[ad_1]

Canadian Dollar Talking Points

USD/CAD fails to extend the series of lower highs and lows from earlier this week as it retraces the decline following the Federal Reserve interest rate decision, but the opening range for May warns of a larger pullback in the exchange rate amid the failed attempt to test the 2021 high (1.2964).

USD/CAD Rate Outlook Mired by Failure to Test 2021 High

USD/CAD bounces back from a fresh weekly low (1.2714) on the back of US Dollar strength, and it seems as though the recent shift in investor confidence is benefitting the Greenback as the US stock market comes under pressure.

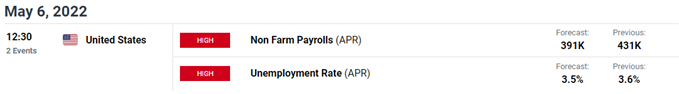

It remains to be seen if the update to the US Non-Farm Payrolls (NFP) report will influence USD/CAD as the Federal Open Market Committee (FOMC) insists that “additional 50 basis point increases should be on the table at the next couple of meetings,” and a 391K rise in employment may keep the central bank on track to normalize monetary policy at a faster pace as the “labor market is extremely tight.”

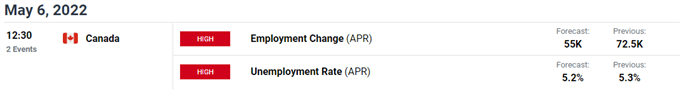

At the same time, Canada’s Employment report may encourage the Bank of Canada (BoC) to follow a similar approach as the economy is expected to add 55K jobs in April, and the central bank may deliver another 50bp rate hike at its next meeting on June 1 as “growth looks to have been stronger in the first quarter than projected in January and is likely to pick up in the second quarter.”

As a result, the developments may lead to a kneejerk reaction USD/CAD as the figures are likely to have a limited impact on the monetary policy outlook, and a further change in investor confidence may keep the exchange rate afloat as the Greenback benefits from the deterioration in risk appetite.

In turn, USD/CAD may appreciate over the coming days as it snaps the series of lower highs and lows from earlier this week, and a further advance in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

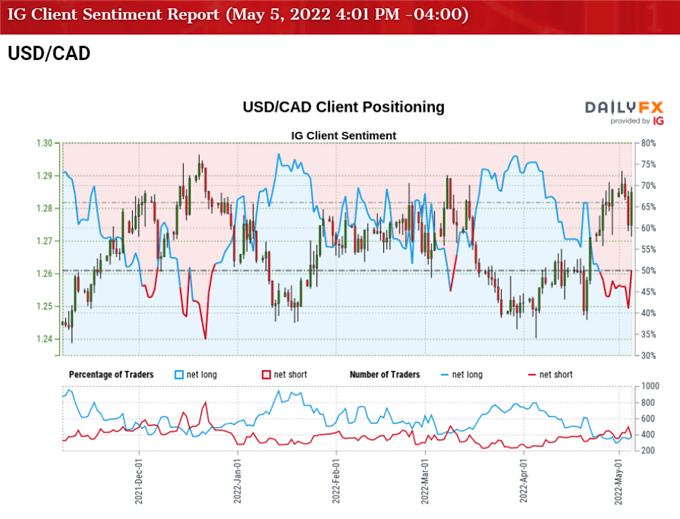

The IG Client Sentiment report shows 49.86% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.01 to 1.

The number of traders net-long is 6.70% lower than yesterday and 2.84% higher from last week, while the number of traders net-short is 24.01% lower than yesterday and 10.78% lower from last week. The rise in net-long position comes as USD/CAD retraces the decline following the Fed rate decision, while the drop in net-short interest has alleviated the recent flip in retail sentiment as 49.03% of traders were net-long the pair earlier this week.

With that said, swings in investor confidence may sway USD/CAD over the coming days as the US and Canada employment report may do little to sway the FOMC and BoC, and recent price action raises the scope for a larger advance in the exchange rate as it snaps the series of lower highs and lows from earlier this week.

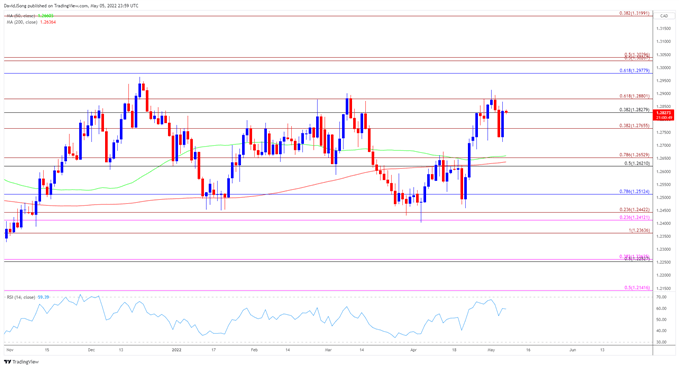

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, USD/CAD reversed course ahead of the April low (1.2403) as it failed to push below the Fibonacci overlap around 1.2410 (23.6% expansion) to 1.2440 (23.6% expansion), with the exchange rate clearing the March high (1.2901) at the start of the month as it traded to a fresh yearly high (1.2914).

- However, lack of momentum to test the 2021 high (1.2964) may lead to a larger pullback in USD/CAD as the recent rally in the exchange rate fails to push the Relative Strength Index (RSI) into overbought territory, with the opening range for May in focus for the week ahead as price struggles to hold above the Fibonacci overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion).

- Failure to hold above the 1.2770 (38.2% expansion) region may lead USD/CAD to threaten the opening range for May, with a move below the monthly low (1.2714) raising the scope for a run at the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) area.

- Need a close above the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) to bring the 2021 high (1.2964) back on the radar, with a 1.2980 (61.8% retracement) region opening up the 1.3030 (50% expansion) to 1.3040 (50% expansion) area.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Source link