[ad_1]

Investors scrambled for reasons to explain a sharp stock market surge Tuesday that saw the Dow Jones Industrial Average jump nearly 500 points as major indexes turned in their best performance in a month. A look at the calendar may offer the best explanation, argued Fundstrat co-founder Tom Lee.

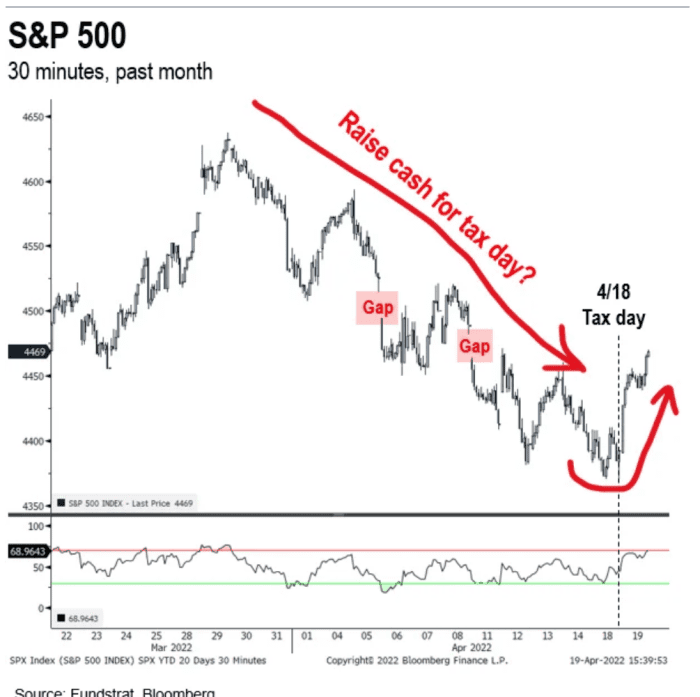

“Equities have fallen in a straight line since late March (13 trading sessions) and the decline continued into April 18th,” the deadline for filing federal income tax returns, Lee said in a Tuesday note.

The note highlighted research that shows stocks have tended to suffer in the runup to “tax day,” as investors raise cash to pay Uncle Sam, often followed by a sustained bounce in years when investors face hefty tax bills (see chart below).

Fundstrat

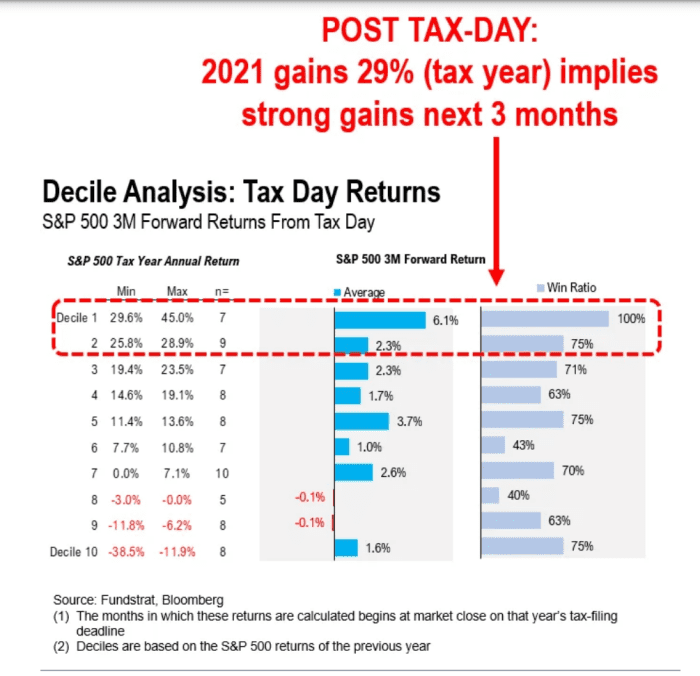

They faced a doozy after another big up year for equities in 2021, Fundstrat has estimated, putting total capital-gains taxes on equities at a record of more than $800 billion, along with another $150 billion or more for crypto-related capital gains.

Fundstrat found that since 1945, post-tax day returns have been strongest following a big up year for the S&P 500

SPX,

defined as in the top two deciles. The 29% advance for the S&P 500 last year was just shy of the cutoff for the top decile at 29.6% (see chart below).

The Dow

DJIA,

jumped 499.51 points, or 1.5%, Tuesday to close at 34,911.20, while the S&P 500 rose 1.6% and the Nasdaq Composite

COMP,

advanced 2.2% — the biggest percentage gains for all three indexes since March 16, according to Dow Jones Market Data.

[ad_2]

Source link