[ad_1]

The nosedive followed a brief rally Wednesday after Federal Reserve Chairman Jerome Powell pulled the trigger on widely anticipated 50-basis-point interest rate hike, its biggest since 2000.

It also came as focus shifted from Powell’s comments that a larger 75 basis-point rate increase wasn’t something the Fed was actively considering, to what else he said, namely, that the Fed won’t “hesitate” to deliver higher interest rates if they are needed.

“Up, down, up, down, but largely down — it looks like the market is headed down indefinitely,” said Brad McMillian, chief investment officer at Commonwealth Financial Network, in emailed comments Friday.

But for all the drama in stocks, another noteworthy move occurred in a key part of the bond market. The benchmark 10-year Treasury yield

TMUBMUSD10Y,

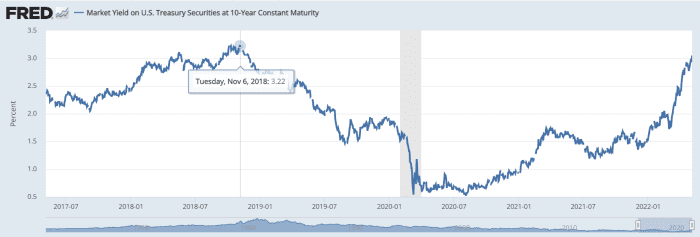

topped the 3% threshold, climbing to 3.124% as of Friday, its highest level since Nov. 13, 2018, according to Dow Jones Market Data.

That rate plays an important role in pricing everything from corporate debt to commercial real-estate loans. Its latest move higher also puts it nearer to a previous top of about 3.25% in 2018 (see chart), or before it declined in advance of the 2020 recession sparked by the pandemic.

10-year Treasury found a top near 3.25% in 2018 before the 2020 recession hit

Board of Governors of the Federal Reserve System.

Like watching for yield curve inversions, the 10-year Treasury yield also has a track record of signaling recessions before they occur.

“Those bonds sniff out a recession faster,” Bill Callahan, investment strategist at Schroders, told MarketWatch. “If the Fed keeps hiking rates without regard to what’s happening in the economy, those rates are going to peak.”

Recession signs

Looking at the past on Wall Street doesn’t necessarily foretell the future, particularly when comparing 2018 with 2022.

“Circumstances are different, in the sense that inflation pressures are much more pronounced and real,” said Jimmy Whang, head of credit and municipal fixed-Income at U.S. Bank,” by phone.

“And the ongoing situation with Russia’s war in Ukraine, coupled with pressures with the zero-COVID policy in China are headwinds to addressing the supply side of equation,” he said Friday.

That is why Whang thinks the 10-year yield could trend higher than in the past before finding a new pre-recession peak.

“What we’ve seen in terms of market performance, it seems to suggest we are headed for a somewhat challenged environment in terms of the Fed navigating a soft landing,” he said.

U.S. equities ended a turbulent week lower, adding to yearly declines, with the S&P 500 index

SPX,

down 13.5% in 2022, the Dow

DJIA,

off 9.5% and the technology-heavy Nasdaq Composite Index

COMP,

22.4% lower.

In addition to a jump in Treasury yields — a significant factor in this year’s painful bond-market rout — the U.S. high-yield, or “junk-bond,” yield recently topped 7%, according to the ICE BofA US High Yield Index, or the highest level in about two years.

“We are in a new regime if you think about coming out of the global financial crisis,” said John McClain, a portfolio manager for Brandywine Global Investment Management’s high yield and corporate credit strategies.

“Until the end of last year, central banks were in the business of suppressing volatility and coming to the rescue of markets,” McClain said, by phone. “The opposite holds true today.”

Where does that leave markets? Steve Friedman, a senior macro economist on the fixed income team at MacKay Shields, said a lot rides on what happens to inflation, pegged at an 8.5% annual rate in March, over the next few months as the Fed hikes rates.

“There is a sense that policy will need to go into restrictive territory next year,” said Friedman, a former Fed staffer, even it that means sparking a recession.

“I think, justifiably, there’s concern about how a soft landing comes about,” he said. “The narrative is a bit unconvincing to market participants and unconvincing to me.”

Read next: Critics ignore new tool Fed has to combat inflation, officials say

U.S. economic data next week includes the consumer price index for April on Wednesday, followed by weekly jobless claims on Thursday and consumer sentiment data for May from the University of Michigan on Friday.

[ad_2]

Source link