[ad_1]

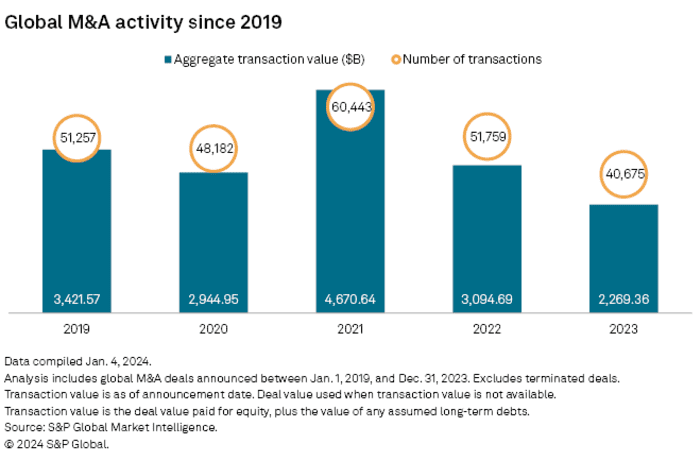

The total value of global merger-and-acquisition announcements fell 26.7% to $2.27 trillion in 2023, as higher interest rates chilled dealmaking, S&P said on Monday.

With higher rates boosting the costs of borrowing for deals, the number of announced company tie-ups moved lower by 21.4%.

All told, 2023 was the weakest year for M&A going back at least to 2019, including the pandemic year of 2020, which saw $2.94 trillion in total dollar volume, compared with the $2.27 trillion in 2023.

M&A volume in 2023 fell to $2.37 trillion, down from about $3.1 trillion in 2022 and about half the $4.67 trillion in the peak year of 2021.

S&P Global Market Intelligence

Not all the 2023 news was bleak, however: Two mammoth deals were announced in the fourth quarter. Exxon Mobil Corp.

XOM,

said in October it would pay $59.5 billion to buy Pioneer Natural Resources, in the largest M&A announcement of the year. Chevron Corp.’s

CVX,

agreement to buy Hess Corp.

HES,

for $53 billion was also announced in October.

“The large transactions at the end of the year helped boost some optimism for the outlook,” said Joe Mantone, an analyst at S&P Global Market Intelligence. “Challenges do continue to exist, as geopolitical unrest and fears of a possible recession are still front of mind for dealmakers and executives.”

Among the fourth-quarter data points from S&P is that the three-month period was the eighth quarter in a row with total stock equity issuance below $100 billion, less than half the average quarter volume of $232.4 billion from 2020 through 2021.

On the equity-issuance front, the IPO market in 2024 is showing increased signs of life, with three companies — American Healthcare REIT, Fortegra and Fractyle Health — on Monday releasing estimated price ranges on their deals.

Also read: American Healthcare REIT, Fortegra and Fractyle Health set IPO price ranges as thaw continues

[ad_2]

Source link