[ad_1]

Australian Dollar Technical Price Outlook: AUD/USD Weekly Trade Levels

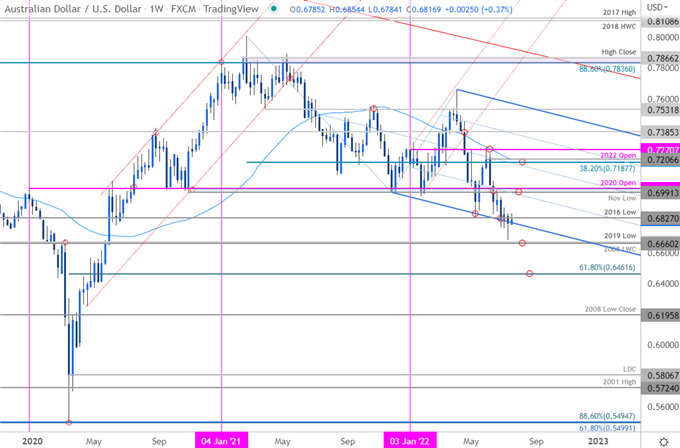

- Australian Dollar technical trade level update – Weekly Chart

- AUD/USD holds downtrend support for a fourth week – risk for price inflection

- Aussie resistance 6991-7016, 7187-7206 (key), 7270- Support 6785, 6660/70 (key), 6461

The Australian Dollar rallied more than 2% off the yearly / monthly lows against the US Dollar with AUD/USD responding to downtrend support for the past month. While the broader outlook remains weighted to the downside, the immediate decline may be vulnerable here and the threat for a recovery rises while above the weekly open. These are the updated targets and invalidation levels that matter on the AUD/USD technical price charts this week. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie technical setup and more.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Notes: In my last AUD/USD Weekly Technical Forecast we noted that AUD/USD was testing a key support pivot with our focus on the weekly close with respect to 6991- 7016– a region defined by the November 2020 swing low, the objective 2020 yearly open, the 2021 lows and the January low-week close. We warned that, “On the other-side of 6991, and things could fall apart rather quickly- stay nimble here.” Aussie registered a close lower that week with price plunging nearly 4.5% before exhausting just below above the 2008 low-week close / 2019 low at 6660/70. Note that AUD/USD has been unable to mark a weekly close below the lower parallel and keeps price just above downtrend support. A good price / time for near-term exhaustion?

Initial weekly resistance now stands back at 6691/7016 with broader bearish invalidation now lowered to the 38.2% Fibonacci retracement of the 2021 decline / 52-week moving average at 7187-72056. Weekly open support rests at 6785 with a break / close below 6660 needed to fuel the next leg lower in price- such a scenario would expose the next key support objective at the 61.8% retracement around 6460s.

Bottom line: AUD/USD is / has been testing downtrend support on building momentum divergence for nearly four weeks now and the immediate short-bias may be vulnerable while above the lower parallel. From at trading standpoint, rallies should be capped by 7000 IF price is still heading lower on this stretch with a weekly close below 6660 needed to mark resumption. I’ll publish an updated Australian Dollar Price Outlook once we get further clarity on the near-term AUD/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

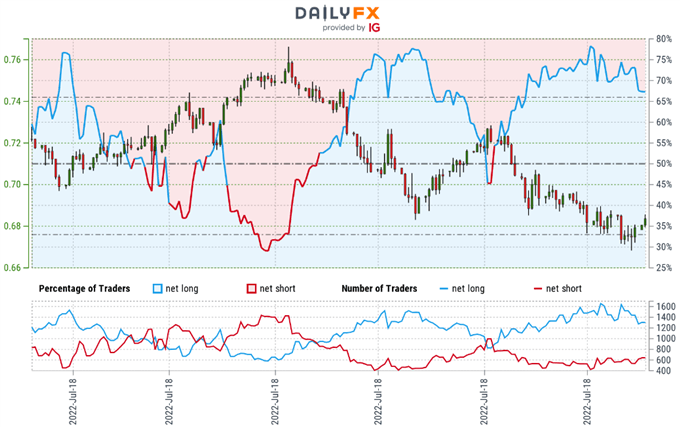

Australian Dollar Trader Sentiment – AUD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long AUD/USD – the ratio stands at +2.05 (67.26% of traders are long) – typically bearish reading

- Long positions are 1.78% lower than yesterday and 17.18% lower from last week

- Short positions are3.88% higher than yesterday and 19.74% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Active Weekly Technical Charts

— Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

https://www.tradingview.com/symbols/AUDUSD/

[ad_2]

Source link