[ad_1]

There’s a strong correlation between interest rates and forex trading. Forex is ruled by many variables, but the interest rate of the currency is the fundamental factor that prevails above them all.

Simply put, money attempts to follow the currency with the highest real interest rate. The real interest rate is the nominal interest rate less inflation.

Forex traders must keep an eye on each country’s central bank interest rate and more importantly, when it is expected to change, to forecast moves in currencies.

This article will cover forex interest rates in depth, touching upon:

- What interest rates are and how they affect currencies.

- Forex interest rate differentials.

- How traders can forecast central bank rates and the impact on the FX market.

- Key forex interest rate trading strategies.

What are interest rates and why do they matter to forex traders?

When traders talk about ‘interest rates’ they are usually referring to central bank interest rates. Interest rates are of utmost importance to forex traders because when the expected rate of interest rates change, the currency generally follows with it. The central bank has several monetary policy tools it can use to influence the interest rate. The most common being:

- Open market operations: The purchase and sale of securities in the market with the goal of influencing interest rates.

- The discount rate: The rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank’s lending facility.

Central banks have two main tasks: to manage inflation and promote stability for their country’s exchange rate. They do this by changing interest rates and managing the nation’s money supply. When inflation is ticking upwards, above the central bank’s target, they will increase the central bank rate (using the policy tools) which can restrict the economy and bring inflation back in check.

The economic cycle and interest rates

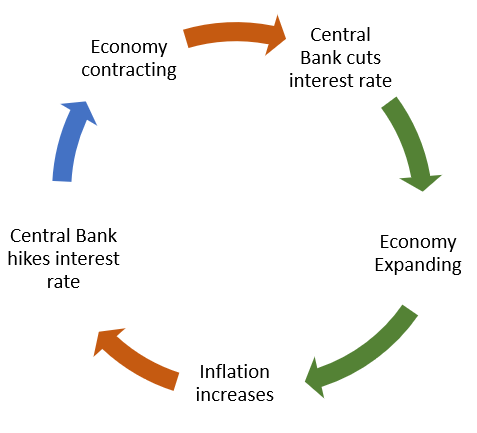

Economies are either expanding or contracting. When economies are expanding, everyone is better off, and when economies are contracting (recession) they are worse off. The central bank aims to keep inflation in check while allowing the economy to grow at a modest pace, all by managing the interest rate.

When economies are expanding (GDP Growth positive), consumers start to earn more. More earning leads to more spending, which leads to more money chasing fewer goods – triggering inflation. If inflation is left unchecked it can be disastrous, so the central bank attempts to keep inflation at its target level, which is 2% (for most central banks), by increasing interest rates. Increased interest rates make borrowing costlier and helps reduce spending and inflation.

If the economy is contracting (GDP growth negative), deflation (negative inflation) becomes a problem. The central bank lowers interest rates to spur spending and investment. Companies start to loan money at low interest rates to invest in projects, which increases employment, growth, and ultimately inflation.

The cycle goes something like this:

How do interest rates affect currencies?

The way interest rates impact the forex markets is through a change in expectations of interest rates that lead to a change in demand for the currency. The table below displays the possible scenarios that come from a change in interest rate expectations:

|

Market expectations |

Actual Results |

Resulting FX Impact |

|

Rate Hike |

Rate Hold |

Depreciation of currency |

|

Rate Cut |

Rate Hold |

Appreciation of currency |

|

Rate Hold |

Rate Hike |

Appreciation of currency |

|

Rate Hold |

Rate Cut |

Depreciation of currency |

Interest rate relevance to forex trading

Imagine you are an investor in the UK that needs to invest a large sum of money in a risk-free asset, like a government bond. Interest rates in the US are on the rise so you start to buy US Dollars to invest in the US government bonds.

You (being the UK investor) are not alone in investing in the country with higher interest rates. Many other investors follow the increase in yield and so increase the demand for US Dollars which appreciates the currency. This is the essence of how interest rates affect currencies. Traders can attempt to forecast changes in expectations of the interest rate which can have a large effect on the currency.

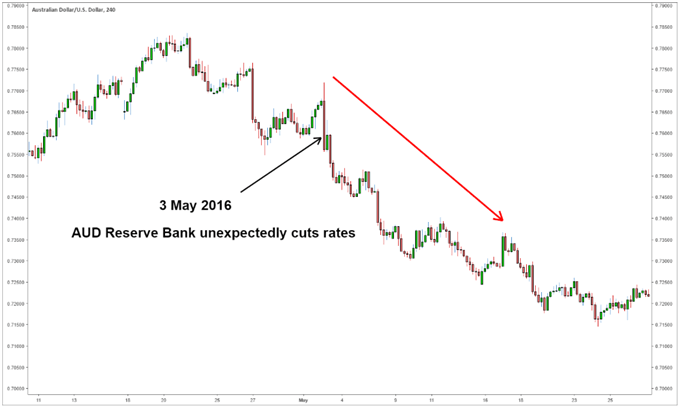

Here is an example of what happens when the market expects the central bank to keep interest rates on hold, but then central bank decreases the interest rate. In this example, the Reserve Bank of Australia was expected to keep interest rates on hold at 2% but instead cut it to 1.75%. The market was surprised by the rate cut so the AUD/USD depreciated.

Understanding forex interest rate differentials

Interest rate differentials are simply differences in interest rates between two countries.

If a trader expects the US to unexpectedly hike interest rates he/she anticipates the US dollar may appreciate. To increase the trader’s chances of success, the trader can buy the US Dollar against a currency with low interest rates as the two currencies are diverging in the direction of their respective interest rates.

Interest rates and their differentials have a large influence on the appreciation/depreciation of the currency pair. The changes in interest rate differentials are correlated to the appreciation/depreciation of the currency pair. It is easier to understand visually. The chart below compares the AUD/USD currency pair (candlestick graph) and the difference between the two-year AUD government bonds and the two-year USD government bonds (orange graph). The relationship shows that as the AUD bonds yield decreases relative to the USD bonds, so does the currency.

Interest rate differentials are widely used in carry trades. In a carry trade money is loaned from a country with a low rate and invested in a country with a higher interest rate. There are, however, risks involved with the carry trade such as the currency invested in depreciating relative to the currency used for funding the trade.

How to forecast central bank rates and the impact on FX markets

Fed funds futures are contracts traded on the Chicago Mercantile Exchange (CME) that represent the markets expectations of where the daily official federal funds rate will be when the contract expires. The market always has its own forecast of where the interest rate will be. A trader’s job is to forecast a change in those expectations.

For a trader to forecast central bank rates he/she will need to keep a close eye on what the central bankers are currently monitoring. Central bankers try to be as transparent as possible to the public about when they expect to increase interest rates and which economic data they are currently monitoring.

The central bankers decide to increase or decrease interest rates based on several economic data points. You can keep up to date with the release of these data points using an economic calendar. Inflation, unemployment, and the exchange rate are some of the major data points. The trader must be in tune with the central bank policy makers and almost try to forecast what their actions will be before they state it to the public. This way the trader can reap the benefits of the markets change in expectations. This method of trading is based on the fundamentals which is different to trading using technical analysis. See our article on Technical vs Fundamental analysis to understand the different ways to analyze forex.

Forex interest rate trading strategies

Forex traders can opt to trade the result of the interest rate news release, buying or selling the currency the moment the news releases. See our guide on trading the news for more expert information.

Advanced forex traders may attempt to forecast changes in central banker’s tones, which can shift market expectations. Traders will do this by monitoring key economic variables like inflation, and trade before central banker’s speeches. See our Central Bank WeeklyWebinar for expert commentary on the latest and upcoming central bank decisions.

Another method is to wait for a pullback on the currency pair after the interest rate result. If the central bank unexpectedly hiked rates, the currency should appreciate, a trader could wait for the currency to depreciate before executing a buy position- anticipating that the currency will continue to appreciate.

Key Concepts

- The interest rate decisions themselves tend to be less important than the expectations for future interest moves.

- Trading currencies with increased interest rate differentials could increase the probability of successful trades.

- It is important to keep up to date with economic data using an economic calendar to forecast potential changes in market expectations.

For more information on how to trade the forex markets see our article on forex candlesticks.

[ad_2]

Source link