[ad_1]

OMAHA, Neb. — After three very long years, the Warren-and-Charlie show is back — much to the relief of value investors and residents of this quiet Midwestern city alike.

We’re talking, of course, about the annual Berkshire Hathaway

BRK.B,

shareholder meeting, the event that’s been called “Woodstock for capitalists” and that features an hours-long question-and-answer session with chairman and chief executive officer Warren Buffett — aka the Oracle of Omaha — and vice chairman Charlie Munger.

For many years, tens of thousands of the Berkshire faithful, to say nothing of countless financial professionals, have descended upon this town (population: roughly 475,000) to hear the two men expound upon their no-nonsense philosophy of investing, with a few homespun life lessons thrown into the mix. In the process, the event has grown into a multi-day affair encompassing everything from a shopping expo — think dozens of products on sale from the many companies Berkshire owns or invests in — to a 5k run.

The pandemic put a stop to all that in 2020 and 2021, with the meeting going virtual. Given the advanced age of the two men — Buffett is now 91 and Munger 98 — some wondered if the pair would attend another in-person gathering.

That has made this year’s event, which kicks off with the shopping expo Friday followed by the actual meeting on Saturday, a must-attend one for plenty of shareholders. Those who came before want to experience it one more time and renew acquaintances with friends made from previous years.

And those who never previously attended want to make sure they get the chance while it’s still happening — at least with Buffett and Munger in their center-stage roles.

“I have had it on my bucket list,” said Patrick Jue, a 50-year-old longtime Berkshire investor who traveled from Texas with his father and fellow shareholder, Bobby Jue, 77, for their first-ever Omaha event.

Like many meeting newbies, the Jues were turning their trip into a true pilgrimage, making sure to stop everywhere from Buffett’s modest home — the Oracle has lived there for decades — to his favorite local steakhouse, Gorat’s. “We’re doing pretty much everything Warren Buffett,” Patrick added, after finishing a hefty meal at Gorat’s that included the Berkshire chief’s favorites — a T-bone steak and hash browns.

“I have had it on my bucket list,” said Patrick Jue (right) of his visit to Omaha for the Berkshire Hathaway shareholder meeting. He is seen here with his father, Bobby Jue, outside Gorat’s, the Omaha steakhouse that’s a Warren Bufett favorite.

Charles Passy

For Omaha businesses, there’s real money to be made from the meeting, especially given that the city hosts few other events that attract this many attendees. The annual College World Series is the closest rival, but it doesn’t have quite the same cachet — or the ability to draw the global audience that the Berkshire event does, with sizable numbers of visitors coming from Europe and Asia.

Gene Dunn, the one-time owner of Gorat’s who has returned this weekend to lend the current proprietors a hand, said the steakhouse can do a month’s worth of business during the Berkshire weekend. That equates to about 1,500 T-bones, if you’re counting.

“It’s a huge deal for the town,” said Dunn.

He isn’t the only one helping out during this all-important weekend. Ashley Blodgett, a Gorat’s manager, said it’s an all-hands-on-deck situation, with the restaurant recruiting anyone it can find to cook, clean or otherwise pitch in. “We ask our siblings, we ask our mothers,” she said.

Blodgett added that Gorat’s servers particularly look forward to the Berkshire meeting. The top ones can earn $2,000 in tips during the weekend, she noted.

Overall, the Berkshire affair generates about $21 million for the local economy, according to Omaha Convention and Visitors Bureau Executive Director Deborah Ward. Or at least it did in 2019, the last year the meeting was held in person.

Attendance has been as high as about 40,000 for previous shareholder gatherings, according to press reports. But it remains to be seen if the 2022 edition will be as large since some may be hesitant to come because of the ongoing pandemic.

“Everybody has got their own personal feelings about traveling,” said Ward.

And the cost of attending this year isn’t cheap, because of inflation and rising fuel prices. A round-trip flight from New York to Omaha for this weekend can easily run $1,000-plus, while some hotels in downtown Omaha are asking more than $500 a night for a room. Officials with Hopper, the travel app that tracks pricing, said airfares to Omaha are up 19% for this year’s Berkshire meeting period compared to 2019.

The town is putting its best foot forward this year in any case. Just ask Tiffany Guyle, director of sales and marketing for The Farnam, a luxury hotel in downtown Omaha that opened in 2021. That makes this year’s Berkshire meeting the first for the 120-room lodging — and Guyle is trying to make sure guests get the right impression.

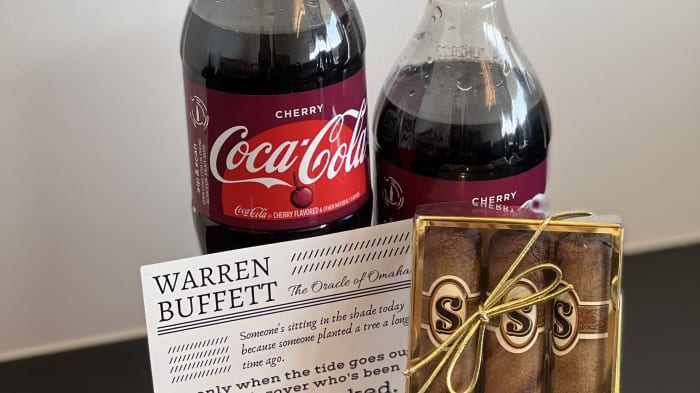

Among other touches, she is offering them a Berkshire-themed welcome gift that includes See’s Candies (Berkshire owns the confectioner) and Cherry Coca-Cola (Berkshire has a sizable chunk of the soda company’s shares — and Buffett professes a never-ending thirst for it, literally).

“This is our coming-out party. This is our debutante ball,” said Guyle of the weekend and what it means to her hotel.

From Omaha, with love: Some of the Berkshire Hathaway and Warren Buffett-themed items in the welcome gift that The Farnam, a luxury hotel in the city, is offering to guests this weekend.

Courtesy The Farnam

Still, the real point of the weekend is to talk investing in general and Berkshire specifically. Buffett and Munger will likely field questions about the effects that inflation and the war in Ukraine could continue to have on the stock market. But they will also probably be asked about company matters, such as how Berkshire might spend some of the $100 billion-plus in cash it has built up.

There could be tougher queries as well. Some shareholders are pushing for Berkshire to remove Buffett from his role as chairman, saying it’s a conflict for him to be both the head of the company’s board and its chief executive. (In effect, Buffett is his own boss.) The proposal is opposed by Berkshire’s board and isn’t expected to pass, however.

There is also the matter of what will become of Berkshire without Buffett and Munger one day running the show. Greg Abel, a Berkshire vice chairman, is in line to take over, but some wonder if it will still be the same company adhering to the same principles — for example, Buffett’s insistence on not paying a dividend to shareholders and instead using company money to find the next great investment.

Hand in hand with such questions is naturally another one: What will become of the big Berkshire weekend itself? The company will have to continue holding an annual meeting, but it remains to be seen if it will have the drawing power that the Buffett-and-Munger fest does, an event that Berkshire shareholder Mitchell C. Hockenbury describes as a kind of Comic-Con for financial nerds and value-investing disciples.

Hockenbury should know: With fellow Berkshire investors Matthew Peterson and Quintin Smith, he throws an annual barbecue for about 100 of those coming to Omaha, replete with burgers, brats and lots of talk about financial strategy. This year’s event, held Thursday night, drew people from as far away as the Netherlands and India.

Hockenbury, an Omaha native who now lives in Kansas City, Mo., said everyone is mindful about Buffett and Munger’s advanced ages and what the future holds for the meeting and its treasured place in investing circles and the life of this Midwestern city.

“There are not many more years left,” he said.

[ad_2]

Source link