[ad_1]

- Tax rises for all and large cut in government spending

- United Kingdom to enter recession as economy begins to contract

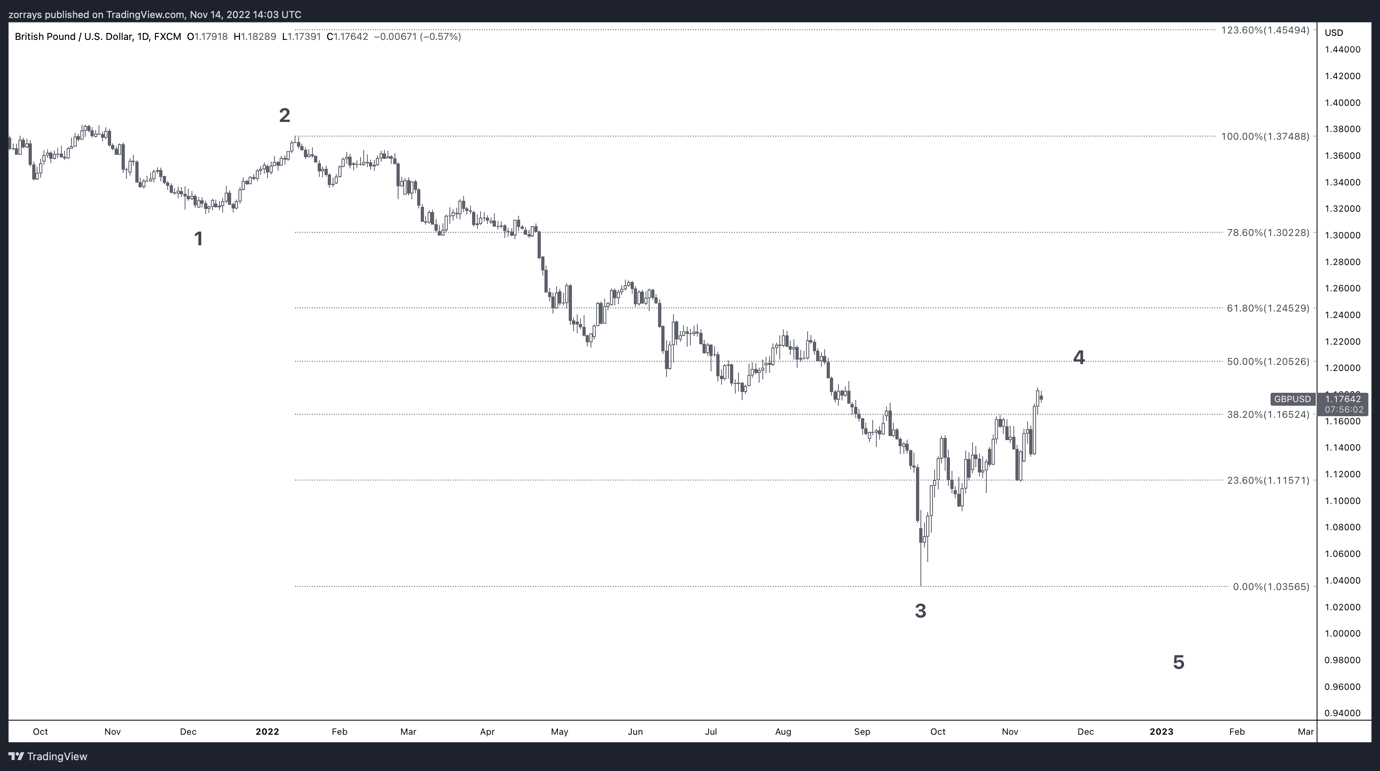

- GBPUSD may meet 1.20 prior to a drop

- BoE continues to hike rates as they shrink their balance sheets (Gilt sales)

Recommended by Zorrays Junaid

Get Your Free GBP Forecast

Dark days will be ahead of the United Kingdom, at least into mid 2024 as UK Chancellor Jeremy Hunt warns that tax rises will be for all and cut in government spending is inevitable. This was confirmed today that the UK’s economy is contracting from Q3 2022 onwards. This unpalatable outcome will put a weigh on GBP and the Gilt. BoE will continue to hike rates and shrink their balance sheet from this month onwards.

GBPUSD

Daily Chart – November 14th 2022

Chart prepared on TradingView by Zorrays Junaid

Combining the macro theme of the United Kingdom, I am projecting a further continuation to the downside in the near-term future for GBPUSD. Best case prior to a sell off would be that we may reach up into 1.20 key level which is aligned 50% retracement since January 2022 high at 1.37. This is where GBPUSD had an aggressive sell off into all-time lows at 1.03.

Since September lows, at 1.03, the price action has been in favour of GBPUSD since weak US CPI data was released. However, the concerns are that the price only moved up in a corrective format since then up to now. This gives me a big clue that GBPUSD is in wave 4 and in for another push down into wave 5.

Gilt

10 Year Gilt – Daily Chart

2022 has been a bruising year for both sterling and the 10-year Gilt. As BoE are on a mission to shrink their balance sheet this would mean a sell off Gilt is in play from this month onwards. This could result us seeing a rotation within the Gilt in the near term future.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

[ad_2]

Source link