[ad_1]

Apple, AAPL, Nasdaq, Corporate Earnings – Talking Points

- Apple, Inc. posts earnings per share of $1.52 on $97.28 billion in revenue for Q2’2022

- Buyback program boost of $90 billion, dividend increased from $0.22 to $0.23

- Supply chain outlook uncertainty may weigh on the stock amid China lockdowns

Apple Inc. reported a rosy batch of figures in its second-quarter earnings report following a rebound in technology stocks, with the Nasdaq-100 Index (NDX) posting a 3.48% gain at the closing bell. The iPhone maker saw $97.28 billion in revenue for Q2, beating the $93.98 billion Bloomberg consensus forecast. Earnings per share (EPS) of $1.52 also beat the $1.42 consensus forecast.

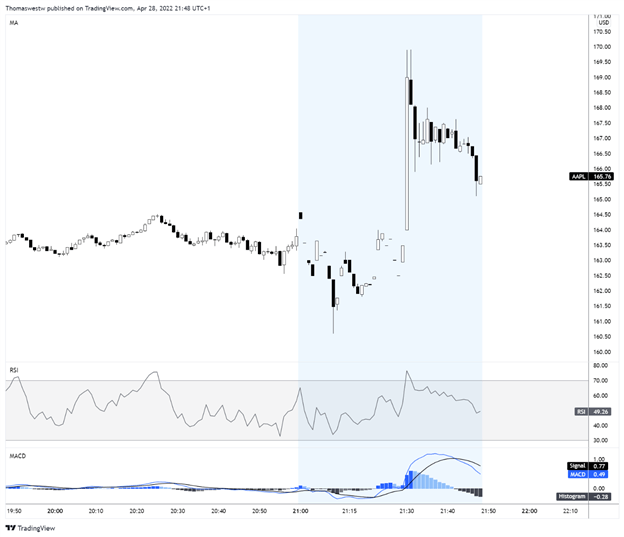

Apple stock rose 2.0% in after-hours trading, extending its 4.52% trading session gain. The company boosted its share buyback program by $90 billion and increased its dividend by 5% from $0.22/share to $0.23/share. That looks like it will keep investors happy for now. Options pricing put today’s one-day implied move at 6.21%.

A wildcard remains, however. China’s commitment to its “Zero-Covid” policy will likely continue to weigh on Apple’s supply chain. Investors will be laser-focused on commentary around those logistical challenges, along with inflation woes, during this evening’s earnings call. Apple’s policy of not offering guidance during the Covid-19 pandemic continues, which will leave investors on the watch for forecasts from analysts and big banks over the coming days and weeks.

Apple One-Minute Chart

Chart created with TradingView

**Check out Amazon earnings and its price reaction here**

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Source link