[ad_1]

Dax 40 News & Analysis:

- Dax 40 supported by energy stocks, but key resistance limits the upside move

- Global equities face major systemic risk ahead of this week’s economic data

- Dax futures remain faithful to key technical levels that may continue to provide support and resistance for the imminent move

Recommended by Tammy Da Costa

Get Your Free Top Trading Opportunities Forecast

Dax 40 Holds Ground as Bulls Aim for Critical Resistance at the 2015 High

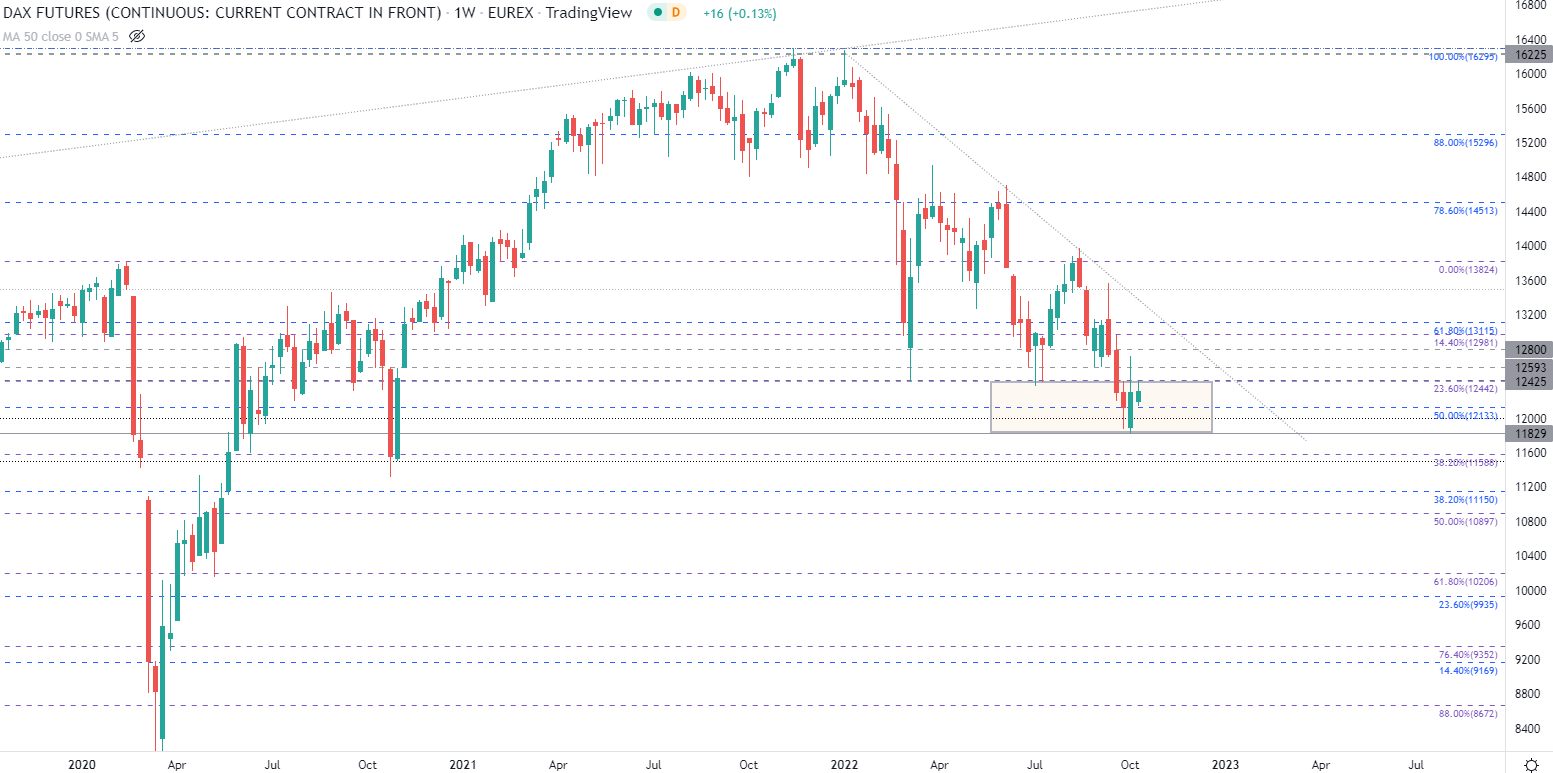

Dax futures continue to trade been key levels of support and resistance between key Fibonacci levels of the 2020 move. After rebounding off trendline resistance at 13,970 in August, a sharp sell-off in European equities drove Dax 40 to a near-two year low of 11,829 before climbing back above the key psychological level of 12,000.

How to trade the Dax: Trading strategies and tips

With the relief rally driving the major stock index to the July 2019 high of 12,650, a temporary retest of 12,721 was accompanied by a strong retaliation from bears. As the German index retreated, the 23.6% retracement of the above-mentioned move came back into play at 12,442 before plunging to current support at 12,133 (the 50% Fib of the same move).

Starts in:

Live now:

Oct 11

( 17:10 GMT )

Recommended by Tammy Da Costa

Trading Price Action

Dax 40 (Futures) Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

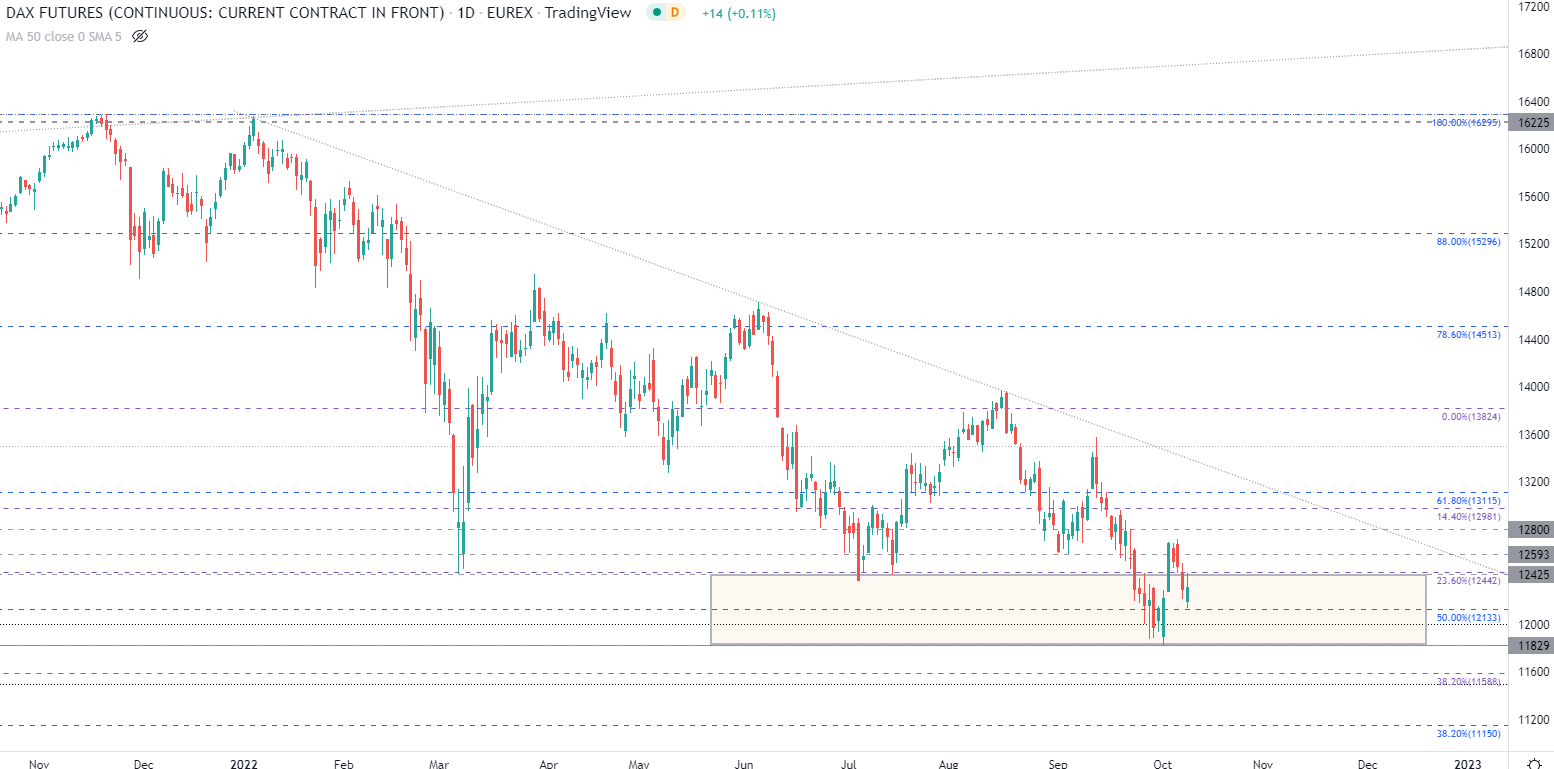

The key technical levels discussed above are further highlighted on the daily chart which illustrates the zones of confluency which may hold both bulls and bears at bay.

Dax 40 (Futures) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

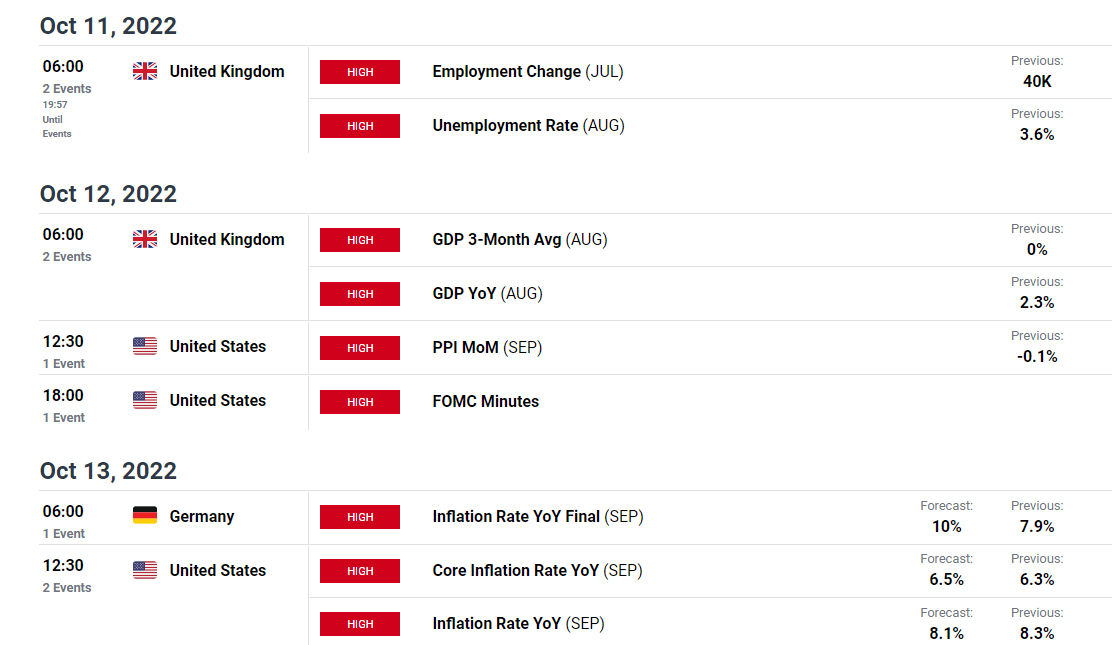

Fundamental Data Remains Key for Equities

While dampening sentiment and higher interest rates remain a key concern for risk-assets, this week’s inflation data and the FOMC minutes remain key catalysts for global equities. If inflation comes in higher than expected or the Federal Reserve continues to reiterate its hawkish stance, Dax, FTSE & US equity indices remain at risk of further declines.

DailyFX Economic Calendar

Visit theDailyFX Educational Centerto discover theimpact of politicson global markets

For the upside move to continue, a break of the April 2015 high (12,430) and a hold above 12,443 could see prices rise back towards the next big zone of resistance at 12,650.

However, if bears continue to drive prices lower, a move lower and a break of 12,133 and 12,000 could fuel the bearish move back towards 11,829.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link