[ad_1]

Australian Dollar, AUD/USD, Technical Analysis, Retail Trader Positioning – IGCS Update

- Australian Dollar gains most since end of July

- Retail traders started unwinding bullish bets

- Will AUD/USD extend higher from here?

Recommended by Daniel Dubrovsky

Get Your Free AUD Forecast

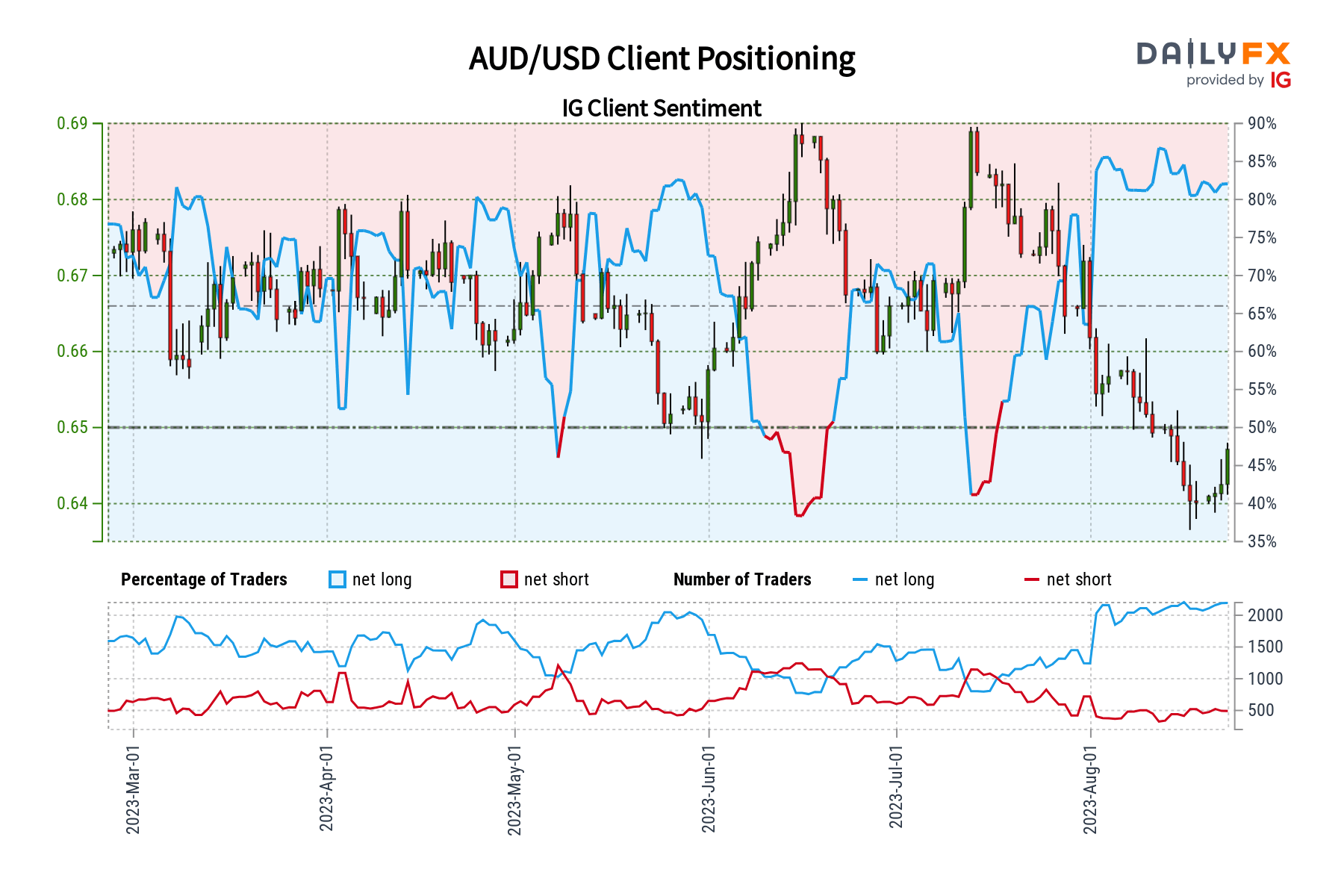

Over the past 24 hours, the Australian Dollar soared 0.9 percent against the US Dollar, resulting in the best single-day performance for AUD/USD since the end of July. In response, retail traders have started to slowly decrease their upside exposure. This can be seen by looking at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, could the Aussie be looking to extend recent gains?

AUD/USD Sentiment Outlook – Bullish

The IGCS gauge shows that about 78% of retail traders still remain net-long AUD/USD. Since the vast majority are biased to the upside, this remains to offer a warning that the exchange rate may fall down the road. However, downside exposure has increased by 16.67% and 34.11% compared to yesterday and last week, respectively.

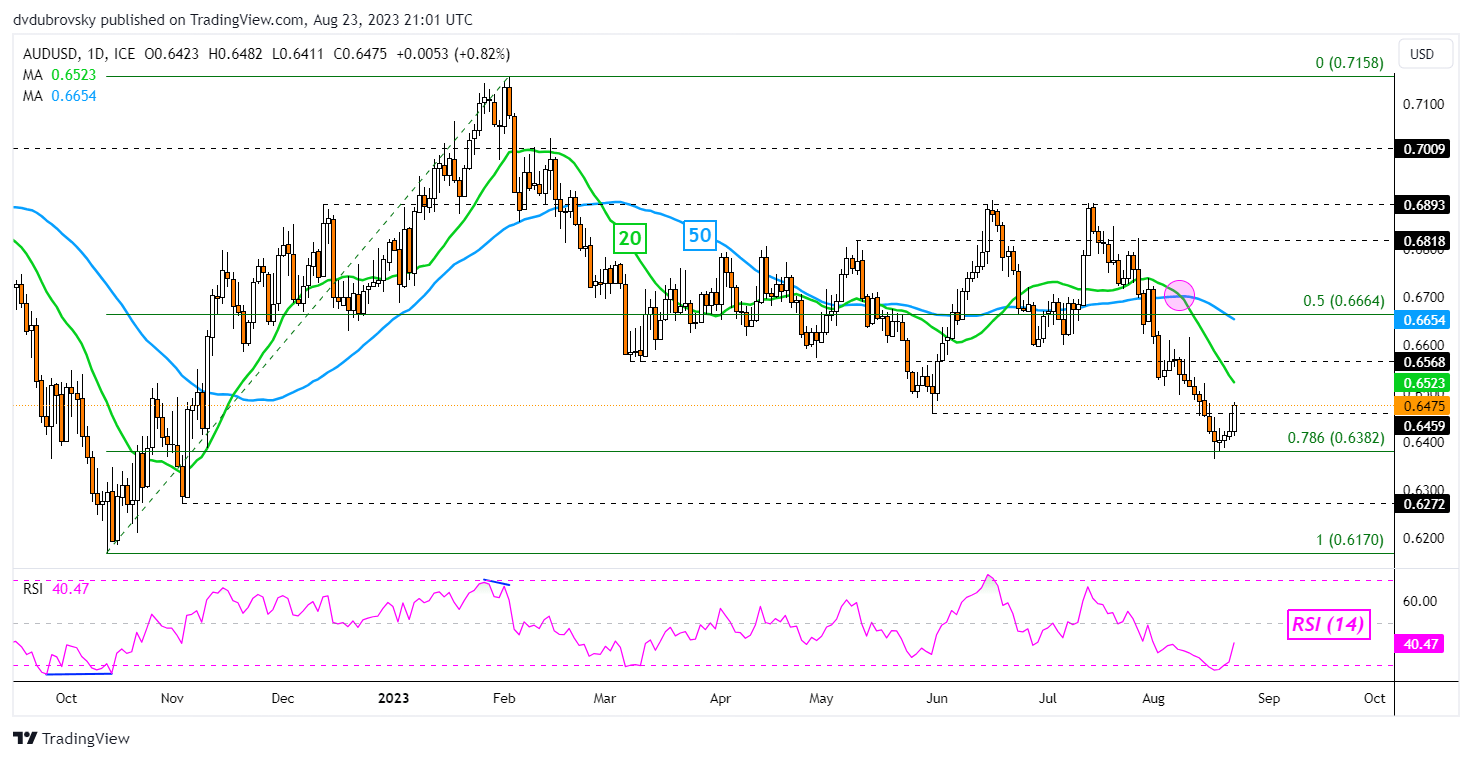

Australian Dollar Daily Chart

Taking a look at the daily chart, AUD/USD has extended gains after failing to breach the 78.6% Fibonacci retracement level of 0.6382. Now, the exchange rate has closed above the May 31st low of 0.6459. From here, immediate resistance is the 20-day Moving Average, followed by the 50-day line. A bearish Death Cross between the two lines remains in play.

It would likely take a confirmatory breakout above the 20-day line to offer a stronger bullish technical conviction. As such, recent gains ought to be treated with a pinch of salt. Confirming a breakout below 0.6382 opens the door to extending the prevailing downtrend since the middle of July.

Recommended by Daniel Dubrovsky

How to Trade AUD/USD

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

[ad_2]

Source link