[ad_1]

It felt like a bit of a catch-up on Monday, with the Dow

DJIA

outperforming the S&P 500

SPX

which outperformed the Nasdaq Composite

COMP.

In any event, it broke a four-session losing streak for the S&P 500, though the August gremlins might be back out on Tuesday. More on that later.

But for the call of the day we’ll go way back in time to Friday — ancient history — when the Labor Department reported 187,000 jobs were created in July. Steve Englander, head of North America macro strategy at Standard Chartered, has been something of a jobs-report skeptic, previously noting the divergence between the payrolls report and the quarterly census of employment and wages. (The most recent data, from December, shows the payrolls report with 2.2 million more jobs than the more authoritative, but less timely, QCEW report does.)

What Englander finds fault with in the July report is the birth-death model. Each month the government surveys 122,000 businesses and government agencies, covering about a third of all workers, to come up with the job numbers produced by what’s called the establishment survey. But new companies pop up, as well as fail, all the time. Hence the birth-death model fills in the gap with its estimate for job creation or destruction each month.

Englander for these purposes is looking at the non seasonally adjusted numbers, which showed 182,000 private-sector jobs created in July. The birth-death model was responsible for 280,000 of them, which means existing companies got rid of 98,000 positions.

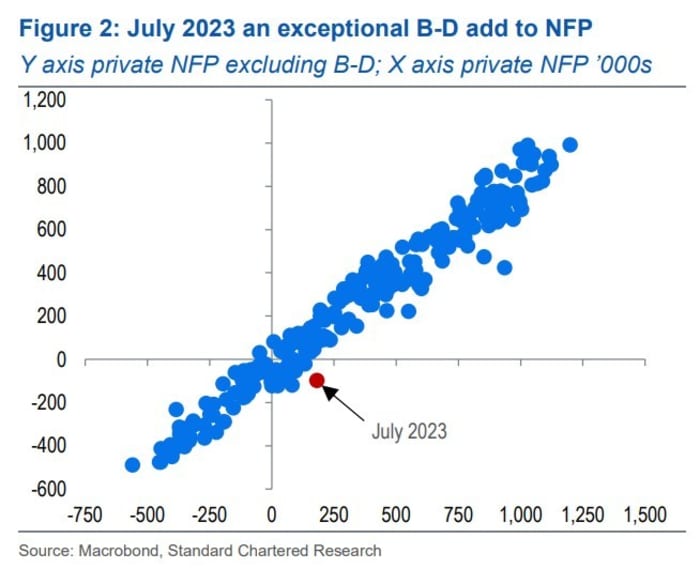

“The behavioral question is whether it is plausible that optimism on economic prospects led to many jobs being created at newly established firms when ongoing businesses were contracting. The BLS’ business employment dynamics data, which is based on administrative data rather than a model, tells us this is very unlikely. As is intuitive, job creation from new and existing firms tends to move together. This is the basis of our suspicion of excess animal spirits at BLS,” he said.

MarketWatch’s examination of the numbers does find months that the private-sector job creation of new companies is positive when existing companies are reducing workers, but it isn’t normal — five out of the last 27 reports when January figures are excluded.

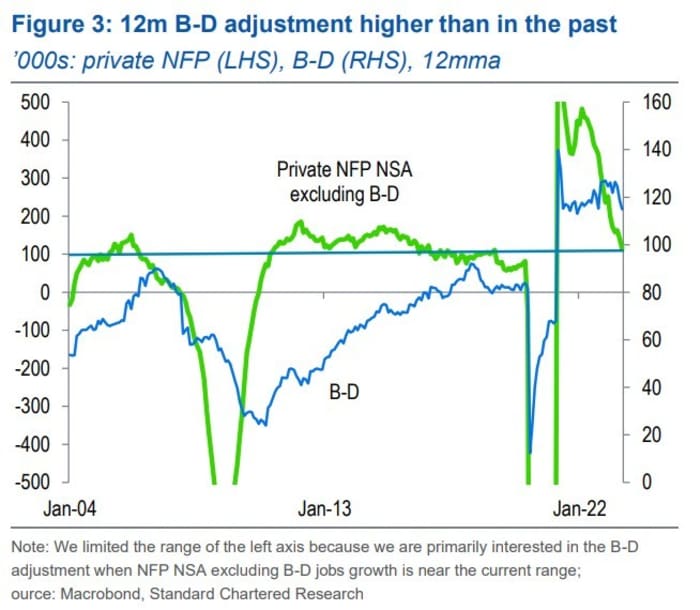

Englander says the figures may be overstated by as much as 200,000 — and applying seasonal adjustment would leave private-sector job creation down by nearly 30,000. If he’s right about the overstatement, this also implies job openings data could be awry, since that report uses the headline payrolls data for alignment. And he says when the average of 12 months of private payrolls excluding births and deaths are near current levels, the average 12-month birth-death adjustment has been 35,000 to 60,000 jobs lower than it is now running.

The markets

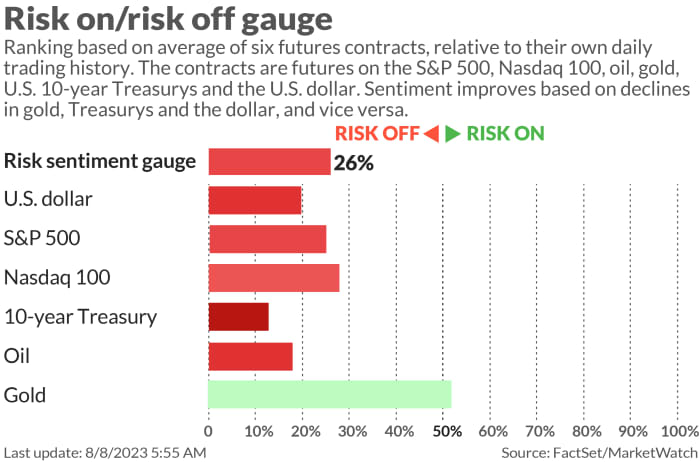

A risk-off tone seems to be the flavor for Tuesday. U.S. stock futures

ES00,

NQ00,

were lower, oil futures

CL.1,

dropped, and the yield on the 10-year Treasury

BX:TMUBMUSD10Y

was back around 4%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

A big slate of earnings includes results from United Parcel Service, Eli Lilly

LLY,

and Warner Music

WMG,

with Rivian Automotive

RIVN,

and Upstart

UPST,

reporting after the close. UPS stock

UPS,

skidded on a reduced outlook while AMC Entertainment

AMC,

reported earnings and revenue ahead of forecast.

Among Monday’s after-hours releases, Paramount Global

PARA,

produced results ahead of forecast and agreed to sell Simon & Schuster to KKR for $1.6 billion, Palantir Technologies

PLTR,

announced a new $1 billion stock buyback and Beyond Meat

BYND,

reduced its forecast.

Novo Nordisk

NVO,

Lilly’s rival for diabetes drugs, said its Wegovy treatment also reduces cardiovascular events, by some 20% in a study.

Moody’s placed the credit ratings of six banks on review for downgrade and did cut the rating of several others, in which they blamed on interest-rate and asset and liability risks.

June trade data is due for release, after the advanced report said the deficit in goods narrowed by 4.4%. In China, its trade surplus of $80.6 billion for July was worse than the $70.6 billion that was expected.

Best of the web

Elon Musk calls the Cybertruck Tesla’s

TSLA,

best product. Here comes the test.

Even Zoom

ZM,

is making employees go back to the office.

Dish

DISH,

and EchoStar

SATS,

may be merged, joining two companies both controlled by Charlie Ergen.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

PLTR, |

Palantir Technologies |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

TUP, |

Tupperware Brands |

|

TTOO, |

T2 Biosystems |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AMZN, |

Amazon.com |

The chart

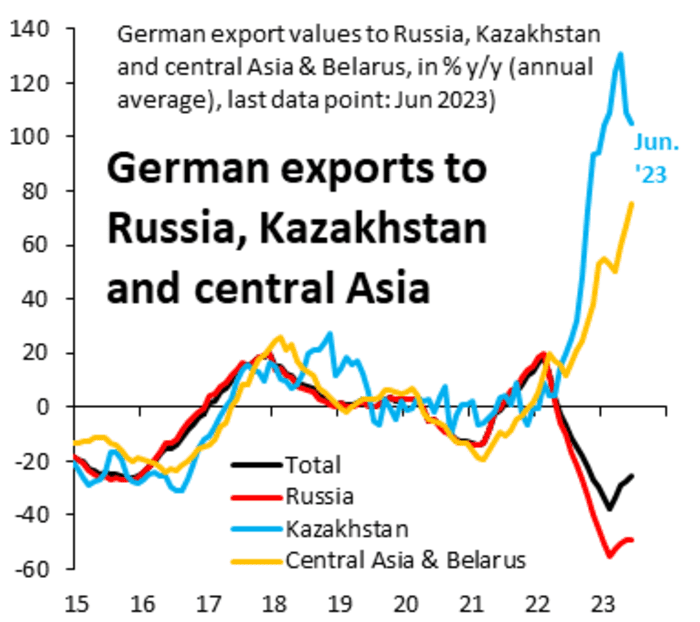

German exports to Kazakhstan, Central Asia and Belarus are surging, more than doubling over the last year. Now, the Kazakh economy did grow at a nearly 5% clip during June, but it seems that some of these exports may be headed to Russia, according to Robin Brooks, chief economist at the Institute of International Finance. He also points out German and Polish exports to Kyrgzstan are surging, as are Swedish exports to Kazakhstan. European Union countries sanctions are meant to prevent the export of cutting-edge technology, certain types of machinery, aviation goods and technology, dual-use goods and luxury goods to Russia, among other restrictions.

Random reads

The Baltimore Orioles took its lead play-by-play voice off the air after he accurately recalled the team’s losing ways in previous seasons.

A car crashed into the second floor of a house in Pennsylvania.

Hank the Tank, a bear (female it turns out) that broke into 21 homes, has been captured.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

[ad_2]

Source link