[ad_1]

The last five weeks has been brutal for digital currencies as more than 21% has been shaved off the crypto economy’s fiat value since March 27. While all the crypto assets combined shed roughly 0.8% in the last 24 hours, bitcoin has lost 9.4% since last week and seven day statistics show ethereum has dropped 8.1% against the U.S. dollar. Since the crypto economy’s significant losses, the stablecoin UST has managed to take the top ten market capitalization among 13,439 crypto assets.

3 Stablecoins Hold Top 10 Positions, Terrausd Enters the 10th Spot

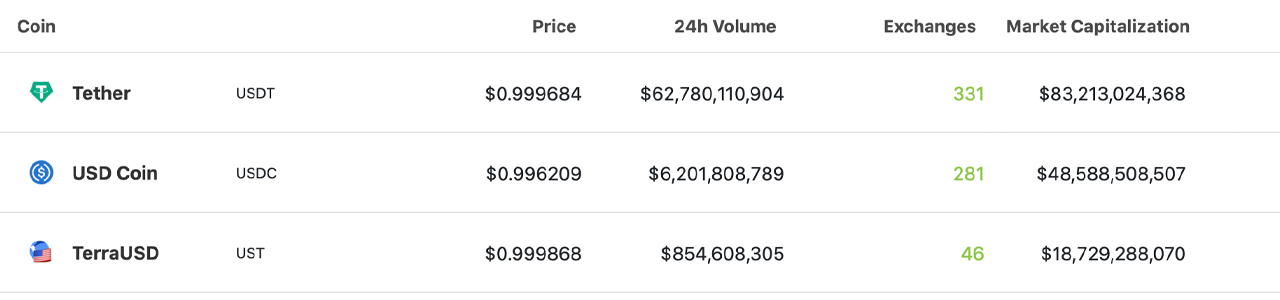

Today, three stablecoins now command a position in the top ten largest cryptocurrency market capitalizations. While tether (USDT) and usd coin (USDC) have been in the top ten for quite some time, Terra’s UST is now holding the top ten spot since the crypto economy’s market conditions turned red. Another fundamental that pushed UST higher is the fact that the algorithmic stablecoin’s market valuation expanded by 12.3% over the last 30 days.

There hasnt been another time when three stablecoins command a top ten position and fiat-pegged tokens have been a prominent force in the crypto ecosystem. Tether (USDT) has a significantly large $83.3 billion market capitalization, which represents 4.78% of the entire crypto economy.

USDC has $48.7 billion market capitalization, which equates to 2.79% of the $1.7 trillion crypto economy. Terrausd (UST) has a valuation of around $18.76 billion and it represents 1.07% of the aggregate value of all 13,439 crypto assets combined.

5 Crypto Assets Represent 66.44% of the Crypto Economy, BUSD and DAI Hold Positions in the Top 20

Between all three of the stablecoins in the top ten, USDT, USDC, and UST represent 8.64% of the crypto economy’s fiat value. That’s pretty large seeing how bitcoin’s (BTC) market valuation is 39.2% and ethereum’s (ETH) capitalization is 18.6% of today’s $1.7 trillion total.

BTC, ETH, USDT, USDC, and UST equate to 66.44% of the entire crypto economy’s capitalization on May 6, 2022. In addition to the prominence of three stablecoins in the top ten crypto market positions, the Binance stablecoin BUSD is currently in the 11th spot with a $17.5 billion market cap.

Besides USDT, USDC, and UST, there’s only two stablecoin projects in the top 20 largest crypto market valuations. The stablecoins include BUSD and Makerdao’s decentralized stablecoin DAI.

Years ago when stablecoins were scoffed at and taken for granted, it’s likely no one thought the fiat-pegged token project’s would be top ten contenders. Furthermore, the entire lot of stablecoins today is worth $189.52 billion. Out of today’s $110.46 billion in global trade volume, stablecoin swaps represent $75.82 billion of Friday’s volume.

What do you think about the fact that three stablecoins are now top ten contenders? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link