[ad_1]

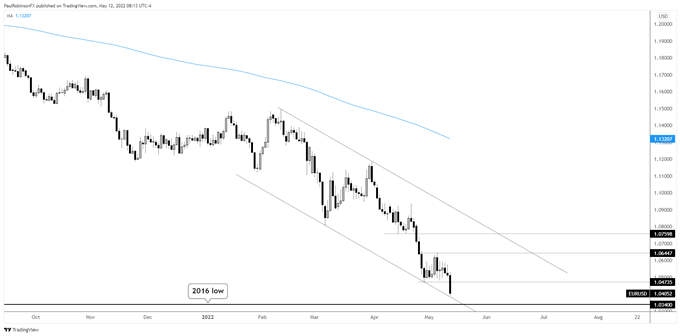

EUR/USD Technical Highlights:

- EUR/USD is taking towards the 2016 low at 10342

- Will we see a reprieve from support or parity soon in the cards?

The EUR/USD is about to trade at the worst levels since 2016, the 10342 level is quickly approaching. It’s a massive level, obviously, given it is the bottom from the last significant USD cycle. Will we see a reprieve from that level, or are dollar forces too strong?

At the moment it looks like the EUR/USD could blow right through support, but that is usually the case in a market environment such as this. However, we could see some volatile price action around that low that suggests a low may form. Of lesser importance is a lower channel line that is in near confluence with the 2016 low, it could become a factor.

It’s not expected to be a major low at this juncture, although it could, but at the least a tradeable low that will see the euro recover in the days/weeks ahead. Trying to play it from the long-side could initially be difficult. The thinking on this end, if looking to play a bounce to take a wait-and-see approach.

Let the EUR/USD show it wants to hold first by putting in a bounce, and then perhaps looking to enter on a retracement. But for now it is just a scenario to watch. Price could melt on through, in which case the parity drumbeat will likely grow very loud.

For now, there is a little room for the EUR/USD to drop before 10342 comes into play, at which time we will pay close attention to how the market responds. Existing shorts may want to tighten up trailing stops while would-be longs may want to take the above outlined approach and be patient.

EUR/USD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link