[ad_1]

EUR/USD, DAX, Euro Analysis

German DAX rises above trendline resistance, at least temporarily

The German Dax 40 has experienced its second day of gains despite the elevated concerns surrounding the consequences that may arise if Germany (Europe’s largest economy) issues a complete embargo against all Russian energy products (including gas).

As global leaders impose harsher bans and sanctions against Russia, Germany has come under rigorous scrutiny from Western allies who are not as dependent on Russian oil and gas.

Visit the DailyFX Educational Center to discover the impact of politics on global markets

Although an immediate withdrawal would likely cripple the already fragile Russian economy, the decision to do so would exacerbate supply constraints, driving inflation higher. While these concerns are likely to persist for the duration of the war, the performance weighted DAX has managed to hold onto recent gains with the CAC 40 following suit.

Germany 40 (DAX) Technical Analysis

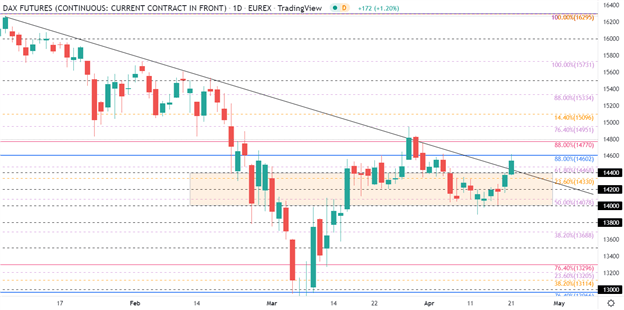

In my article yesterday, I discussed the importance of the 14,000 – 14,400 range which has provided both support and resistance for the index throughout this month. After bulls failed to push through the 61.8% Fibonacci (Feb – March 2022 move) level of 14,468 in early April, price action retreated back into the zone discussed above, before bouncing off of the 14,000 handle.

DAX 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

As buyers manage to recover back above 14,400, they will need to maintain favor above 14,600 which was temporarily tested earlier today. If DAX is able to clear this level, the 14,770 handle may provide additional resistance which then leaves the door open for the March high at 14,951.

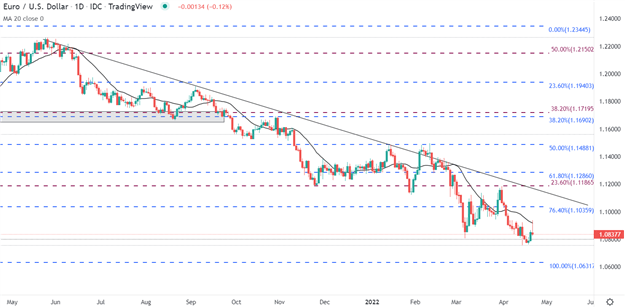

EUR/USD bounces off support but bulls have a long way to go

With investors pricing in Europe’s uncertain geopolitical backdrop and a 50 basis point rate hike to be announced at the next FOMC meeting (4th May), the EUR/USD continued to fall against the Dollar until reaching a huge zone of support at the key psychological level of 1.0800 which continues to hold bears at bay.

For all market-moving data releases and events, see the DailyFX Economic Calendar

However, with recent hawkish commentary suggesting that the ECB (European Central Bank) could begin to hike rates as early as July, the Euro gained, muting the downward move.

For the bearish trajectory to prevail, bears would need to push below the 1.0800 handle with the next level of support residing at 1.063 (the March 2020 low). A break below this level then paves the way for a retest of the 2016 low at 1.038.

EUR/USD Daily Chart

Chart prepared by Tammy Da Costa using TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link