, |

73% | 23% | 4% | $313.00 | $367.63 | 17% |

| Paycom Software Inc. |

PAYC, |

70% | 30% | 0% | $370.17 | $398.61 | 8% |

| Ceridian HCM Holding Inc. |

CDAY, |

56% | 38% | 6% | $63.57 | $71.38 | 12% |

| Twitter Inc. |

TWTR, |

0% | 94% | 6% | $42.19 | $41.51 | -2% |

| Mastercard Inc. Class A |

MA, |

92% | 8% | 0% | $335.85 | $425.48 | 27% |

| Prologis Inc. |

PLD, |

75% | 25% | 0% | $129.63 | $161.93 | 25% |

| Salesforce Inc. |

CRM, |

86% | 14% | 0% | $162.59 | $221.07 | 36% |

| Abiomed Inc. |

ABMD, |

40% | 50% | 10% | $282.28 | $328.33 | 16% |

| Incyte Corp. |

INCY, |

52% | 43% | 5% | $72.20 | $88.35 | 22% |

| Illumina Inc. |

ILMN, |

28% | 55% | 17% | $210.35 | $242.69 | 15% |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

29% | 71% | 0% | $285.77 | $356.62 | 25% |

| PayPal Holdings Inc. |

PYPL, |

71% | 29% | 0% | $96.23 | $119.39 | 24% |

| Chipotle Mexican Grill Inc. |

CMG, |

70% | 30% | 0% | $1,723.32 | $1,781.77 | 3% |

| Aptiv PLC |

APTV, |

74% | 19% | 7% | $96.74 | $130.41 | 35% |

| Intuitive Surgical Inc. |

ISRG, |

64% | 32% | 4% | $221.32 | $255.19 | 15% |

| Celanese Corp. |

CE, |

54% | 38% | 8% | $115.29 | $145.14 | 26% |

| Autodesk Inc. |

ADSK, |

70% | 26% | 4% | $211.68 | $256.30 | 21% |

| Booking Holdings Inc. |

BKNG, |

66% | 31% | 3% | $1,981.03 | $2,397.46 | 21% |

| Activision Blizzard Inc. |

ATVI, |

46% | 54% | 0% | $78.51 | $93.59 | 19% |

| Source: FactSet | |||||||

Don’t miss: 12 semiconductor stocks bucking the downcycle trend

And for income: Preferred stocks can offer hidden opportunities for dividend investors. Just look at this JPMorgan Chase example.

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on Sept. 21 and 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.

[ad_2]

Source link