[ad_1]

US Dollar, Euro, British Pound Vs Japanese Yen – Price Action:

- USD/JPY has turned back sharply from key resistance.

- EUR/JPY and GBP/JPY have also run into a major roadblock.

- What is the outlook and the key levels to watch in the yen crosses?

Recommended by Manish Jaradi

How to Trade USD/JPY

The Japanese yen has run into strong support against some of its peers, raising the prospect of some more gains in the short term.

The yen has appreciated after the Fed raised its benchmark rate by the widely expected 25 basis points to the 5.00-5.25% range. “We’re closer or may be even there,” Fed Chair Powell said with reference to the terminal rate. While this hints at a pause in the hiking cycle, the Fed retained a hawkish bias, noting “in determining the extent to which additional policy firming may be appropriate”. Key focus will be on incoming data, particularly jobs report and CPI data ahead of the June meeting, and the extent to which credit tightening has spilled over the broader economy.

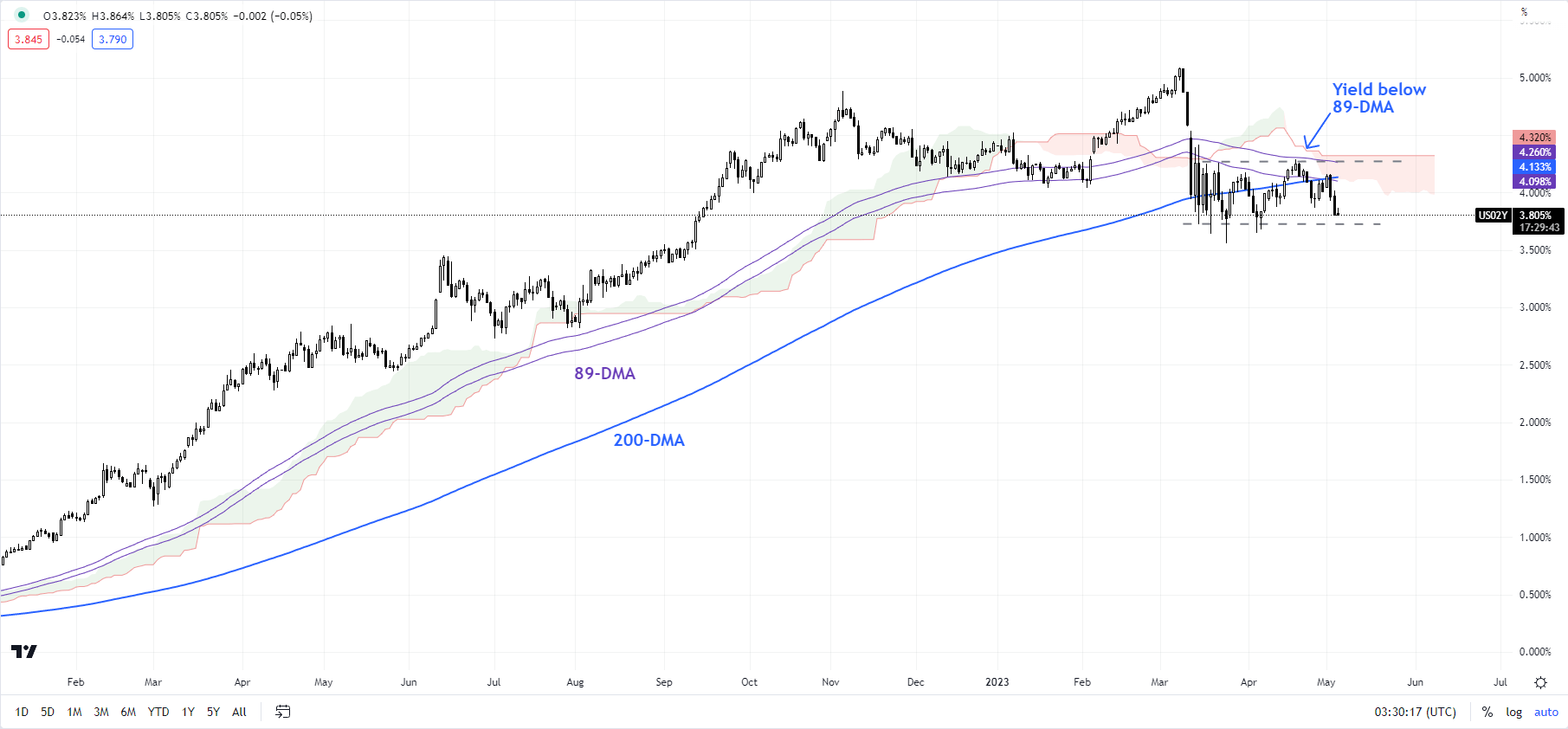

In terms of monetary policy outlook, the Fed indicated a pause at its meeting yesterday is likely to keep a lid on USD and Treasury yields, unless data suggests otherwise in the coming week. Meanwhile, the Bank of Japan last week kept the ultra-loose policy settings unchanged. If risk sentiment remains in check due to the uncertainty with regard to the US debt ceiling and the banking sector, USD/JPY could move toward the lower end of the well-established range.

US Treasury 2-year yield Daily Chart

Chart Created by Manish Jaradi Using TradingView

USD/JPY: Is this it?

On technical charts, USD/JPY has essentially been sideways in recent weeks, though the broader picture remains bearish, as highlighted in recent updates. SeeApril 17,April 21, andApril 26updates. The pair has faced solid resistance at the March high of 138.00, roughly coinciding with the 200-day moving average.

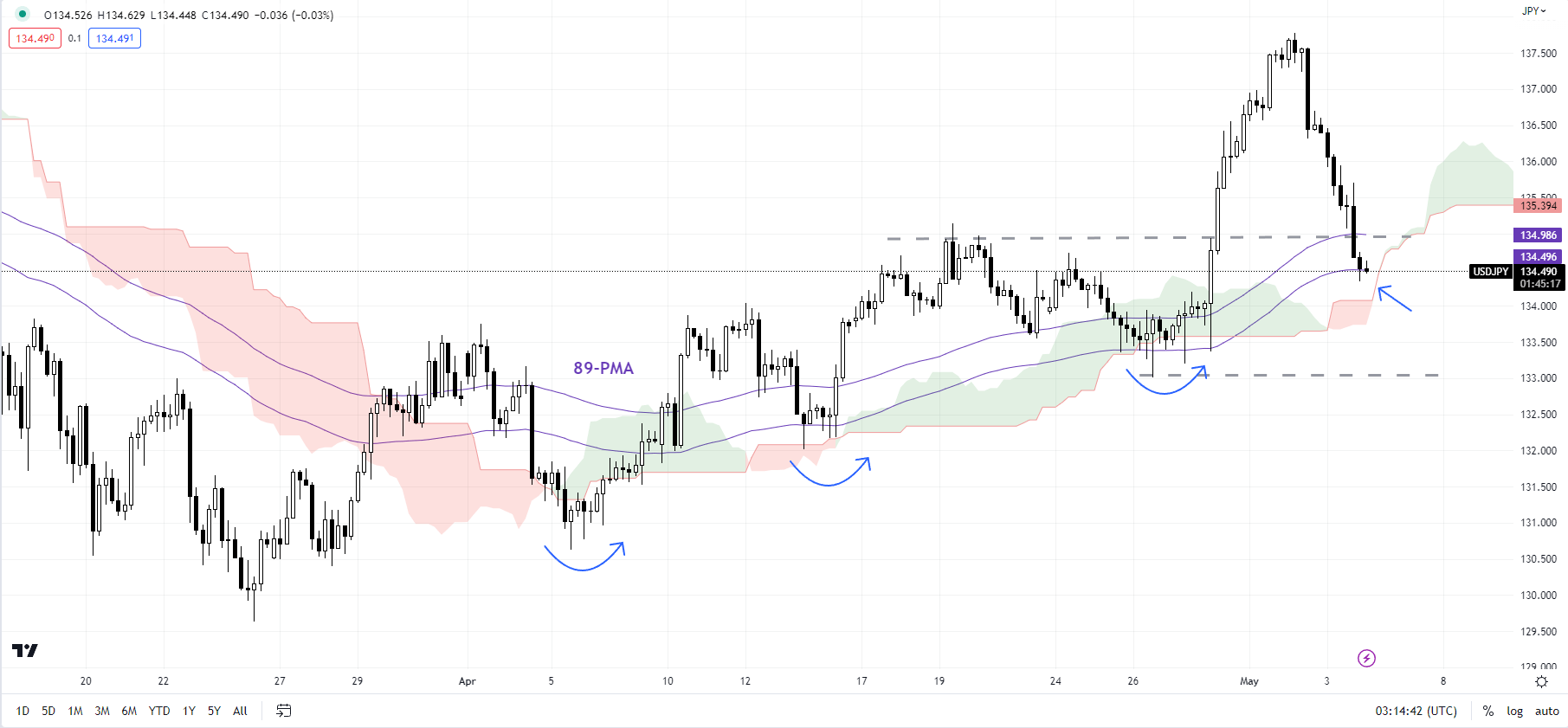

USD/JPY 240-minute Chart

Chart Created Using TradingView

On the 240-minute charts, the pair is now testing quite a strong cushion on the 89-period moving average, roughly around the lower edge of the Ichimoku cloud. Since early April, the pair hasn’t decisively fallen below the converged support. Any break below would confirm that the short-term upward pressure had faded, paving the way toward the April 27 low of 133.00. Furthermore, any break below 133.00 would expose downside risks toward the March low of 129.65.

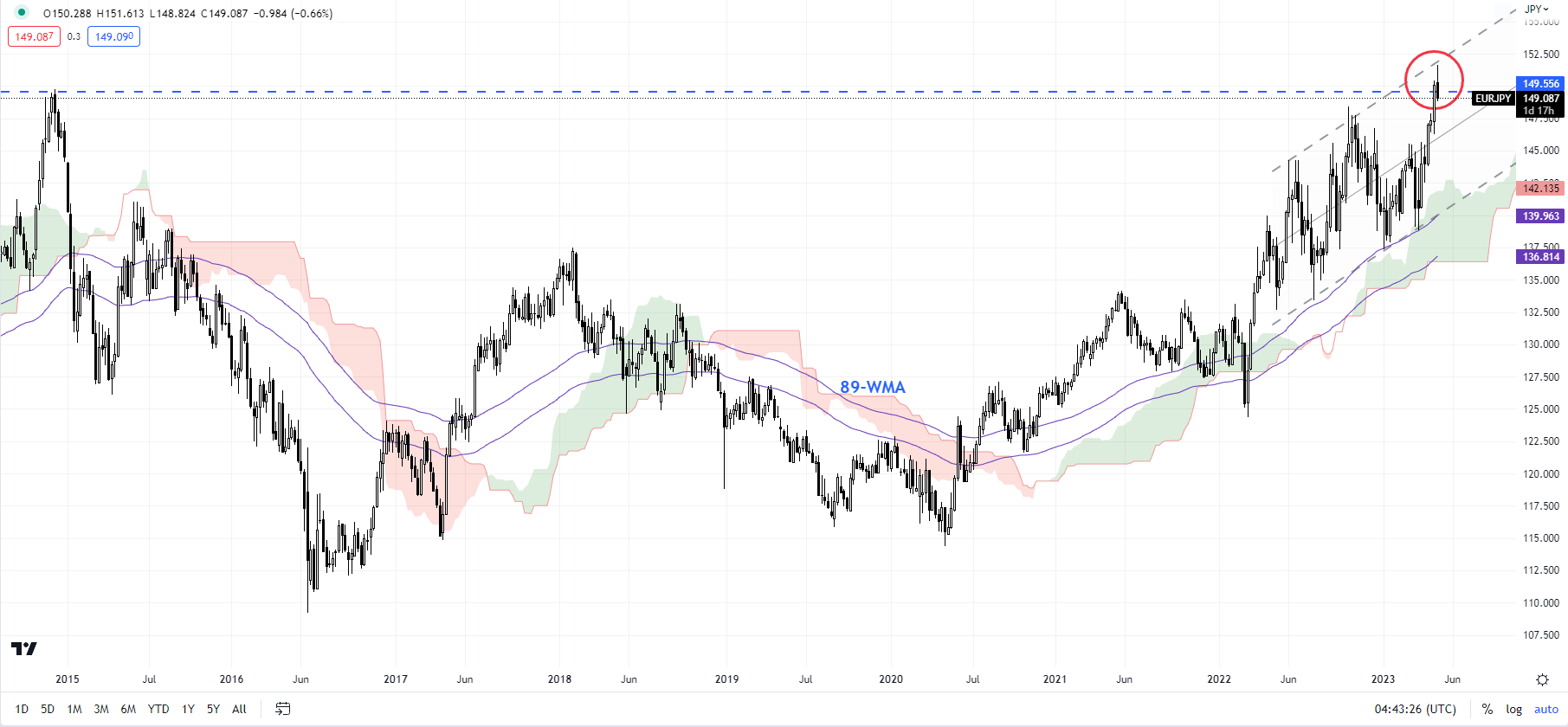

EUR/JPY Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/JPY: Tough resistance holds for now

EUR/JPY is facing a stiff hurdle at the 2014 high of 149.75. A negative momentum divergence on the daily charts (rising price associated with declining Stochastics) suggests the cross could find it tough to clear the hurdle at least in this attempt. However, the upward pressure is unlikely to fade while the cross stays above the late-April low of 146.25.

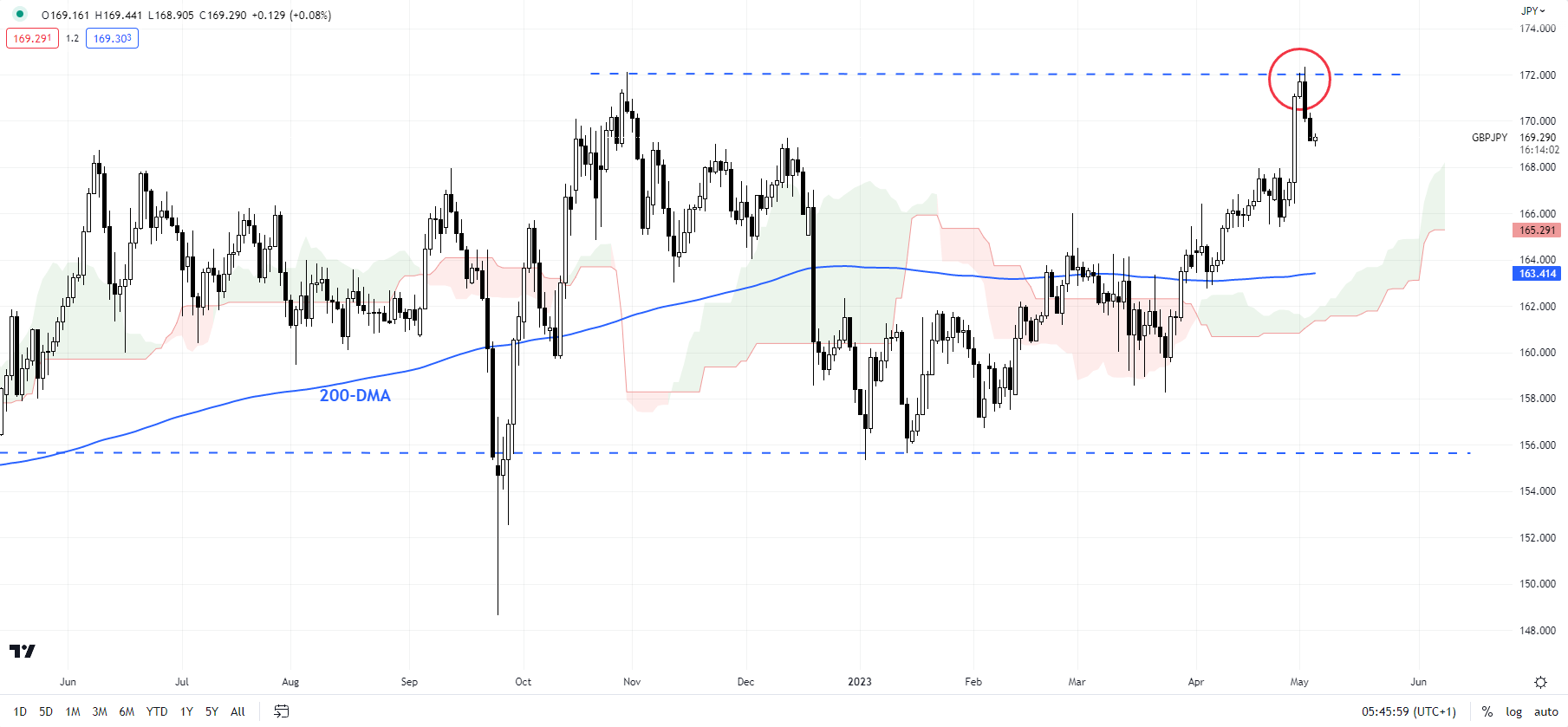

GBP/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

GBP/JPY: Retreats from resistance

GBP/JPY has retreated from the October high of 172.10. Any break below immediate support at the mid-April high of 167.95 would confirm that the upward pressure had eased, opening the way toward the end-April low of 165.40.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

Source link