[ad_1]

Australian Dollar, AUD/USD, Fed, Trade Data, China PMI – Talking Points

- Australian Dollar rally in focus ahead of expected growth in Australia’s trade surplus

- A Caixin PMI print due out today will shed further light on China’s growth troubles

- AUD/USD rallies to its 100-day Simple Moving Average as MACD makes a bullish move

Thursday’s Asia-Pacific Outlook

The Australian Dollar is flying higher versus the US Dollar and other major peer currencies. A relatively dovish Federal Reserve announcement fueled a pullback in the US Dollar after Chair Jerome Powell tempered talks over a 75-basis point rate hike going forward. That language sparked a risk-on response across equity markets, and traders piled into short-term Treasury markets, pushing yields lower.

The Fed’s move follows the Reserve Bank of Australia’s decision earlier this week to hike its benchmark rate by 35 bps. Aussie Dollar traders and the rate market weren’t expecting such a move from Governor Philip Lowe. That allowed the beaten-down Australian Dollar to rally. Now, with a tempered Fed, the Australian Dollar may have more room to climb. Today’s trade data due out at 01:30 GMT may trigger some additional buying. Analysts expect to see Australia’s trade surplus for March climb to A$8.4 billion, up from A$7.46 billion. A rebound in exports is seen driving that trade surplus growth.

Asia-Pacific equity markets will look to carry over the bullish momentum from Wall Street. Overnight, US stocks surged in the best performance of the year. The benchmark S&P 500 gained 2.99% for the biggest one-day rally since May 2020. Hong Kong’s Hang Send Index futures are pointing higher in early morning trade following Wednesday’s 1.10% drop. S&P is set to report its purchasing managers’ index (PMI) for Hong Kong’s April period, which may influence today’s price action.

Elsewhere, Singapore will see its own April PMI data cross the wires. The Philippines April inflation rate is expected to drop at 4.6% on a year-over-year basis, according to a Bloomberg survey. China’s PMI data from Caixin may have the largest impact within the APAC region. The April PMI for China’s services sector is seen crossing the wires at 40.0, which would be down from 42.0 in March. The increased rate of expected contraction is likely from a wave of Covid infections across the country that have shut down several cities, including Shanghai. USD/CNH is lower for a second day this morning.

AUD/USD Technical Forecast

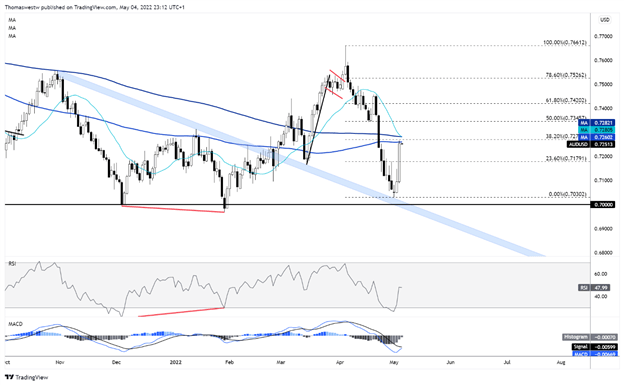

AUD/USD is trading just below its 100-day Simple Moving Average (SMA) as the shorter-term 20-day SMA crosses below the 200-day SMA just above current prices. Those SMAs may pose as resistance in the days ahead. The 38.2% Fibonacci retracement is also nearly aligned with those SMAs. However, the MACD looks on track to cross above its signal line while the RSI oscillator nears its midpoint.

AUD/USD Daily Chart

Chart created with TradingView

{{Newsletter}}

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Source link