[ad_1]

Trouble may be brewing in the second half of this year, but there’s a window for a stock-market rally during the first six months of 2023, in the view of Stifel chief equity strategist Barry Bannister.

The potential for a rally in equities is based on his expectations for inflation to fall sharply, for the Federal Reserve to pause interest-rate hikes in the second quarter, and for no official recession, as declared by the National Bureau of Economic Research, before midyear, according to a Jan. 9 note from Bannister.

All of that should add up to a lower real yield on the 10-year U.S. Treasury note

TMUBMUSD10Y,

and to the S&P 500 rising to 4,300 by the end of June, according to the note.

“2023 may be a year of 2 halves, with the S&P 500 peaking mid-2023,” wrote Bannister. “The S&P 500 in late 2023 may give back some or all of 2023 gains.”

During the first half of the year, the equities rally will probably be led by “cyclical growth” and “cyclical value” stocks as hot inflation cools, Bannister wrote. He sees economic risk for equities likely rising again in late 2023, when a recession for U.S. industrial production may already be “locked in” after “long and variable lags” to the Fed’s aggressive rate hikes aimed at bringing down inflation.

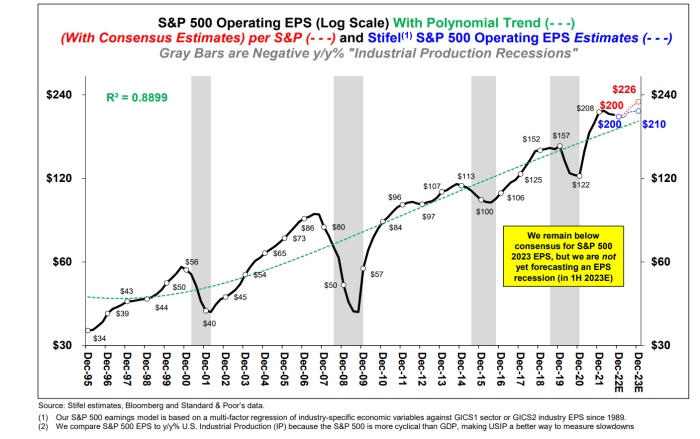

Stifel’s earnings-per-share forecast for the S&P 500 features a “major” slowdown in the second half of the year, Bannister said in the note. “Additionally, inflation may turn back up late-2023, causing the Fed to re-tighten financial conditions.”

The downside risk for the S&P 500 may be 3,300, according to Bannister.

STIFEL NOTE DATED JAN. 9, 2023

While Bannister does not yet see a recession in earnings per share, or EPS, for the S&P 500 in the first half of 2023, he cautioned that in the second of the year, the benchmark may face a slowdown in EPS that’s similar to 2012 or 2015-2016.

The S&P 500 was trading around 3,913 on Tuesday afternoon, as the U.S. stock market climbed after initially struggling for direction following Fed Chair Jerome Powell’s speech in Sweden.

The S&P 500

SPX,

was up 0.5% in Tuesday afternoon trading, while the Dow Jones Industrial Average

DJIA,

had gained 0.4% and the technology-laden Nasdaq

COMP,

was up 0.8%, according to FactSet data, at last check.

Investors have been anxious about a potential recession in 2023, fearing that the Fed’s rapid pace of rate hikes in 2022 and continued monetary tightening this year could lead to a hard landing for the U.S. economy.

“The Fed drives this bus,” said Bannister. “Real yields were repressed 2000-2020 amid crises, and if hastily normalized, stocks could fall further.”

The U.S. stock market is up so far this year after tumbling in 2022 as the Fed raised its benchmark rate to battle the highest inflation in four decades. The S&P 500 has edged up around 1.9% this month, following a 19.4% drop in 2022 for the index’s worst year since 2008, FactSet data show.

Meanwhile, Stifel has forecast that headline readings from the U.S. consumer-price index (CPI) will fall to 3.5% on a year-over-basis by the end of the third quarter, Bannister’s note said. Headline inflation ran as high as 9.1% in the 12 months through June, falling to 7.1% in November.

The next CPI reading, scheduled for Thursday, will provide details on U.S. inflation data for December.

It took 16 months for inflation to rise to last year’s June peak on a year-over-year basis, according to Bannister, who said Stifel’s measures point to it taking around 16 months to fall to 3.5%.

“Major inflation bursts are symmetrical,” meaning that “up” equals “down,” he said. “Every leading indicator of inflation sub-components now points down.”

Also see: Why the consumer is ‘critical’ for investors to watch in 2023 as bear market ‘not yet complete’

[ad_2]

Source link