[ad_1]

And … it’s gone.

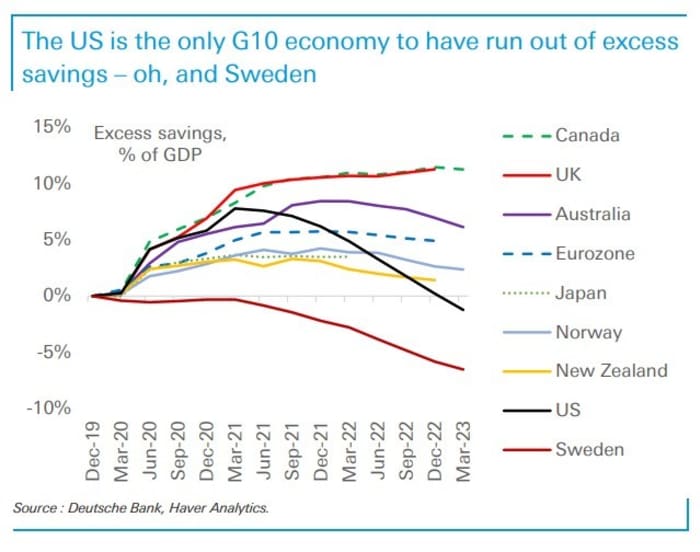

A new research paper by a trio of Federal Reserve economists in the central bank’s international division say the excess savings accumulated in the U.S. during the pandemic have been burned off.

That doesn’t mean Americans aren’t saving, but that their savings are now below the trend, as measured in a few different ways.

Federal Reserve

Other advanced economies including Canada, France and Germany also have experienced what the authors call a “hump-shaped path,” though these economies still have a stock of excess savings, where they don’t expect to be burned off until the fourth quarter.

Though the price of the excess savings was the current inflation, the researchers pointed out the benefits of the COVID-19 aid. “The large fiscal transfers implemented by governments supported a strong economic rebound, with both GDP and employment recovering at a remarkable pace, likely preventing worse outcomes,” they said.

“As [advanced economies] are expected to continue to use their accumulated stock of excess savings to fuel consumption in the quarters to come, the resulting strength in aggregate demand could continue to be a source of price pressures,” they said. No surprise, then, that inflation is higher in the eurozone and the U.K. than in the U.S.

Interestingly, Deutsche Bank extended the Fed analysis, and found that Sweden has depleted its savings by even more. Sweden, of course, tried its best to keep its economy open during pandemic. “As Sweden never locked down as hard as other countries in 2020, households never accumulated excess savings before their saving rates quickly fell below pre-Covid trends amid the inflation and interest rate shocks from 2021 onwards,” said Robin Winkler, a Deutsche Bank strategist.

Rising rate expectations in Europe and the U.K. have helped 5-year yields on U.K. debt

TMBMKGB-05Y,

rise above that of the U.S.

TMUBMUSD05Y,

as Germany’s

TMBMKDE-05Y,

rate differential vs. the U.S. has narrowed.

Winkler drew two conclusions. “First, the divergence in excess savings in the last year or so is consistent with our medium-term view of the U.S. economy slowing most rapidly in the second half and the Fed being closer to easing policy than most other central banks in G10. Second, while the U.K. and the eurozone could hold out a little longer thanks also to excess savings, the lack of excess savings supports our view that Sweden faces even stronger headwinds,” he said.

The euro

EURSEK,

this year has gained 6% against the Swedish krona.

[ad_2]

Source link