[ad_1]

Icahn Enterprises LP’s stock was flat on Wednesday after the investing arm of billionaire activist investor Carl Icahn posted an unexpected fourth-quarter loss but revenue that topped estimates.

The company said it’s sticking with its $1-per-unit distribution, which it halved in August after the stock was pummeled when short seller Hindenburg Research on May 2 published a scathing article about the company, accusing it of overstating values and paying a dividend it could not afford, among other things.

The company had a net loss of $139 million, or 33 cents per unit, for the quarter, narrower than the loss of $255 million, or 74 cents per unit, posted in the year-earlier period. Revenue fell to $2.644 billion from $3.28 billion a year ago.

The FactSet consensus was for per-unit earnings of 21 cents and revenue of $2.358 billion.

Indicative net asset value was $4.76 billion at year-end, down about $411 million from the third quarter, in line with guidance. The decline was mostly due to shorts in the investment funds that are used for hedging, and to distribution to the company’s unitholders.

Icahn reiterated the stance he took last week on activist investing, which he said was “the best investment paradigm that exists. While this method of investing certainly is somewhat volatile, over the long term the returns cannot be matched.”

The reason it works so well, he said, is that “somewhat unfortunately, many public companies are not well run. It is very difficult and expensive to remove a poorly performing CEO and board.”

Icahn Enterprises currently has 25 board seats in its disclosed public company investments, he added.

It encourages all of its companies to pursue spinoffs and asset sales when they believe doing so will create value. It also urges them to improve leadership and help companies manage complex litigation.

“We have continued to pick our spots and find new, exciting activist opportunities, including the recently announced positions in American Electric Power Co.

AEP,

and JetBlue Airways Corp.

JBLU,

within our investment segment,” he said.

Also read: Carl Icahn lands two JetBlue board seats days after disclosing stake in airline

Icahn Enterprises, which is 84% owned by Icahn and his son, Brett, offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate. Its unit holders are mostly retail investors.

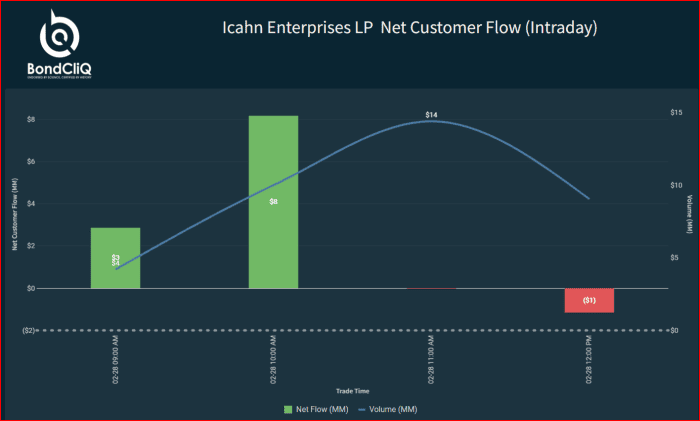

The company’s bonds, meanwhile, saw net buying on Wednesday, after the company stuck with its distribution policy.

Icahn Enterprises net customer flow (intraday).

BondCliQ Media Services

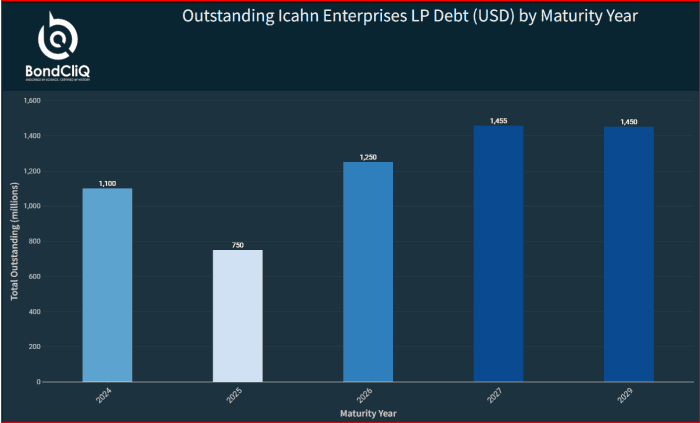

The company has about $6 billion in outstanding dollar-denominated bonds, the bulk of which mature in 2027.

Outstanding Icahn Enterprises debt (in U.S. dollars) by maturity year.

BondCliQ Media Services

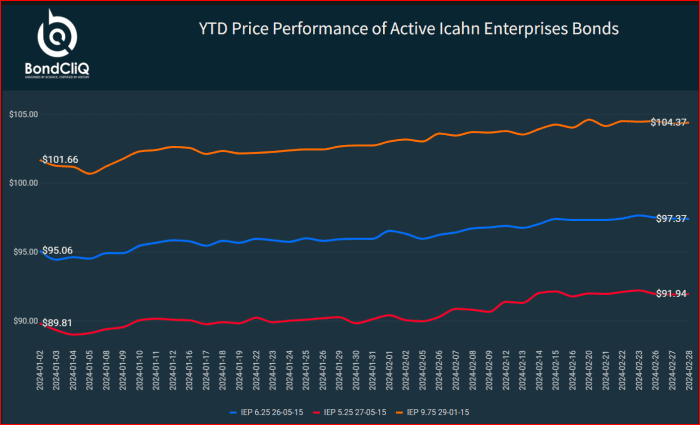

Prices have been creeping higher in the year to date.

Year-to-date performance of active Icahn Enterprises bonds.

BondCliQ Media Services

The stock

IEP,

remains down 64% over the last 12 months, following the short seller’s report. The S&P 500

SPX

has gained 27.5% in the same time frame.

[ad_2]

Source link