[ad_1]

US STOCKS OUTLOOK:

- S&P 500, Nasdaq 100, and Dow Jones rally at the start of the week

- Biden’s comments on removing tariffs on Chinese imports support risk appetite

- May US Services and Manufacturing PMI will be closely watched on Tuesday

Most Read: EUR/USD Soars as Lagarde Talks Up Hikes, ECB to Exit Negative Rates in Q3

U.S. stocks rose on Monday, recovering moderately from last week’s sell-off that pushed the S&P 500 to the brink of an official bear market. Sentiment was buoyed by comments from President Biden, who indicated that his government is considering reducing tariffs on Chinese goods imposed by the previous administration. Any move to roll back duties fully or partially on imports could help ease inflationary pressures and bolster profit margins, especially for retailers.

The mood was also boosted after JPMorgan Chase’s CEO, Jamie Dimon, said the bank could hit key return targets ahead of schedule and that storm clouds over the U.S. economy may dissipate. If financial institutions, which have a cyclical business, project confidence in the future and expect good results in 2022, it makes sense to believe that the economy is not about to roll off the cliff, as many forecasters have come to predict.

When it was all said and done, the S&P 500 jumped 1.86% to 3,973, supported by Apple and Microsoft’ strong rally. Meanwhile, the Dow Jones led gains on Wall Street, soaring 1.98% to 31,880, its best level since last Wednesday. The Nasdaq 100, also climbed, up 1.68% to 12,034, but its advance was capped by rising Treasury rates.

In recent months, traders have faded or aggressively sold every rally amid a lack of faith in the outlook, so it’s uncertain whether gains will be sustained this time around. However, it should be noted that even during large market downturns, there may be instances where stocks bounce back for several days or even weeks as sellers close out their bearish positions to take profits before reengaging short bets once better levels are reached.

To be confident that this is not another dead cat bounce, it would be important to see a follow-through to the upside and a broadening of breadth over the next few days (more stocks participating in the rally). For this to happen, the volatility index (VIX), known as the investors’ fear gauge, will have to continue to fall and stabilize around the 20 zone. Incoming data will also have to hold up and show that the US economy remains resilient despite mounting headwinds, including red-hot inflation, supply chain issues and softening spending.

Tomorrow we will get a better idea of how economic activity is performing during the second quarter when S&P Global releases its May PMIs for the services and manufacturing sectors. While both surveys are expected to reveal some slowing compared to April’s results, the magnitude of the deceleration will be key to assessing the health of the economy and whether extreme pessimism and rising recession fears are justified at this time. Check out DailyFX’s calendar to see what investors are expecting.

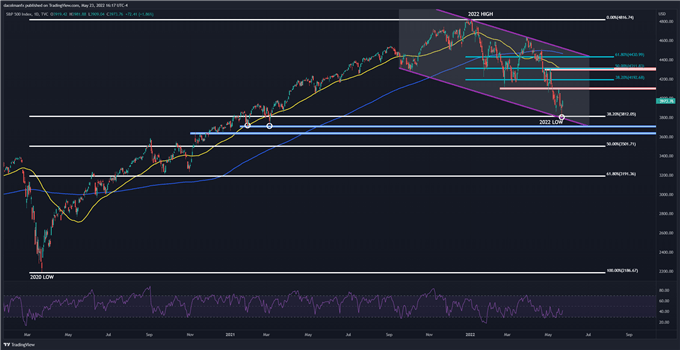

S&P 500 TECHNICAL ANALYSIS

The S&P 500 briefly entered bear market Friday, but managed to stage a solid rebound after being rejected by a technical support zone, running from 3,805 to 3,800, where the lower boundary of a short-term descending channel converges with the 38.2% Fibonacci retracement of the 2020-2022 rally. If the index manages to extend its recovery in the coming days, initial resistance appears at 4,100, followed by 4,192, the 38.2% Fib retracement of the 2022 decline. On the flip side, if the bears return and drive the price lower, selling momentum could reaccelerate, exposing the 3,805/3,800 area. If this floor is breached, the downside focus shifts to 3,710, followed by 3,635.

S&P 500 TECHNICAL CHART

S&P 500 Technical Chart Prepared Using TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Source link