[ad_1]

USD, GBP/USD, EUR/USD Analysis and Talking Points

USD: A continued repricing of recession risks has been felt in the commodity after a dramatic sell-off in oil prices during yesterday’s session. Meanwhile, the already strong USD has been further fueled by safe-haven flows and will likely continue to do so as risk sentiment sours. That said, the spike higher in the greenback has been a wrecking ball for its major counterparts, most notably the Euro, which is printing fresh two-decade lows and looks set for parity.

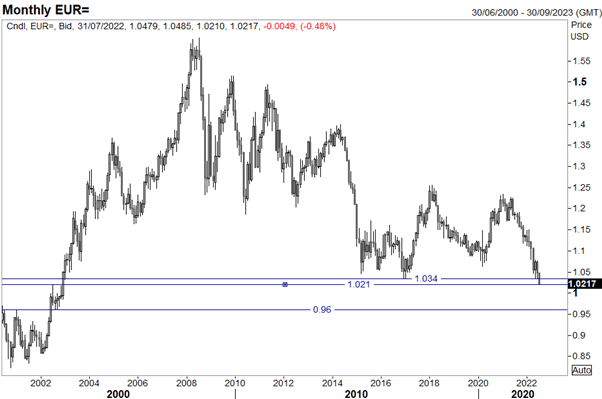

EUR/USD Chart: Monthly Time Frame

Source: Refinitiv

The negatives for the Euro are well-known and could be further exacerbated by two events this month. Firstly the annual maintenance shutdown of Nordstream from July 11-21st and secondly the ECB’s July meeting where all the focus is on whether the central bank can announce a credible anti-fragmentation tool. That said, the bias would be to fade any bounce backs in the single currency from 1.0300-20. Looking ahead, eyes will be on the upcoming ISM Non-Manufacturing PMI report and after last week’s weak manufacturing figure, this data will be closely watched as to whether it would add further weight to recession risks.

Resistance – 1.0340-50 (2017-2022 lows), 1.0485-90 (Jun 30/Jul 1st highs), 1.0558 (50DMA).

Support – 1.0210 (July 2002 peak), 1.0000 (Parity)

Top Q3 Trade Idea – Euro May Break Parity

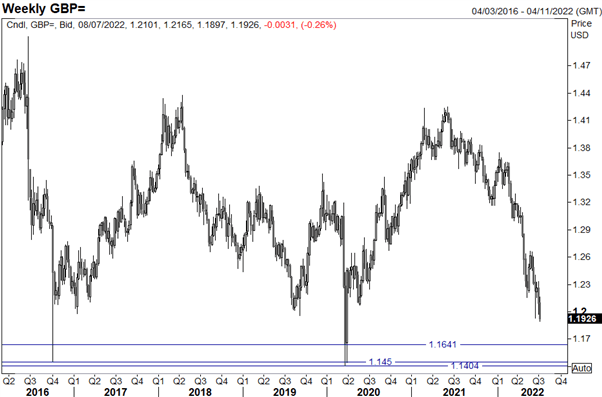

GBP: Politics is at the forefront of the talking heads in the media, however, for traders, the Pound has been rather sanguine about the political turbelence. While GBP/USD is significantly lower in recent sessions, the pair has not moved lower since key cabinet members annouced their resignations, meanwhile, EUR/GBP is in fact lower. It is the beginning of the end for Boris Johnson, although, the current backdrop that plagues the Pound remains unaltered. This has been evidenced by this morning’s soft construction PMI data, while BoE Chief Economist Pill comment’s were not exactly in favour of a larger hike in the Bank rate.

Comments made by BoE’s Pill

- One-off bold moves can be disturbing to markets

- There is a case for steady-handed approach

- If we get a reputation for big, sharp moves in bank rate, markets will see it as noise

Alongside this, should Boris Johnson reluctantly announce his resignation, aside from choppy price action in the short term, the medium term outlook still remains for lower GBP on rallies. Reminder, when former UK PM, Theresa May, resigned, GBP actually closed the session higher. Outside of a short-squeeze, the bullish argument is lacking.

Resistance – 1.2000 (round number), 1.2215 (May low), 1.2332 (Weekly High)

Support – 1.1900 (Weekly low), 1.1614 (2020 closing low), 1.1400-50 (Brexit/Covid lows)

GBP/USD Chart: Weekly Time Frame

[ad_2]

Source link