[ad_1]

And so we reach the last trading day of 2022. Good riddance.

Thankfully at this time of year there is no shortage of analysts and investors wishing to look ahead. Unfortunately, most don’t see much of a fresh start.

Rather, 2022’s themes — inflation, tighter monetary policy, war, and declining earnings — will continue to dominate, certainly for the first half of the year, anyway. That is the rough consensus.

Bank of New York Mellon has done a good job of distilling the plethora of possible market factors into five key takeaways that may help investors navigate the coming year, and beyond. Here they are.

A mild global recession is likely. BNY Mellon prices the chances of a global recession at 70%, though it does reckon it will be probably be mild and relatively short.

“However, the market has yet to price this in, which is why we expect volatility to continue in the first half of 2023. History tells us that markets can rebound before a recovery in the real economy. These rallies are very hard to pinpoint and can happen quickly, making it critically important to stay invested.”

Inflation moderates but remains elevated. The U.S. economy has remained resilient so far despite rate hikes totaling 4.25% over just 10 months. This means inflation may not retreat as fast as the Fed and investors hope.

“Aided by a tight labor market, increasing wages and more than $1 trillion of savings leftover from the pandemic, consumer spending continued to drive U.S. growth through the third quarter.” says BNY Mellon.

November’s CPI report showed that price rises have peaked, but “even as inflation is easing and the Fed begins to slow its pace of tightening, we are concerned that stickier inflation drivers, namely labor and shelter costs, will keep monetary policy tighter for longer and push the economy into a mild recession”.

Which means that: The Federal Reserve is likely to hike and hold. In previous tightening cycles, the cycle ended when the federal funds rate was

above the inflation rate., notes BNY Mellon.

“With the current inflation rate nearly three percentage points above the fed funds rate, the Fed likely has more work to do. We expect the fed funds rate to peak around 5% by the middle of next year. While market consensus has priced in interest rate cuts by the third quarter of 2023, we think the Fed is likely to hold rates steady after its final hike.”

Source: BNY Mellon

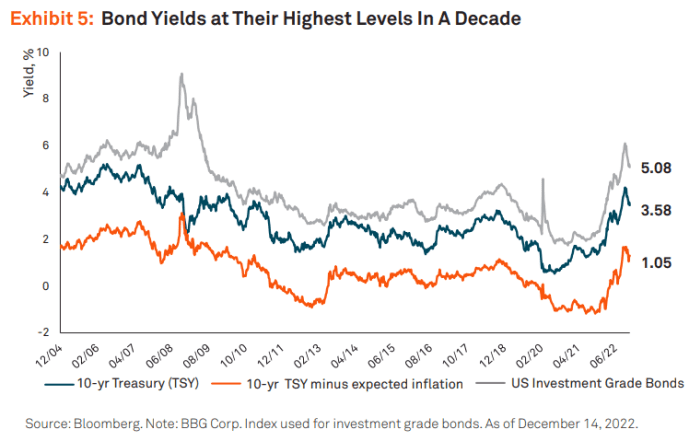

Bonds are back. Fixed income had its worst performance in 40 years, says BNY Mellon, “with the Bloomberg Aggregate Bond Index down about 11% after partially recovering from even steeper declines.” This has left yields at their most attractive in 10 years.

“For investors, it means that TINA (There is No Alternative to Equities) is over, with the focus now on generating income through higher yields. At a 3.6% yield, 10-year Treasuries

TMUBMUSD10Y,

offer greater income than the S&P 500’s

SPX,

1.8% dividend yield. With these improved yields, we are upbeat about the potential for more attractive total returns moving forward and for bonds to revert to their traditional role as a ballast in portfolios,” says the bank.

It sees the 10-year yield in the 3.5%-4% range for 2023. That’s around where it is now, but there will likely be “significant volatility in the interim.”

Source: BNY Mellon.

A new equity regime emerges. BNY Mellon doesn’t expect stocks to bottom until the market fully prices in a recession and earnings estimates for 2023 have fallen further.

“At $232, the consensus EPS estimate is considerably higher than our $205-$215 estimate, which reflects the weakening economy…Assuming an economic recovery by the end of 2023, we anticipate earnings will move higher in 2024 and have estimated an earnings of $240-$250.”

Consequently, the bank has a year-end 2023 target range for the S&P 500 of 3,800-4,500 — that’s wide to reflect heightened uncertainty.

Along with government bonds, BNY Mellon favors U.S. stocks relative to other markets, with a preference for large caps. Those unprofitable growth stories will continue to struggle, while “high-quality companies that generate strong cash flows and profits, as well as those that offer sustained dividend growth, should provide better value”.

Away from equities, the bank likes high-rated corporate debt and alternative assets like infrastructure and private real estate.

Markets

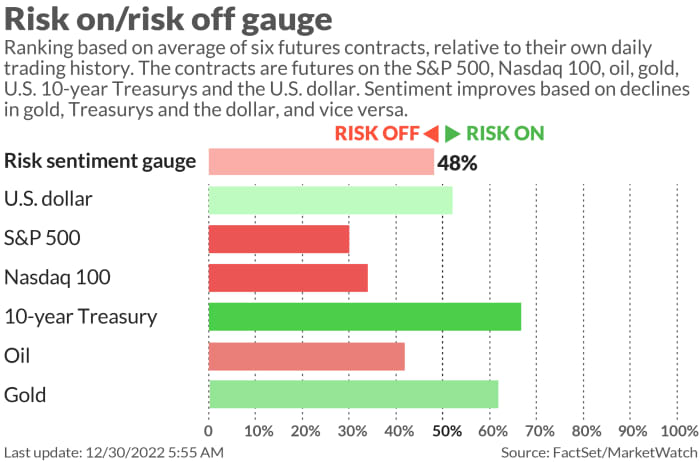

Stocks look like giving back a bit of the previous session’s strong rally, with the S&P 500 futures

ES00,

slipping 0.3%. Benchmark 10-year Treasury yields

TMUBMUSD10Y,

are up 3.5 basis points to 3.855% while the dollar index

DXY,

is barely changed at 103.84. WTI crude futures

CL.1,

are off just 0.1% to $78.35 a barrel and gold

GC00,

is retreating 0.3% to $1,820 an ounce.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

U.S. equity markets will be open for a full session on Friday and closed on Monday to celebrate the new year. Treasury markets will close early at 2 p.m. Eastern on Friday and will shut on Monday, too.

The last notable economic data-point of 2022 will be the Chicago PMI report for December, due for release at 9:45 a.m. Eastern.

U.S. tweaks electric vehicle tax-credit program in move to appease allies.

Southwest Airlines

LUV,

said it expects to return to normal operations Friday after more than a week of widespread flight cancellations.

U.K. house prices are enduring their worst losing streak since the great financial crisis, says lender.

Soccer mourns passing of Brazilian legend Pele.

Best of the web

The Truss regime’s ‘moron premium’ still looms over the U.K. economy.

The bravery and recklessness of Ukraine’s improvized army.

Did 2022 break Wall Street’s ‘fear gauge’?

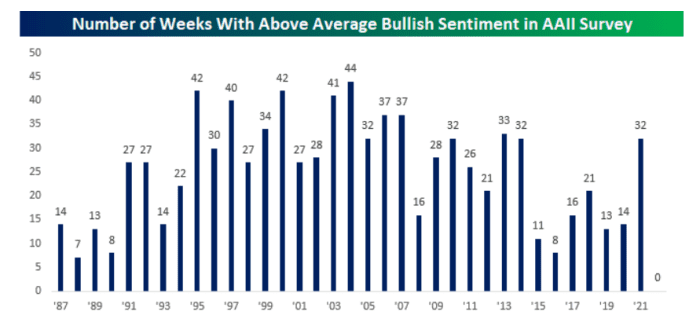

The chart

Here’s a neat illustration from Bespoke Investment of just how miserable traders say they have been during 2022. “Individual investor bullish sentiment increased more than five percentage points [in the past week] but still remains depressed at less than 26%. This week’s results also officially confirm that 2022 will be the first year in the history of the survey (since 1987) that bullish sentiment was below its historical average every week of the year,” says Bespoke.

Source: Bespoke Investment.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MULN, |

Mullen Automotive |

|

APE, |

AMC Entertainment preferred |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

KALA, |

Kala Pharmaceuticals |

|

AMZN, |

Amazon.com |

|

BBBY, |

Bed Bath & Beyond |

Random reads

Jack the Ripper’s only known facial composite found in archives.

The glory of England’s Lake District…in Lego.

Man given a year to live now cancer-free after immunotherapy trial.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link