[ad_1]

Investors are bracing for a preholiday data dump that includes the Fed’s favorite inflation gauge, as the last full week of trading for 2023 closes out.

Questions are being raised about whether the midweek plunge in stocks was random jitters, or the start of something more sinister. Stock futures are pointing to another day of losses, as China gaming stocks help dampen the festive mood.

Our call of the day comes from a Wall Street veteran who theorizes that based on the high number of stock holdings for American households, investors could be facing “seven lean years” of returns ahead.

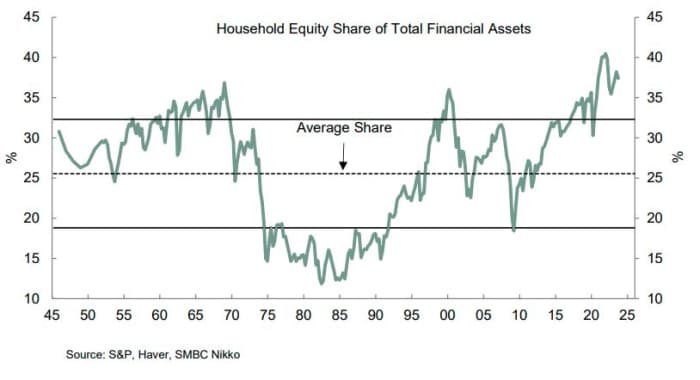

The U.S. household equity share of total financial assets was 36.3% in the third quarter, Joseph Lavorgna, former Deutsche Bank chief U.S. economist, who now does the same job at SMBC Nikko Securities, told clients in a recent note.

That percentage is down from an record of 40.5% in the fourth quarter of 2021, but still well above any other period prior to the current business cycle, he says.

Before the pandemic’s onset, the previous record share was set during the internet boom in the first quarter of 2000, with the peak before that 36.9% during the decade’s “conglomerate fad,” said Lavorgna, who also served as chief economist of the Council of Economic Advisers under former President Donald Trump.

So why does elevated equity exposure matter? “Historically, when households own a high percentage of equities in their investment portfolio, future stock returns tend to meaningfully lag historical averages,” he said.

“Future returns are based on the stock market’s performance over the next seven years because this is broadly consistent with the average length of the post-WWII business cycle,” he explains.

Lavorgna and his team calculated the average long-term household equity share of financial assets at 25.6%, represented by dashed line in the above chart. High or low household exposure is determined by one-standard deviation bands around that long-term average, shown as solid lines.

“From 1952 to 2016, the long-term total annualized return of the S&P 500 including reinvested dividends is 11.4%. However, when the household

share of stock holdings is one standard deviation above its long-term average, stocks return just 4.1% annualized over the proceeding seven years. The opposite is true when the household share of stocks is below its long-term average. Stocks return a large 16.0% annualized over the next seven years,” he said.

The S&P 500’s total return through November is 22.9%, and well above the market’s long-term annual average, he says, but notes that the cumulative annualized return since 2016 is 11.4%, equal to annual returns from 1952 to 2016 period.

While the ratio stood at 31.9% in the fourth quarter of 2016, if history holds, Lavorgna says “stock returns over the next seven years should be much lower than the historical average of double-digit gains.”

The markets

Stock futures

ES00,

NQ00,

are pointing south ahead of the open following Thursday’s rebound, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

steady, and gold

GC00,

up 0.5% to $2,062 as the dollar

DXY

weakens. Oil

CL.1,

is moving higher.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,746.75 | 0.58% | 4.17% | 23.63% | 24.18% |

| Nasdaq Composite | 14,963.87 | 1.37% | 4.89% | 42.97% | 42.84% |

| 10 year Treasury | 3.889 | -2.44 | -58.20 | 0.99 | 14.04 |

| Gold | 2,059.50 | 1.26% | 2.78% | 12.53% | 14.04% |

| Oil | 74.54 | 3.85% | -0.85% | -7.42% | -6.06% |

| Data: MarketWatch. Treasury yields change expressed in basis points. | |||||

The buzz

The Fed’s preferred inflation gauge — the price index for personal-consumption expenditures (PCE) — is due at 8:30 a.m., alongside durable-goods orders, personal income and spending. New home sales are due at 10 a.m.

Follow the data and market action in MarketWatch’s Live Blog

Nike shares

NKE,

are down 11% after the athletic-wear maker announced plans to cut $2 billion in costs over three years, citing a ‘softer’ outlook and cautious consumer spending. Adidas

ADS,

and Puma shares

PUM,

also fell in Europe.

NetEase

9999,

NTES,

lost a quarter of its value and Tencent shares

700,

tumbled 12% after China’s gaming regulator announced new proposals aimed at spending and rewards in online gaming.

Tesla

TSLA,

moved forward with a plan to build an energy-storage battery factory in China. Separately, Elon Musk told Cathie Wood, chief executive of ARK Invest, that he wants to convert his X platform into a “giant brain” and financial platform.

Rocket Lab USA

RKLB,

stock jumped after the company won a government contract to build 18 vehicles.

Best of the web

Apple’s AI research signals ambition to catch up with Big Tech rivals.

Bank have been increasing their usage of a Fed facility set up after the collapse of SVB.

CIA’s chief spy emerges as key figure in Hamas hostage crisis.

The chart

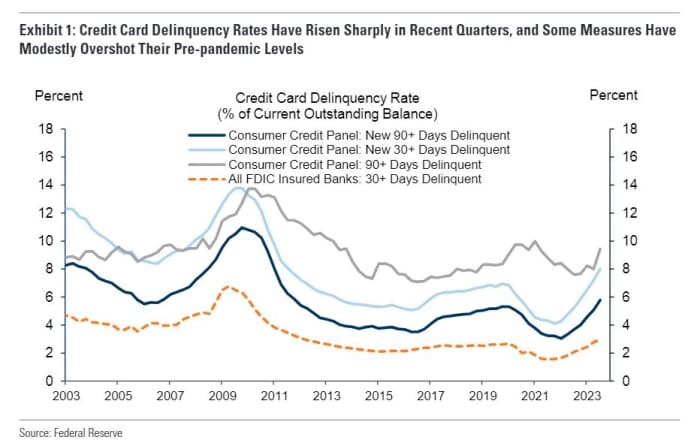

The below chart from Goldman Sachs offers a visual on concerns this year of credit-card debt and delinquency, with some measures now above prepandemic levels. Chief economist Jan Hatzius cites three drivers: an increasingly risky borrower pool, rising interest rates and resumption of student loan payments this fall.

Overall, they expect new credit card delinquencies to rise from 8% in the third quarter of this year to 9.5% in the first half of next year, then back to 9% at end 2024.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

NVDA, |

Nvidia |

|

MARA, |

Marathon Digital |

|

AMC, |

AMC Entertainment |

|

NKE, |

Nike |

|

BABA, |

Alibaba |

Random reads

The “world’s most expensive handbag” and everything else that billionaires want for Christmas.

NASA finds Christmas tree cluster in space.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

[ad_2]

Source link