[ad_1]

The U.S. Federal Reserve isn’t the only central bank with a tough decision to make.

Traders and analysts aren’t certain what the Bank of England will do at Thursday’s meeting, despite red-hot inflation.

Analysts at Barclays are among those now expecting the Bank of England to keep interest rates at 4% rather than lift them.

“We think significant upside risks to inflation would have called for a final 25 basis point hike, largely for risk-management considerations. However, that call presupposed that the transmission of monetary policy tightening across major jurisdictions remained orderly, which no longer seems to be the case, with increasing risks of a material tightening in financial conditions via the banking channel,” they said.

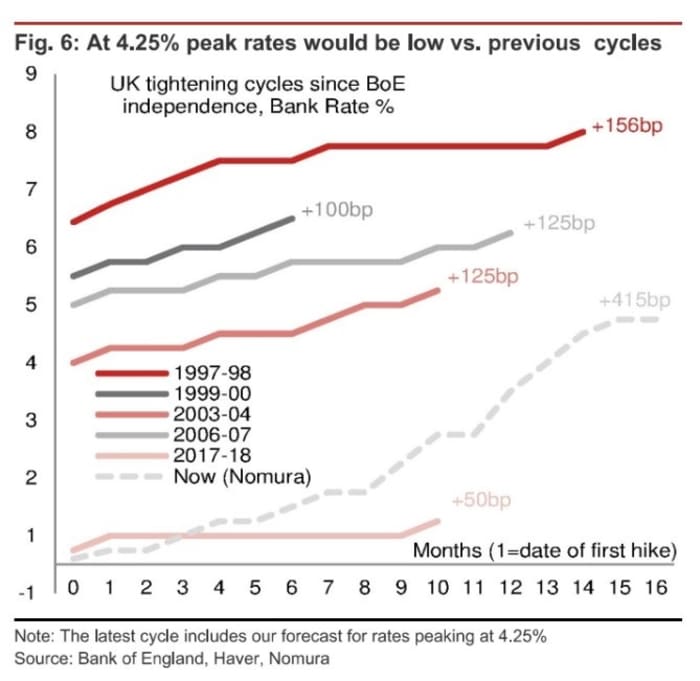

Economists at Nomura, by contrast, see a “last hurrah” with a quarter percentage point hike. Core inflation is still at 5.8% year-over-year, and the labor market is strong, with a near 100,000 rise in payrolls in February. Rates at 4.25% would be the highest since the financial crisis of 2008, but not particularly high relative to other cycles.

Analysts at Evercore say the Bank of England will be looking over their shoulder at what the Federal Reserve does on Wednesday. “If the Fed goes ahead and follows the [European Central Bank] in delivering a cautious hike anyway, [Gov. Andrew] Bailey and Co may worry that a BoE pause could be read as signaling greater concern about UK banks,” they say. If the Fed pauses, they say, “for sure the BoE will too.”

That’s interesting logic, particularly as the Bank of England makes its decision on Wednesday, even though it’s announced on Thursday. Unlike the Fed, the Bank of England publishes the minutes simultaneously with the decision.

At Bank of America, they urge investors to be humble. “Either way, we expect a further dovish shift to guidance and no further hikes after this week,” they add.

The pound

GBPUSD,

was trading around $1.22 on Tuesday. The yield on the 2-year gilt

TMBMKGB-02Y,

was 3.28%, having been above 4% as recently as three weeks ago.

[ad_2]

Source link