[ad_1]

Gold, Silver, XAU/USD, XAG/USD, Technical Analysis, Retail Trader Positioning – Talking Points

- Retail traders are turning more bearish gold and silver

- This could hint at further gains for the precious metals

- Check out the webinar for a dive into the fundamentals

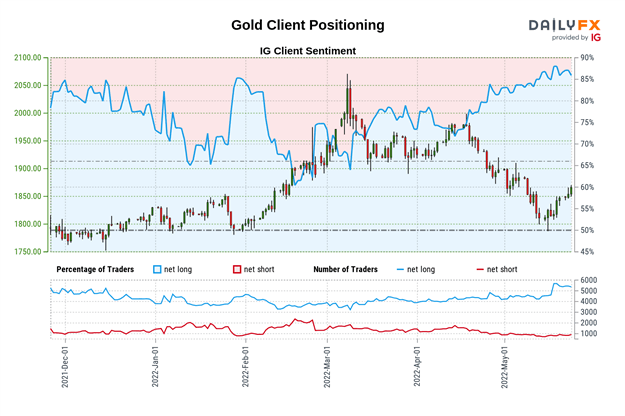

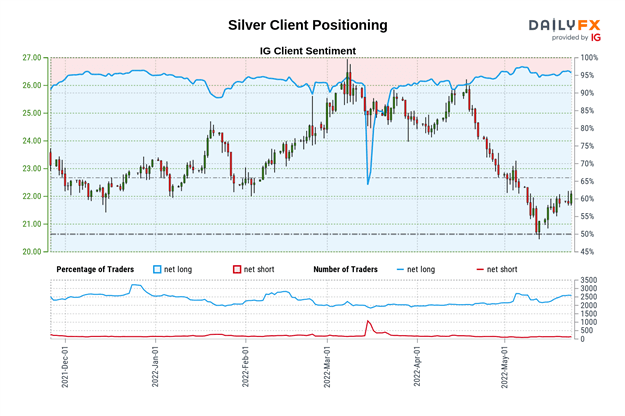

Gold and Silver prices have been on the rise as of late, tracking a decline in the US Dollar and Treasury yields. Now, retail traders are increasingly betting that XAU/USD and XAG/USD could reverse lower. This can be seen by looking at IG Client Sentiment (IGCS), which tends to behave as a contrarian indicator. With that in mind, could an increasingly bearish shift in retail traders hint at more gains to come for the precious metals? For a deeper dive into the fundamentals, check out the webinar recording above!

Gold Sentiment Outlook – Bullish

The IGCS gauge shows that about 84% of retail traders are net-long gold. Since most traders are still biased to the upside, this suggests that prices may continue falling. However, downside exposure has increased by 3.03% and 16.08% compared to yesterday and last week respectively. With that in mind, recent shifts in positioning are hinting that the price trend may soon reverse higher.

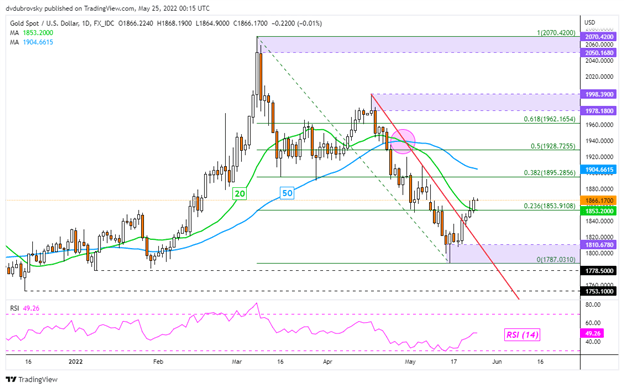

XAU/USD Technical Analysis

On the daily chart, gold has confirmed a breakout above the near-term falling trendline from late April. That has opened the door to reversing the downtrend since then. Recently, prices have also taken out the 20-day Simple Moving Average (SMA), exposing the 50-day line. On balance, this could hint at further gains. Otherwise, a turn lower would place the focus on the 1787 – 1810 support zone.

Silver Sentiment Outlook – Bullish

The IGCS gauge shows that about 95% of retail traders are net-long Silver. Since the majority of them are still heavily biased to the upside, this suggests that prices may continue falling. However, downside exposure has climbed by 9.57% and 6.78% versus yesterday and last week respectively. With that in mind, recent changes in positioning are hinting that Silver may soon reverse higher.

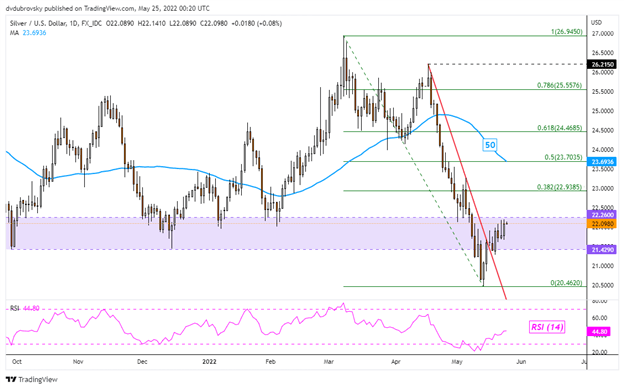

XAG/USD Technical Analysis

Silver prices confirmed a breakout above the falling trendline from the middle of April, opening the door to extending gains. Still, prices have been unable to break above the former 21.42 – 22.26 support zone, which could hold as new resistance. A breakout higher exposes the 50-day SMA, which could reinstate the downside focus. Such an outcome would place the focus back on the May 13th low at 20.462.

*IG Client Sentiment Charts and Positioning Data Used from May 24th Report

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

[ad_2]

Source link