[ad_1]

Shares of AMC Entertainment Holdings Inc. rallied again Wednesday, extending a recent sharp bounce that appears to have put the stock on track to break out from a long-term technical downtrend.

The movie-theater operator’s

AMC,

stock, which was one of the original “meme” stocks, shot up as much as 11.3% intraday before pulling back to be up 3.5% in afternoon trading. That followed a 16.4% surge on Tuesday, which bucked the broader stock market’s worst day of 2023, even though AMC didn’t release any news.

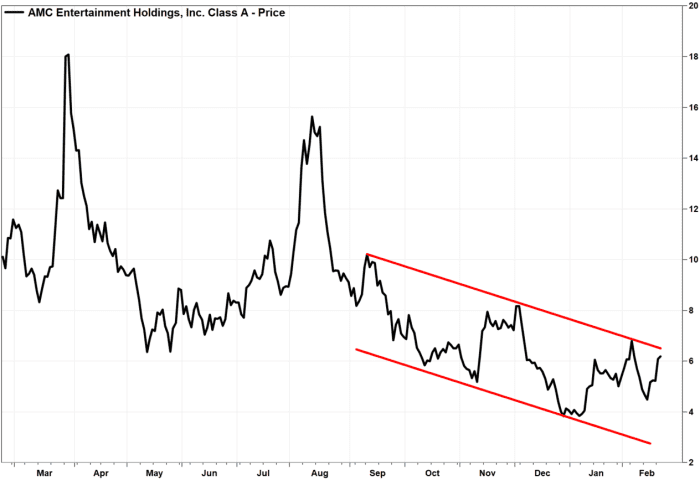

And after running up 20.6% in two days and 40.4% in five days, Wednesday’s intraday pullback appears to suggest that upward momentum may be waning, especially since the stock couldn’t quite make it up to test a couple of key technical levels on the shorter-term charts.

For one, a downtrend line starting at the Sept. 12 close that connects the closing highs in early December and early February currently extends to roughly $6.50, or about 2.8% above current levels.

FactSet, MarketWatch

Trendlines are one of the easiest ways to identify a trend. Keep in mind that while it only takes two points to draw a line, it takes three points on the line to identify a trend. Read more about trendlines.

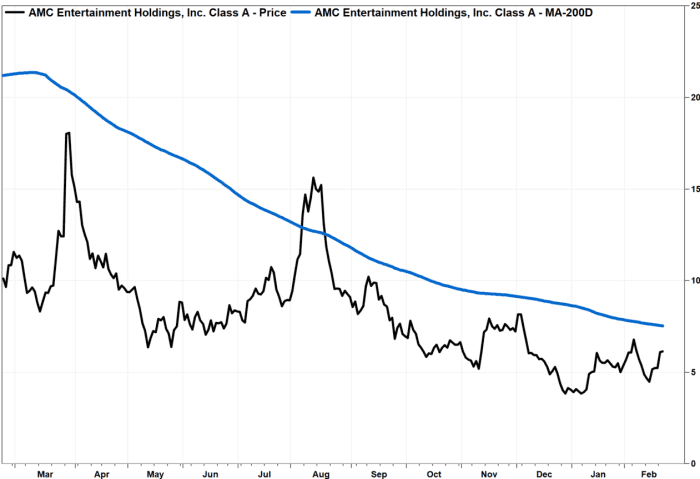

Meanwhile, the 200-day moving average, which many chart watchers view as a dividing line between longer-term uptrends and downtrends, extends to $7.54 on Wednesday, according to FactSet data, which is about 19% above current levels.

FactSet, MarketWatch

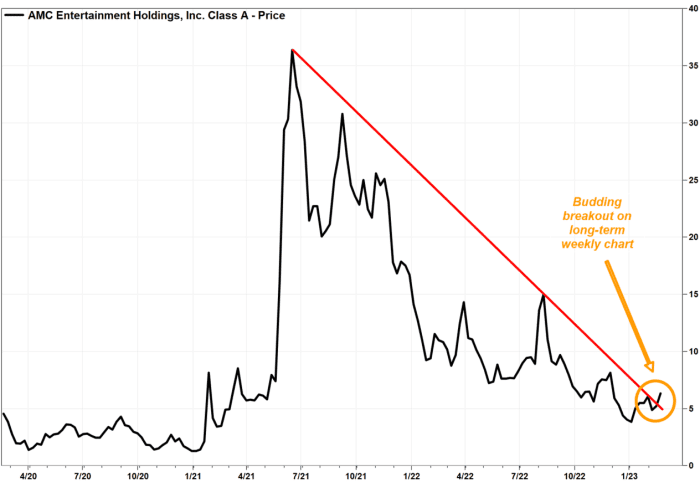

Clearing those levels might seem daunting for bulls, who have already put in a lot of work in the past week. But extending the time frame of AMC’s stock chart from a daily chart to a weekly chart, there may be good reason for bulls with a longer-term view to express some enthusiasm.

Also read: AMC CEO Adam Aron eyes 2023 hike in movie releases, touts ‘path to eventual pandemic recovery.’

The stock’s rally this week has taken it above a downtrend line that started at the meme-stock weekly closing peak of $36.40 on June 16, 2021, and connected the weekly closes of $15.01 on Aug. 12, 2022, and $6.08 on Feb. 3.

FactSet, MarketWatch

That downtrend line currently extends to just about $5. A close Friday above that line would suggest a breakout has occurred.

One of the six major tenets of the Dow Theory of market analysis, which has remained relevant on Wall Street for more than a century, is that a trend is assumed to remain in effect until there is a definite signal that it has reversed. And trendlines are among the tools that can provide those signals, according to the CMT Association. Read more about the Dow Theory.

If the breakout signal is confirmed, the 200-day moving average will be a key chart point to keep an eye on, at least for the short term.

AMC shares have soared 55.2% so far in 2023 but have shed 37.6% over the past 12 months, while the S&P 500

SPX,

has slipped 0.6% this year and has lost 7.6% over the past year.

[ad_2]

Source link