[ad_1]

August FX Seasonality Overview:

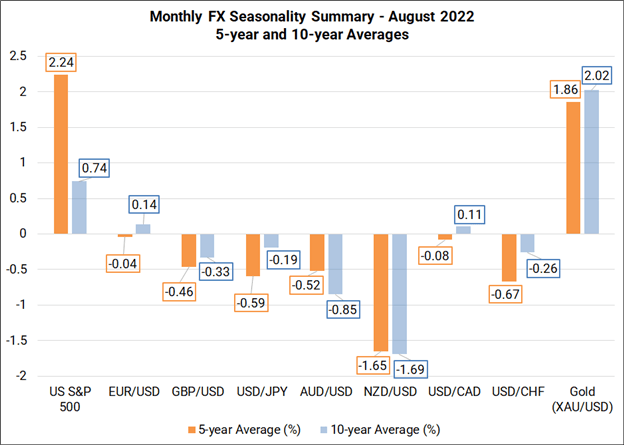

- The eighth month of the year typically sees a mixed performance by the US Dollar.

- The Japanese Yen and Swiss Franc tend to do well in August, while the Australian and New Zealand Dollars fare poorly.

- August has been a good month for both gold prices and US stocks.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For August, our focus is on the trailing 5-year and 10-year performances, both of which capture trading during the winddown of aggressive central bank intervention beginning with the 2008/2009 Global Financial Crisis – not dissimilar from the environment we find ourselves in now.

Nevertheless, as has been the case for the past five months, ongoing ahistorical conditions reduce the reliability of using seasonality as a meaningful price action indicator. After all, global commodity markets remain distressed amid Russia’s ongoing invasion of Ukraine, and global supply chains are still dealing with China’s zero COVID strategy. We must conclude that strategies based around seasonality tendencies remain less viable than in years past.

Monthly Forex Seasonality Summary – August 2022

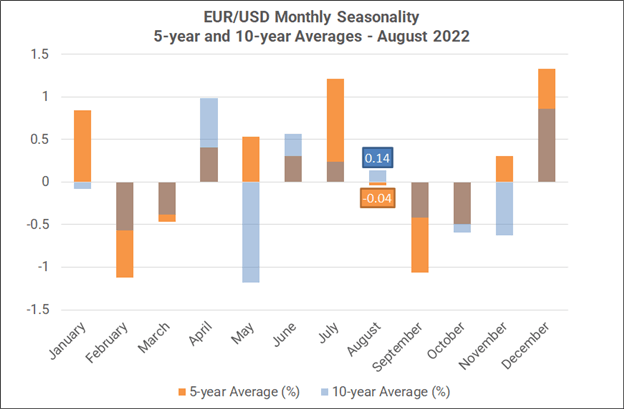

Forex Seasonality in Euro (via EUR/USD)

August is a mixed month for EUR/USD, from a seasonality perspective. Over the past 5-years, it has been the fifth worst month of the year for the pair, averaging a loss of -0.04%. Over the past 10-years, it has been the fifth best month of the year, averaging a gain of +0.14%.

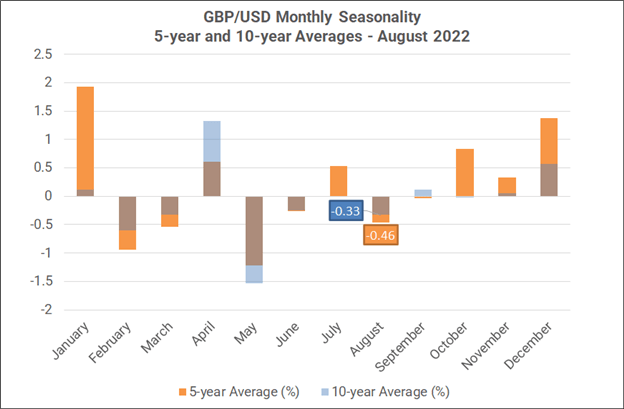

Forex Seasonality in British Pound (via GBP/USD)

August is a bearish month for GBP/USD, from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the pair, averaging a loss of -0.46%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -0.33%.

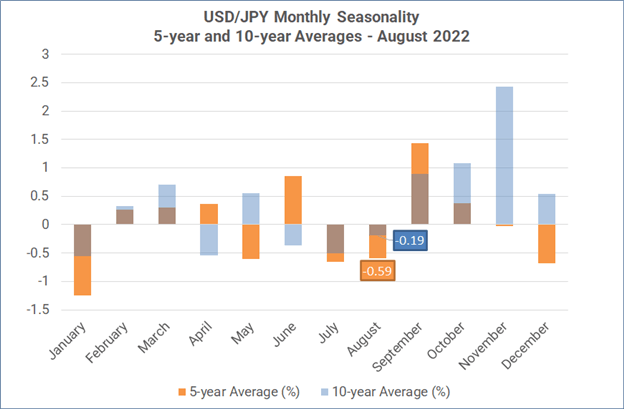

Forex Seasonality in Japanese Yen (via USD/JPY)

August isa bearish month for USD/JPY, from a seasonality perspective. Over the past 5-years, it has been the fifth worst month of the year for the pair, averaging a loss of -0.59%. Over the past 10-years, it has been the fifth worst month of the year, averaging a loss of -0.19%.

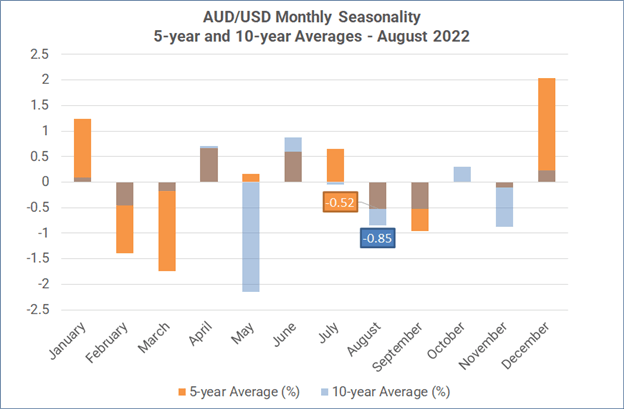

Forex Seasonality in Australian Dollar (via AUD/USD)

August is a bearish month for AUD/USD, from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the pair, averaging a loss of -0.52%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -0.85%.

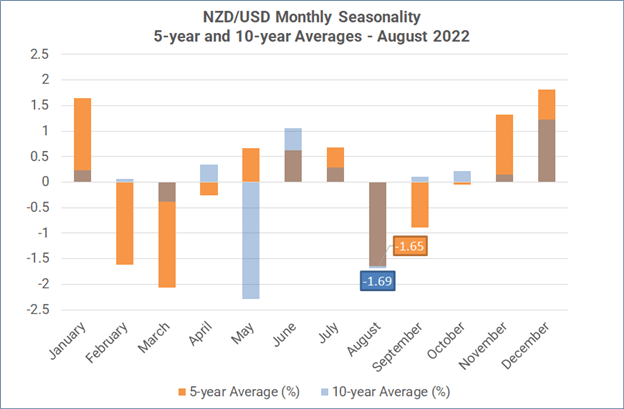

Forex Seasonality in New Zealand Dollar (via NZD/USD)

August isa bearish month for NZD/USD, from a seasonality perspective. Over the past 5-years, it has been the second worst month of the year for the pair, averaging a loss of -1.65%. Over the past 10-years, it has been the second worst month of the year, averaging a loss of -1.69%.

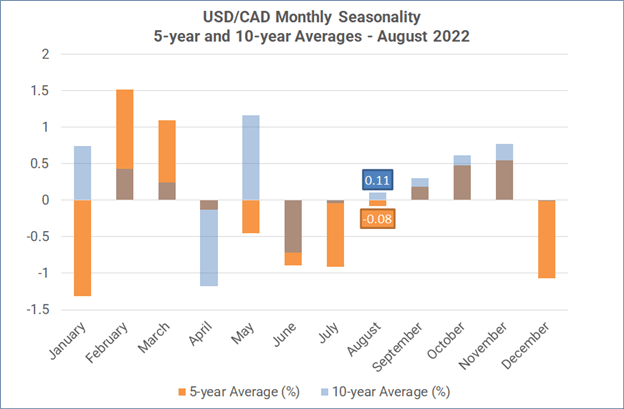

Forex Seasonality in Canadian Dollar (via USD/CAD)

August is a mixed month for USD/CAD, from a seasonality perspective. Over the past 5-years, it has been the sixth best month of the year for the pair, averaging a loss of -0.08%. Over the past 10-years, it has been the fifth worst month of the year, averaging a gain of +0.11%.

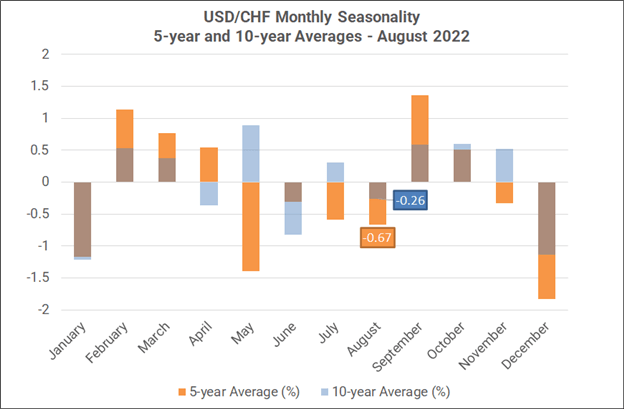

Forex Seasonality in Swiss Franc (via USD/CHF)

August is a bearish month for USD/CHF, from a seasonality perspective. Over the past 5-years, it has been the fourth worst month of the year for the pair, averaging a loss of -0.67%. Over the past 10-years, it has been the fifth worst month of the year, averaging a loss of -0.26%.

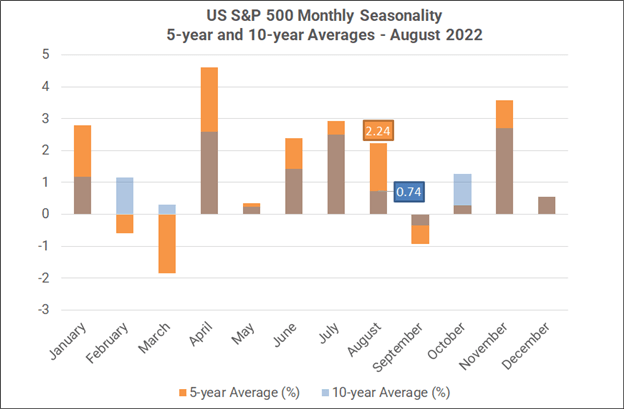

Forex Seasonality in US S&P 500

August isa bullish month for the US S&P 500, from a seasonality perspective. Over the past 5-years, it has been the sixth best month of the year for the index, averaging a gain of +2.24%. Over the past 10-years, it has been the fifth worst month of the year, averaging a gain of +0.74%.

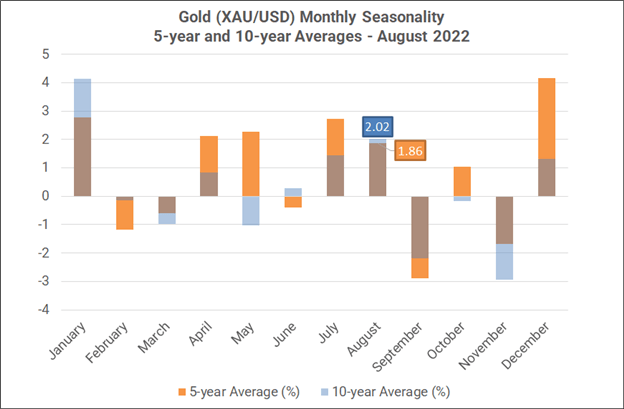

Forex Seasonality in Gold (via XAU/USD)

August is a bullish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the sixth best month of the year for the precious metal, averaging a gain of +1.86%. Over the past 10-years, it has been the second best month of the year, averaging a gain of +2.02%.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Source link