[ad_1]

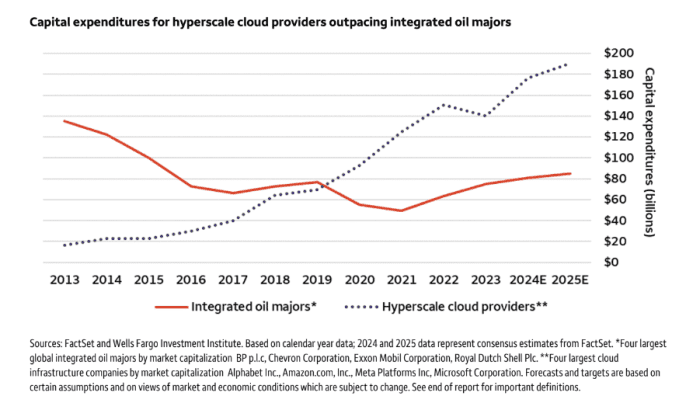

The race for new and upgraded data centers to handle the artificial-intelligence boom has the world’s top technology titans far outpacing major oil companies in capital expenditures, according to the Wells Fargo Investment Institute.

Alphabet Inc.

GOOG,

GOOGL,

Amazon.com Inc.

AMZN,

Meta Platforms Inc.

META,

and Microsoft Corp.

MSFT,

— the four largest cloud infrastructure companies by market capitalization — have begun shelling out significantly more on capital expenditures than their counterparts in the oil industry since the pandemic erupted in 2020.

Large cloud infrastructure companies have been spending more to upgrade or acquire new facilities than their counterparts in the oil industry since 2020.

FactSet and Wells Fargo Investment Institute

The biggest “hyperscale” cloud companies reported about $140 billion in combined capital expenditures in 2023, while the four biggest global integrated oil companies by market capital — BP

BP,

Chevron Corp.

CVX,

Exxon Mobil Corp.

XOM,

and Shell PLC

SHEL,

— were closer to a combined $80 billion.

Crude oil prices

CL00,

BRN00,

shot up to past $100 in March 2022 in the wake of pandemic shocks and Russia’s war in Ukraine, before supply cuts by major oil producers pushed prices back down to $80 a barrel. When energy costs rise, oil companies historically have increased capital expenditures to bolster crude production.

However, Larry Pfeffer, an equity-sector analyst in the industrials at the Wells Fargo Investment Institute, expects spending by the top four hyperscale tech companies to reach almost $200 billion annually by 2025, a boom that will have “ripple effects.”

Data centers have been a niche part of commercial real estate for years, with needs growing in the wake of the COVID crisis and with the release in late 2022 of ChatGPT, especially for newer facilities that can handle the voracious demand for power needed by AI-focused clients.

Read: AI is fueling a gold rush in new data centers, the hottest buildings in real estate

[ad_2]

Source link