[ad_1]

The biggest part of the roughly $10 trillion U.S. corporate bond market looks poised to cement its worst year ever, by a long shot.

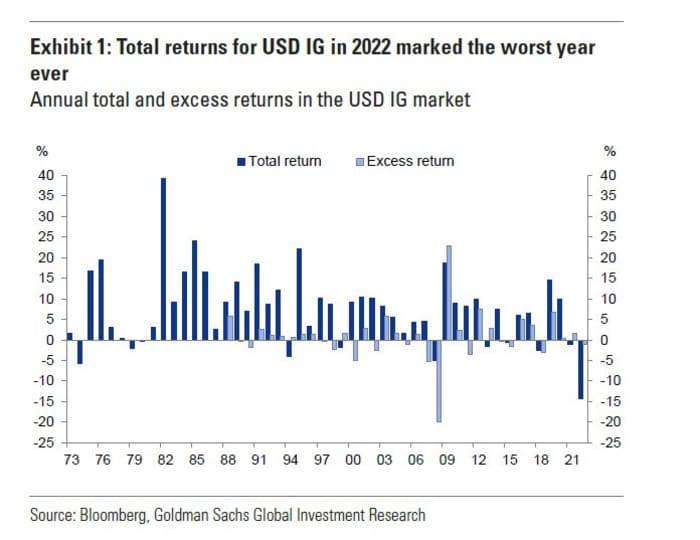

Investment-grade corporate bonds, a longtime source of funding for the world’s biggest companies, was set for a minus-14% total return in 2022, “a level that is nearly three times the second-greatest decline on record since 1974,” according to Goldman Sachs researchers.

November’s sharp rally helped corporate bonds recover from the year’s worst levels, but it wasn’t nearly enough (see chart) to keeping a dismal year for corporate bonds out of the record books.

Investment-grade corporate bonds head for worst year ever, by a lot

Bloomberg, Goldman Sachs Global Investment Research

In prior years, a total return pullback of about -5% for investment-grade corporate bonds would have been notable, as was the case in the wake of the 2007-2008 global financial crisis.

But 2022 has been an entirely different environment, with the carnage in corporate bonds not stemming from a wave of company defaults but mostly to the Federal Reserve’s rapid pace of rate hikes. Its policy rate shot up to a 4.25% to 4.5% range last week, from near zero in March.

Fed Chairman Jerome Powell and other U.S. central bankers also said the benchmark Fed rate could now peak above 5% next year, and stay there for a while, until inflation finds a sustained path lower.

See: Fed officials reinforce stern message of slowing inflation by higher interest rates

“The quasi-entirety of this year’s decline has been driven by the historic selloff in the rates market,” the Goldman credit research team wrote, in a weekly client note. “Excess returns, while likely to finish the year in negative territory, have held up better at -1.2%.”

Bonds prices also fell dramatically in 2022, reflecting the diminished appeal of low yielding assets in an environment of both high inflation and climbing interest rates. Goldman’s team pegged a record share of investment-grade corporate bonds as trading below $80 prices this year. Prices below $70 are often considered distressed.

Many individuals gain exposure to bonds through exchange-traded funds. Shares of the large $18.6 billion iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

were down 18.6% on the year through Monday, according to FactSet. That compares with a roughly 13.4% decline for the $82.8 billion iShares Core U.S. Aggregate Bond ETF

AGG,

a fund that tracks the benchmark Bloomberg U.S. Aggregate Bond Index.

With U.S. inflation showing signs of slowing and a peak terminal Fed rate in sight, many bond investors and analysts expect 2023 to be a year of recovery for many fixed-income sectors that currently offer some of the highest yields in a decade, particularly if only a mild recession hits.

“We continue to expect a notable improvement in the return profile for total return investors in 2023, and a move into positive territory for excess returns,” the Goldman team wrote about investment-grade corporate bonds.

Stocks were lower again Monday, with the S&P 500 index

SPX,

down nearly 300 points, or 0.8%, while the Dow Jones Industrial Average

DJIA,

was 1.2% lower and the Nasdaq Composite Index

COMP,

was off 1.6%.

[ad_2]

Source link