[ad_1]

S&P 500 FORECAST:

- U.S. stocks slide, dragged lower by higher Treasury yields

- The S&P 500 extends losses for the second straight day, consolidating below the 4,800 level

- A bearish double top pattern appears to be developing on the S&P 500’s daily chart

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Gold Prices in Turmoil as Treasury Yields Rebound and US Dollar Dominates

U.S. stocks were under pressure on Wednesday, dragged lower by higher yields following better-than-anticipated December retail sales figures, which grew by 0.6% month-over-month versus a forecast of 0.4%. In this context, the S&P 500 fell roughly 0.75% in early afternoon trading in New York, extending its slide for the second straight session and consolidating below the 4,800 level.

Strong data, while a positive sign for the economic outlook, could delay the start of the Fed’s easing cycle and reduce the likelihood of aggressive rate cuts this year, as policymakers will be reluctant to cut borrowing costs substantially in the presence of healthy growth and sticky inflation. For this reason, markets are responding negatively to the good news.

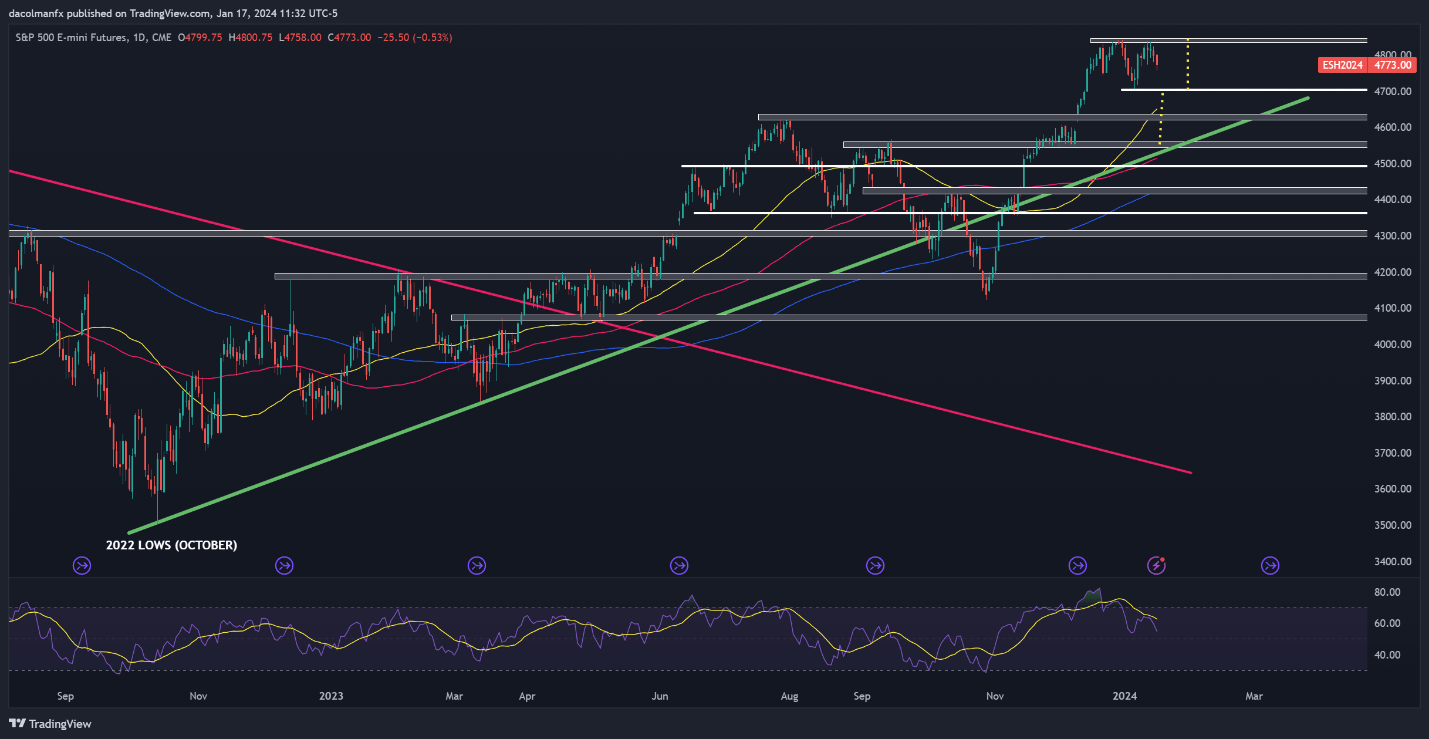

Turning to technical analysis, the S&P 500 established a fresh record in late December, only to retrench and lose its grip on the gains in the days that followed. Last week, the equity index staged a moderate rebound and tried to rally back to its recent highs but was quickly slammed lower, forging in the process what appears to be a double top, a bearish technical configuration.

If you’re looking for an in-depth analysis of U.S. equity indices, our first-quarter stock market forecast is packed with great fundamental and technical insights. Get the full trading guide now!

Recommended by Diego Colman

Get Your Free Equities Forecast

A double top is a reversal pattern, composed of two similar peaks separated by a valley in the middle, which often develops in the context of a prolonged bullish move. This ominous technical setup is confirmed once prices complete their “M”-like shape and breach the support level created by the intermediate trough – the neckline.

The potential size of the downward retracement can be quantified by projecting vertically the height of the double top from the break point. In the case of the S&P 500, the neckline is identified at 4,700. With that in mind, a breakdown could usher in a pullback towards trendline support at 4,550. On further weakness, the focus will be on 4,490.

Although the short-term bias is turning a bit bearish, a move above 4,850 would invalidate the double top, opening the door to new records.

To get an edge in your trading and understand how market positioning may affect the S&P 500’s trajectory, request a free copy of our sentiment guide!

| Change in | Longs | Shorts | OI |

| Daily | 6% | 2% | 3% |

| Weekly | -10% | 9% | 2% |

S&P 500 TECHNICAL CHART

Source: TradingView

[ad_2]

Source link