[ad_1]

Tesla has recently been one of the most active and volatile stocks. However, what appears to the naked eye is not always the same when placed under the microscope of analytical mathematics.

Lawrence McMillan

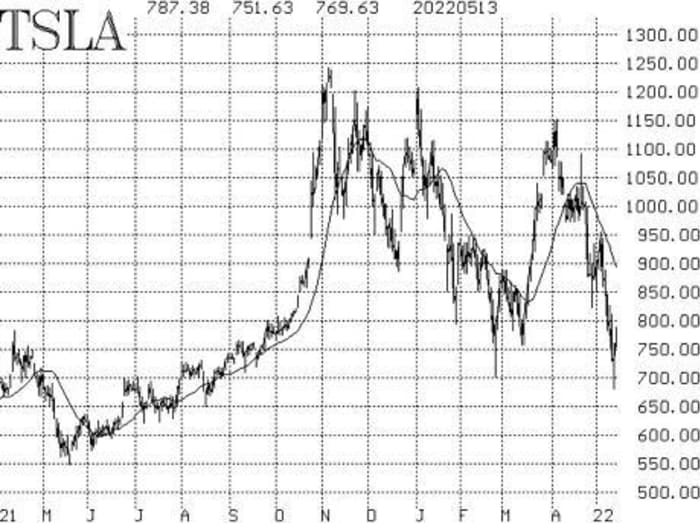

We can see that the stock was in a steady uptrend from May through October of 2021. Then, it experienced a strong rise into November. Since then, it has been volatile – swinging back and forth in wide ranges and generally moving lower. Note that the stock bottomed in the 550-570 area back in May 2021.

This action has increased both the realized volatility of Tesla stock and the price of its options. In reality, though, Tesla options are not very expensive on a historical basis. However, there is a pattern to the pricing of the Tesla options that presents itself as a highly viable strategy.

A look into Tesla volatility

Let’s begin with some analysis of the volatility of Tesla and its options. Currently, the stock’s 20-day realized (historical) volatility (HV) is 82%. I would not be too concerned with what 82% means statistically, but rather use it for comparison with other volatility measures. The 50-day HV is 70%, and the 100-day HV is 71%. So those are in the same general neighborhood.

This chart shows the 20-day HV overlaid on top of the chart of the stock.

Lawrence McMillan

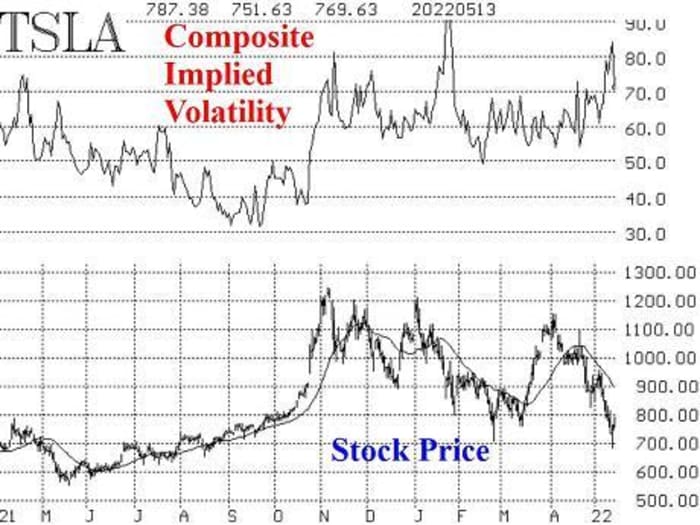

The 20-day HV (top graph) was declining when Tesla was rising, from May through October 2021. That is typical. Since then, however, with Tesla swinging in a wide range, the 20-day HV has increased, although it has roughly stayed in a range of 55% to 90% since last November.

These historical volatilities come into sharper focus when we look at the implied volatilities of Tesla options. On a volume-weighted calculation, the composite implied volatility (CIV) of TSLA options is 71.4%. Since the historical volatilities were 82%, 70%, and 71%, that shows the implied volatility of Tesla options is “about right.” They are not overly expensive but nor are they cheap when we consider how fast the underlying stock has been moving around.

There is one more piece of information that we need to have to build an option strategy: a comparison of today’s implied volatility (CIV) with past daily readings of CIV. That is shown in the next chart.

Lawrence McMillan

You can see that the current CIV (71.3%) is toward the upper end of the range of CIVs over the past year. Last September, Tesla options were trading with an implied volatility of 31% — that is the low point on the Implied Volatility chart. In fact, over the past 600 trading days, the current reading of 71.3% is in the 67th percentile. The percentile is merely an easy way to state how expensive the options are, on a scale of 0 to 100. So they are a little bit “overpriced” but not tremendously so.

Option strategies to consider

Call purchase: So what option strategies make sense? If you are bullish on the stock, you are not really overpaying for an outright call purchase; the outright purchase of the at-the-money, June (17th) 770 call costs 70 points, or $7,000 for one contract. That is a large dollar amount for one call, but statistically is not a terribly high price, for its implied volatility is about 75% — generally in line with the volatilities that were discussed above.

One could counter that dollar expense a little by creating a call bull spread – perhaps selling the Jun (17th) 870 call against the call you are buying. That would bring in roughly $3,000 but would cap off your profit potential at 870.

As one can see from the accompanying stock charts, the stock could be above 870 very quickly if things turn bullish.

Personally, with the CIV in the 67th percentile, if I were outright bullish on the stock, I would not bother with a call bull spread because it caps off your profit potential. Call bull spreads only make statistical sense if the CIV is much higher – perhaps near the 90th percentile or higher.

Put purchase: Essentially, the same argument applies if you are bearish on the stock: buy the at-the-money put and don’t spread. There is a small argument in favor of a bear spread (for example, buy the June 770 put and sell the Jun 670 put) over the call bull spread, which we’ll get to in a minute.

Put sale: If one wouldn’t mind owning the stock at 550, the June (17th) 550 put could be sold for about 8 points. That is where the support was on the above stock charts, and is an implied volatility of 90% — meaning that you would be selling an expensive option (since 90% is higher than the other volatilities discussed above).

The problem with a put sale is that if the stock drops below 550, one might not be so willing to own the stock. But the put sale can always be closed out for a loss if Tesla is falling.

Neutral strategy: A neutral strategy is generally one in which the strategist doesn’t necessarily hold a strong opinion about the forthcoming movements in the underlying stock, but rather can build an option strategy that makes money in a large number of outcomes. Neutral strategies have risk, though, and they cannot just be established willy-nilly without understanding the specifics of the strategy.

One strategy that seems to be viable here involves what is called a “skew” in the implied volatility of the options – particularly the put options. It is often the case with index options, and with stock options where the underlying stock is in a downtrend, that out-of-the-money puts are far more expensive than at-the-money puts.

Consider the following current information:

| TSLA June (17th) Options Implied Volatility | ||

| Option | Implied vol | |

| 500 put | 93% | |

| 550 put | 90% | |

| 600 put | 87% | |

| 650 put | 85% | |

| 700 put | 80% | |

| 750 put | 75% | |

| 770 put | 74% |

The pattern of implied volatility of Tesla put options is called a “negative” skew or “reverse” skew – meaning that out-of-the-money puts are expensive, when compared with at-the-money puts.

By the way, the pattern does not extend to the TSLA calls unless one is looking at extremely far out-of-the-money calls.

When there is a reverse skew, any option strategy that takes advantage of the skew buy puts with “higher” strikes (at-the-money, say), and sell puts with lower strikes. That is why it was noted above that a put bear spread might make some sense (even though it would cap off your downside profit potential, which you probably would not want if you were bearish on Tesla).

However, in this case, we are looking for a more neutral strategy. One of my favorite strategies in this case is to:

- Buy a high strike put

- Sell a lower strike put

- Sell an even lower strike put

- Buy a deeply out-of-the-money to cap off risk

Suppose we establish this strategy:

| TSLA Put Spread | ||||

| Option | Implied vol | |||

| Buy Jun (17th) 700 put | 43 debit | 80% | ||

| Sell Jun (17th) 680 put | 37 credit | 82% | ||

| Sell Jun (17th) 570 put | 15 credit | 88% | ||

| Buy Jun (17th) 400 put | 3 debit | 100% | ||

| Total | 6 credit |

Note that we are buying a lower volatility (80%) and selling two higher volatilities (82% and 88%) on the three higher strikes in the spread. The fourth leg is there mainly to limit risk and reduce the money needed to establish the spread.

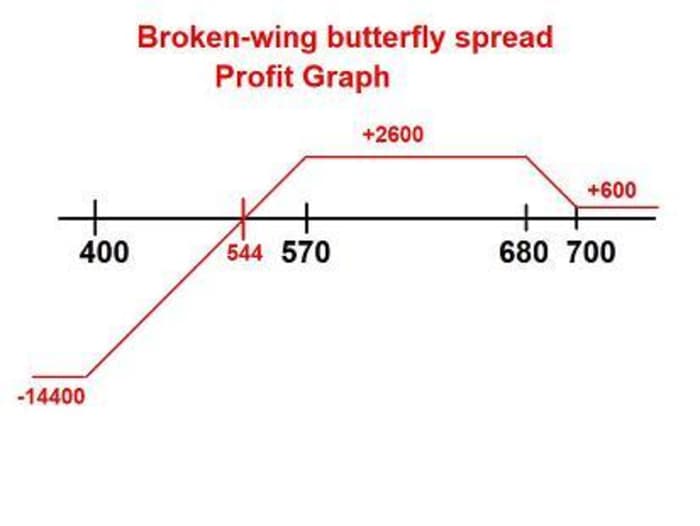

If you want to attach a name to this strategy, it is often called a “broken-wing” butterfly spread.

If the stock is above 700 at expiration, you would profit by the amount of the initial credit ($600 in this case) because all of the puts would expire worthless in that case.

If the stock is between 570 and 680 at expiration, you make $2,600 on the spread.

But if the stock falls below 544 at expiration, you have risk down to the lowest strike, in this case 400. That would generally be too much risk to take (144 points), so in practice, one would stop out this spread if Tesla fell below the lowest short strike, 570. Recall that was the March 2021 low for the stock, so in theory there might be some support at that level. If it fails, then it would be time to abandon this spread.

This is one other interesting aspect to spreads that attempt to take advantage of the skew. The position can often be removed in advance of expiration for a reasonable credit (not the maximum credit, of course). This is due to the way that options decay when there is a skew. For example, if Tesla is between 680 and 700 in early June, one would likely be able to remove the spread for a credit of 5 to 10 points.

The following graph shows the profit and risk potential of this spread if held until expiration. As noted above, one should stop out the position if Tesla falls below 570, rather than risk it dropping to 400.

Lawrence McMillan

This type of spread can only be established in a margin account. Even though there is no margin debit, the requirements for spread trading in options necessitate what is called “collateral margin” to finance the spread. In essence, one must advance the risk of the spread when it is established. Option-oriented brokerage firms might reduce that requirement, but the ultimate risk is the 144 points between the two lower strikes, less the initial credit of 6 points, or $13,800.

Typically, an account with a larger portfolio of stocks might consider a spread such as this as an “overlay,” where the borrowing power of the stocks could be used to finance the spread without actually having to advance cash for the collateral requirement.

Summary

Tesla options are fairly priced. Thus any speculative strategy can be undertaken without fear of having overpaid for the options. Since the options are fairly priced, do not use vertical spreads (call bull spreads or put bear spreads are not optimal at this time). The presence of the reverse skew in the puts means that traders with a more theoretical or neutral bent can consider spreads where puts with higher strikes are bought and puts with lower strikes are sold. The “broken-wing” butterfly is just one example of that type of spread.

Finally, investors with a longer-term view might consider selling expensive, deeply out-of-the-money (expensive) Tesla puts, if they wouldn’t mind buying the stock at the strike price should the share price fall.

Lawrence G. McMillan is a columnist for MarketWatch and editor of the MarketWatch Options Trader newsletter. He is president of McMillan Analysis, an investment and commodity-trading adviser.

[ad_2]

Source link