[ad_1]

Turnaround Tuesday is looking wobbly, as stock futures slip ahead of big earnings from Microsoft

MSFT,

and Alphabet

GOOGL,

after the market close.

Those results could provide a fresh catalyst for market direction after Monday’s mega reversal that some aren’t trusting. Also wary these days is RTM Capital Advisors’ chief investment officer, Mark Ritchie II, who sees a lot of trouble under the hood.

“When the market is grappling with too many things at one time, it’s generally a headwind, meaning the more managers have to discount too many issues, the more they have to lighten up on risk,” Ritchie said in a Monday interview with Real Vision.

In our call of the day, he warns of a “secular bear market” environment — where prices can underperform average gains for years — with solid advice for investors. Among his worries, he noted just 20% of Nasdaq stocks are currently above their 200-day moving averages.

“I’m not saying we’re going to go 10% lower in three days…but every time that happens, it happens in an environment like we’re sitting in where there has been distribution dominating the tape, we’re trading below technical areas of support and there’s very little leadership,” he said.

For retail investors especially, another big theme is worth watching. “The market has been reinforcing certain risk management strategies that I think are being challenged and have been challenged over the last 18 months and I don’t think that is over.” Those include the popular strategy of buying the dip after market selloffs.

“Over the last decade everyone has slowly adopted this idea of maybe it’s the Fed that will bail me out, or TINA [There Is No Alternative],” he said. The casualty list over the past year? Tech dip buyers, long -short equity traders who decided they didn’t need to use stops with GameStop etc., or 60/40 managers who decided instead of paring risk, they bought more bonds, he said.

Bonds and equities could continue to fall in tandem, he cautioned.

“How many people have been conditioned in the larger sense to say that the Fed has my back…as I see it the Fed is saying heads we’re going to raise rates, tails we’re going to raise rates even more. Either scenario we’re gonna withdraw liquidity…now that is not generally speaking the most bullish fundamental driver either.”

As for safety, he’s got a small position on gold, but wants to see technicals shape up better, but sees a “bullish” setup for oil as nothing in the supply-demand situation has changed.

That’s especially coming into a strong seasonal period. “I think if we make new highs, this break has brought some of the shorts back in, and there are enough people on the other side of the trade now that I think a break higher is potentially even more powerful in the short run.” But a crude weekly close below 95 or 90 would mean “the bears are in control.”

He has been saying for months that investors needed to be raising cash, and that’s still the case, even if indexes perk up. Because it’s pointless to try to pick the winners right now as the leaders in the next cycle may be different.

That cash gives investors flexibility to bend with the market. “So you get a rally attempt, you put a little bit of capital to work and then you build on success or failure,” he said. So “dip a few toes” then go in “waist deep” if that’s working. That’s the strategy he applied after the COVID-19 lows of 2020.

Last thing: volume matters. Rally attempts are “predicated on the market having closed higher and above average volume several days after the low, meaning you’re getting subsequent buying…every meaningful rally in the history of the stock market has had valid accumulation days coming or for days after the subsequent low.”

Read: Market ‘not seeing a low yet,’ says Morgan Stanley’s Wilson after ‘ominous’ signal late last week

The buzz

GE

GE,

stock is tumbling on mixed results, UPS

UPS,

is rallying on profit and revenue beats, 3M

MMM,

is also gaining on upbeat earnings, while JetBlue

JBLU,

is down as it revealed plans to cut capacity. Apart from Alphabet and Microsoft, GM

GM,

Visa

V,

Chipotle

CMG,

and Texas Instruments

TXN,

will report after the close.

Twitter

TWTR,

founder Jack Dorsey stamped his approval on Elon Musk’s pending $44 billion acquisition of the micromessaging service, while other reactions seem to split down party lines. Amazon

AMZN,

founder Jeff Bezos, also piped up:

Opinion: It looks like nothing will stop Elon Musk from owning Twitter

The White House will expand the availability of COVID-19 antiviral pill Paxlovid. In China, mass testing continues as Beijing braces for more lockdowns.

Fidelity has become the first major retirement-plan provider to allow bitcoin accounts in 401(k)s. The crypto

BTCUSD,

meanwhile, is climbing.

As Russian forces attempt to encircle eastern Ukraine, foreign minister Sergei Lavrov has warned of risks for World War III and nuclear confrontation.

Data on tap include durable goods orders, house prices indexes, consumer confidence and new home sales.

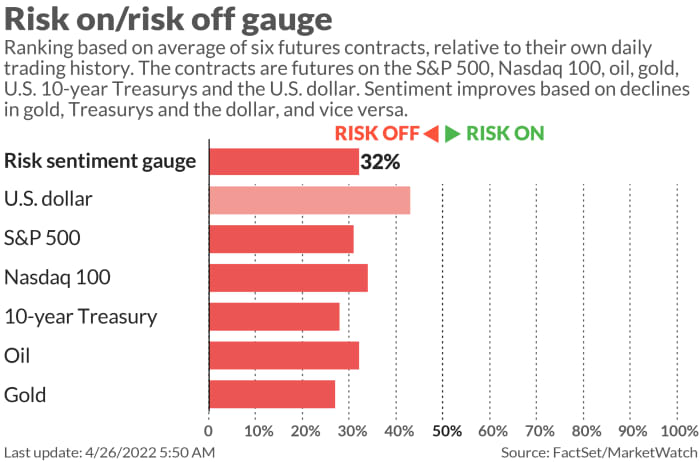

The markets

Stock futures

YM00,

NQ00,

are lower, Treasury yields

TMUBMUSD10Y,

continuing to ease, and oil prices

CL00,

BRN00,

are slipping. The dollar

DXY,

and gold

GC00,

are both perking up. Asia stocks had a mixed day, with more weakness in China

000300,

Tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

TWTR, |

|

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

ATER, |

Aterian |

|

CENN, |

Cenntro Electric |

|

NFLX, |

Netflix |

|

NVDA, |

Nvidia |

Random reads

Sometimes you just need to marry your cat.

Discovered: The ruins of an ancient temple devoted to the Greek god Zeus.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

[ad_2]

Source link