[ad_1]

The bond market is front and center for investors these days, with JPMorgan warning of a “financial accident” if yields keep going up, driving prices lower.

“The damage in bonds has been more severe and more sustained than for equities, and you can’t help wondering where the real damage is. You can’t have this much value destruction in bonds without there being some stress somewhere. However, it’s near impossible to work out where exactly it might come to the surface and on the heels of the worst month for bonds of the year,” noted a team of Deutsche Bank strategists led by Jim Reid on Monday.

Our call of the day from Ed Yardeni, president of Yardeni Research, offers an idea on the next market to fall. That’s as he raises the alarm over what he calls the “Wild Bunch,” or bond vigilantes, who have “seized control of the Treasury market.” His hope is that cooling inflation will calm things down.

In a note to clients, Yardeni ticks off evidence of those bond vigilantes in action. For starters, the fact that the 10-year Treasury yield

BX:TMUBMUSD10Y

rose on recent weak data instead of declining suggests a “shift in bond investors’ focused from what monetary policy makers may do to rising alarm about what fiscal policy makers are doing.”

“The worry is that the escalating federal budget deficit will create more supply of bonds than demand can meet, requiring higher yields to clear the market; that worry has been the bond vigilantes’ entrance cue,” he says.

Yardeni also sees the vigilantes in action when it comes to yield curve disinversion lately — an inverted yield curve occurs when interest paid on short-term debt is more than that of longer term bonds.

“Perversely, now that the Fed seems to be on the verge of terminating its rate hiking, bond investors might have concluded that short-term rates aren’t high enough to cause a financial crisis, credit crunch, and a recession,” he said.

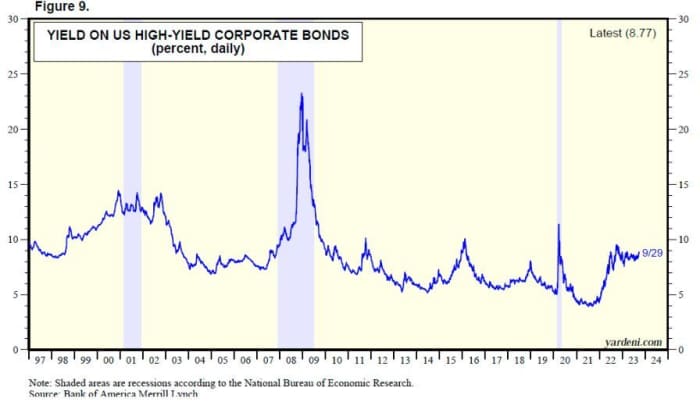

And here’s where he’s on guard for trouble, as he notes that the wild bunch have oddly left the high-yield corporate debt market — flat and stable –alone:

“Could it be that some of them view the government’s securities as riskier than high-yield corporates? The result of their rampage in the Treasury market suggests as much,” he said, adding that they are on alert for signs of rampage spreading to high yields.

And for sure, the wild bunch have DC policy makers in their sights, after causing the Treasury market to fully reverse a drop in the 10-year yield from the global financial crisis through the pandemic over the past three years, he notes.

Their message is clear, says Yardeni: “Take meaningful actions to reduce the federal deficit now and in the future or we will push the bond yield up to whatever level it takes to get you to do so!”

Read: How Treasury market upheaval is rippling through global markets in 4 charts

The markets

Stock futures

ES00,

NQ00,

are pointing to opening losses, with the yield on the 10-year Treasury note

BX:TMUBMUSD10Y

up 4 basis points and that of the 30-year

BX:TMUBMUSD30Y

up 7 basis points. The dollar

DXY

is up, notably against the Russian ruble

USDRUB,

while gold

GC00,

silver

SI00,

and oil

CL.1,

are under pressure.

Read: Gold appears headed for a ‘death cross’ just 5 months after teasing record highs

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

POINT Biopharma

PNT,

stock is up 84% after Eli Lilly announced a $1.4 billion deal for the cancer treatment company, paying $12.50 a share.

SmileDirectClub shares

SDC,

are down another 12% following a bankruptcy filing, as a buyer for the teeth straightening group could be hard to find.

WeWork stock

WE,

is down 5% after the office work space provider said it would miss interest payments to continue talks with its lenders.

U.S.-listed Chinese stocks are down after property developers (except Evergrande, which rallied) pulled the Hang Seng

HK:HSI

2.6% lower. Alibaba

BABA,

JD.com

JD,

XPeng

XPEV,

and Li Auto

LI,

are off 2% or more.

Tesla

TSLA,

has launched a less expensive, rear-wheel-drive version of its bestselling Model Y crossover SUV in the U.S.

Cleveland Fed President Loretta Mester said late Monday that the central bank may need to hike rates once more this year and then keep them high “for some time.”

Elsewhere a speech is due from Atlanta Fed President Raphael Bostic at 8 a.m., followed by job openings at 10 a.m.

Best of the web

Why home insurance prices in the U.S. went up 21% between 2022 and 2023.

Meta plans to charge $14 a month for ad-free Instagram or Facebook.

Burger King is still open in Russia despite a pledge to exit.

The chart

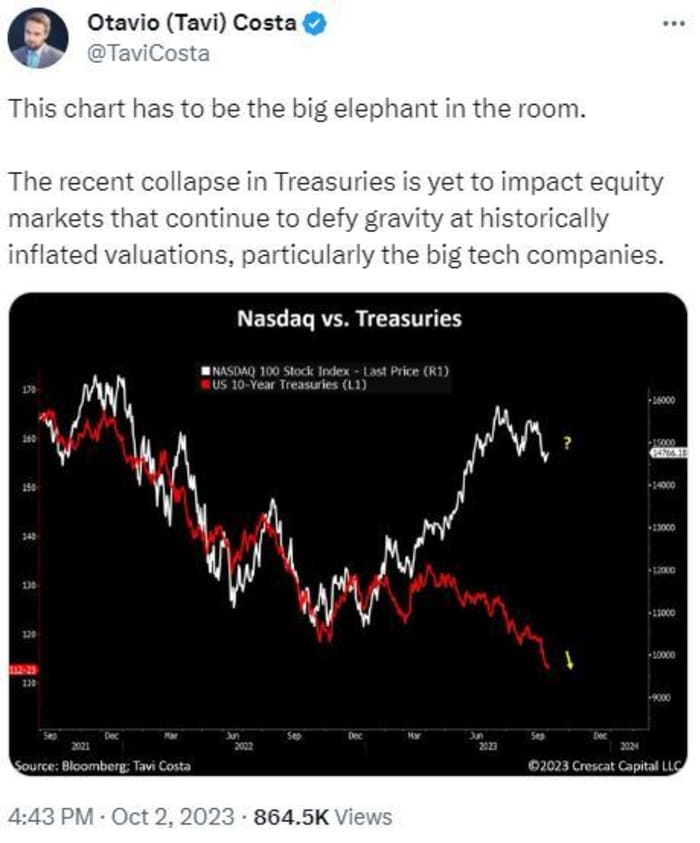

Here’s a chart from the portfolio manager of Crescat Capital, Otavio Costa, whose chart sums up possible brewing trouble for tech companies:

@TaviCosta

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

TTOO, |

T2 Biosystems |

|

AMZN, |

Amazon.com |

|

MULN, |

Mullen Automotive |

|

NKLA, |

Nikola |

Random reads

On the toilet? Stay off your phone.

NASA has a serious plan to build houses on the moon.

In bedbug-plagued Paris, hotels will cost 300% more for the 2024 Olympics

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

[ad_2]

Source link