[ad_1]

Gold Technical Outlook:

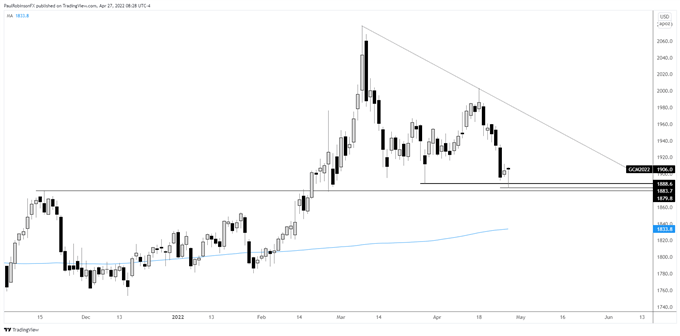

- Gold is holding onto the March low thus far at 1888

- USD strength is hurting precious metals, but extremely extended

Gold has been hurt recently by dollar strength, but bullishness in the USD is at an extreme that could lead to its setback and thus help gold lift off support. Currently, the 10-day correlation between gold and the DXY is -0.88, which means they are moving almost diametrically in opposite directions.

I don’t like to get caught up on correlations, especially using short-term inputs, but it’s clear here that the dollar is hurting gold. Even without looking at metrics it isn’t hard to surmise that USD bullishness is high.

But let’s look at one metric. The DSI (Daily Sentiment Index), a measure of futures traders’ sentiment, shows 95% bullishness. Couple this with the March 2020 high at 102.99 as resistance, and we have conditions for a USD correction/reversal. This should alleviate some downward pressure on gold.

The March low for gold is thus far holding at 1888, with it having punctured it very briefly in overnight trading and leading to a reversal higher already. The fact gold popped back so quickly after taking out support bodes well for it to continue to hold up. As long as we don’t see a daily close below 1888, then the outlook appears neutral at worst.

Looking higher, there is immediate resistance around 1916/19, but not viewed as major. A rally towards the trend-line off the record high looks like a reasonable target if we get a boost from USD weakness. Risk/reward generally speaking from support at this point is attractive even if the trend-line objective is not met.

Gold Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at@PaulRobinsonFX

[ad_2]

Source link