[ad_1]

Speculators have been building up a “historically massive” short position in U.S. Treasury futures ahead of what could be $1 trillion of new debt issuance on the heels of a debt-ceiling resolution, according to Macquarie’s sales and trading global macro strategy desk.

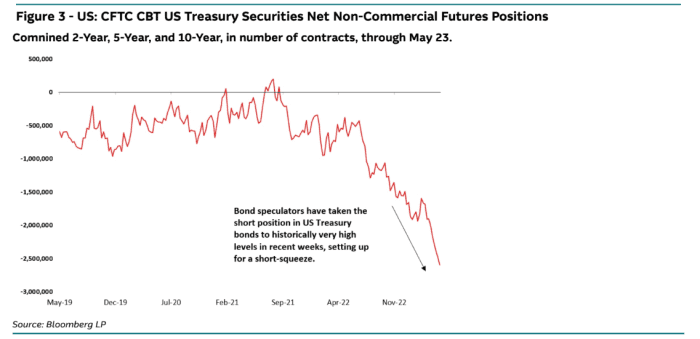

Bond speculators have been taking up a large number of short positions in 2-year, 5-year and 10-year Treasury futures

TY00,

(see chart), according to the Macquarie team, which pinpointed the combined tally of contracts at nearly 3 million as of late May, or the most since 2000.

A big short looks to be building in the Treasury market ahead of an expected flood of T-bill issuance to help refill U.S.coffers run low by the extended debt-ceiling fight.

Bloomberg, Macquarie

The buildup matters because much of Wall Street has been focused on the brief spike in yields on some Treasury bills due in early June to above 7%, or climbing U.S. sovereign CDS spreads as the U.S. teetered toward the brink of a default.

But Macquarie’s team thinks the more important development tied to the debt-ceiling fight has been the significant number of wagers in Treasury futures in the past three weeks.

A look at Commodity Futures Trading Commission data shows an explosion of speculation taking hold in Treasury futures, which Macquarie’s team led by Thierry Wizman pegged as the biggest buildup in short interest in 10-year Treasury futures since 2000. So has been the combined short interest in 2-year, 5-year and 10-year futures.

Short bets are a wager that prices for a stock or bond will fall. Since bond prices and yields move in the opposite direction, fixed-income speculators would be focused on the potential for yields to climb when new Treasury supply outstrips demand.

The Macquarie team said the heavy positioning likely reflect traders “attempting to hedge away or sidestep the inevitable issuance of new bonds,” in a Wednesday trading desk note.

Positioning for a flood

Like others on Wall Street, Macquarie’s team expects heavy U.S. Treasury issuance of $500 billion to $1 trillion over the next few weeks or months, once the debt-limit deal is written into law.

“Markets are trying to get ahead of that as much a s possible,” said George Catrambone, head of fixed income and head of trading at DWS Group, in a phone interview Wednesday, adding that some investors are factoring in higher Treasury yields.

“But I don’t think anyone is quite sure where the demand is going to be,” he said.

Catrambone also said it’s hard to pin any single rationale to open futures contracts. He pointed to other “crosscurrents” at play in markets, including that Congress still has yet to do its part to increase the debt-ceiling.

Investors also aren’t clear on the path lower for inflation to the Federal Reserve’s 2% annual target, he said, or about the mixed signals from Federal Reserve officials on if there will be another rate hike in June, or a pause.

Related: Traders price out June rate hike after Fed officials talk about skipping increase

What’s more, the Treasury might consider getting creative to keep markets on an even keel, including by issuing 5-month bills or other maturities that suit investor needs, Catrambone said.

How it could backfire

Wizman’s team at Macquarie thinks there’s potential for short positions in Treasury futures to backfire if a flood of issuance from a debt-ceiling increase doesn’t cause Treasury yields to rise.

They pointed out that the 10-year Treasury yield

TMUBMUSD10Y,

climbed to about 3.8% in late May from about 3.4% over the past two weeks.

Given the climb, “we’re not convinced that yields can rise further into the issuance of new bonds,” the team said. They also expect “pent-up demand” for Treasury debt to keep yields in check, given the lack of new supply since the $31.4 trillion debt-limit was breached in January.

“So from a technician’s perspective, that’s a setup for a short squeeze that takes the 10-year and 5-year yields back to around 3.5%, with a little help from some

downbeat U.S. data over the next few weeks.”

Treasury yields were mostly lower Wednesday, as were stocks, with the Dow Jones Industrial Average

DJIA,

down 0.4%, the S&P 500 index

SPX,

off 0.6% and the Nasdaq Composite Index

COMP,

down 0.6%, according to FactSet.

The 10-year Treasury was at 3.636% at the end of May, booking its biggest monthly yield climb since February, according to Dow Jones Market Data.

See: ‘Potent liquidity squeeze’ threatens stock market once debt-ceiling deal is done

[ad_2]

Source link