[ad_1]

Buying Nvidia call options remains a good way to profit from gains in the AI chipmaker’s share price because volatility is being undervalued, according to Bank of America.

In a note published Tuesday, the BofA global equity derivatives team observed that Nvidia’s

NVDA,

continued share price rise since last week’s blowout earnings report means that keeping up with the market without having enough exposure to AI stocks, in particular Nvidia, has been an uphill battle.

“With the outlook on the AI-wave and NVDA’s central role remaining upbeat from last week’s earnings call, upside continues to be the pain trade,” said the BofA team.

Using derivatives to chase this rally remains a “prudent strategy,” they added, because the market keeps undervaluing the volatility component of call options.

Call options give investors the right to purchase an underlying stock at a particular level, known as the strike price.

To simplify, one method of establishing the cost of an option is to look at the intrinsic value (determined by how close the shares are trading to the option strike price), the time value (how soon before the option expires), and the volatility value (the more the underlying shares are expected to move, the higher the volatility cost).

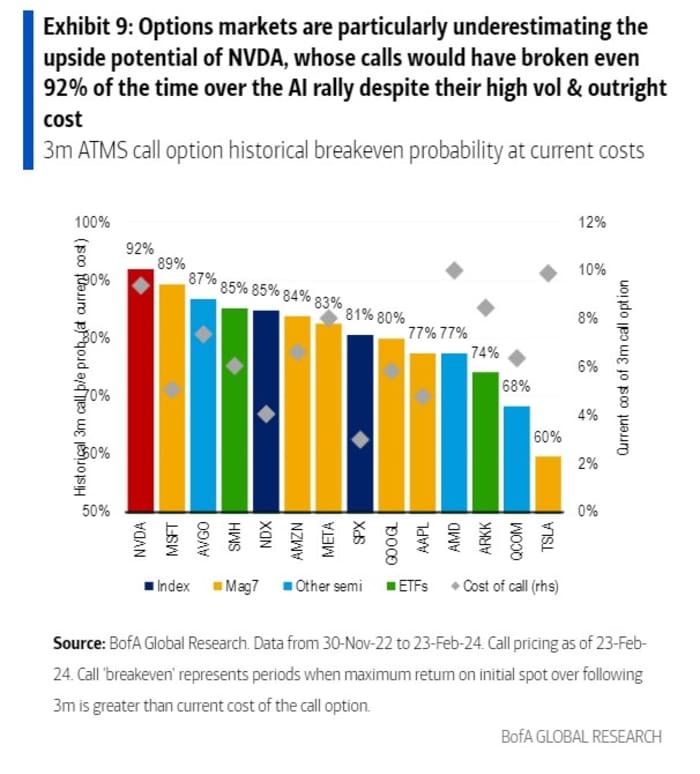

BofA said option markets are “grossly underestimating the range of outcomes” for many AI-related stocks despite the rally since ChatGPT was released in late November 2022.

In essence, the market keeps getting caught out by the size of moves in Nvidia shares. For example, just prior to last week’s earnings report, the option market was pricing in the likelihood of a roughly 9% move up or down by Nvidia shares up to the end of the week. In fact, the next two days after earnings saw Nvidia’s shares jump 16.8%.

The chart below produced by BofA shows that only Advanced Micro Devices

AMD,

and Tesla

TSLA,

have 3-month at the money call options that cost more as a percentage of the share price than Nvidia’s current 10%.

However, while the probability of such calls breaking even since November 2022 for Tesla are just 60%, and 77% for AMD, the probability for Nvidia is the highest of the cohort at 92%.

“As a result, even though buying outright call options on NVDA (or other AI-related names) may have a degree of sticker shock, it has proven to be a reasonably effective way to rent the upside in the current rally,” the BofA team.

[ad_2]

Source link