[ad_1]

Australian Dollar Technical Price Outlook: Near-term Trade Levels

- Australian Dollar technical trade level update – Daily & Intraday Charts

- AUD/USD rebounds off downtrend support- recovery levels in focus

- Resistance 7179, 7270(key), 7313 – Support 7100, 6991-7016 (critical), 6907

The Australian Dollar rallied more than 1.2% against the US Dollar since the start of the week with AUD/USD rebounding off downtrend support ahead of today’s Fed rate decision. While the near-term focus leaves room for a larger recovery, the advance keeps price within the broader April decline and we’re on the lookout for a possible exhaustion high in the days ahead. These are the updated targets and invalidation levels that matter on the AUD/USD technical price charts into the close of the week. Review my latest Strategy Webinar for an in-depth breakdown of this Aussie setup and more.

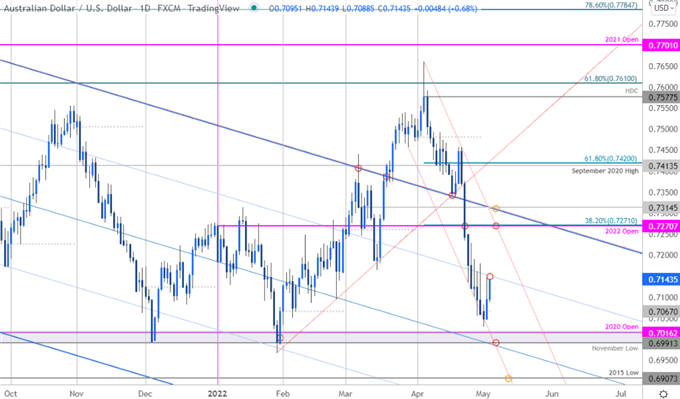

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Technical Outlook: In my last month’s Australian Dollar Technical Outlook we warned of the exhaustion risk as AUD/USD was probing fresh yearly highs just above the 76-handle. We noted that, “the immediate focus on today’s close with respect to the 61.8% Fibonacci retracement of the 2021 decline at 7610.” Right on cue, Aussie registered a high at 7661 before pulling back with price closing the day / week well-below resistance. The subsequent 8.25% plunge turned off channel support into the start of the month with the immediate focus on this near-term recovery.

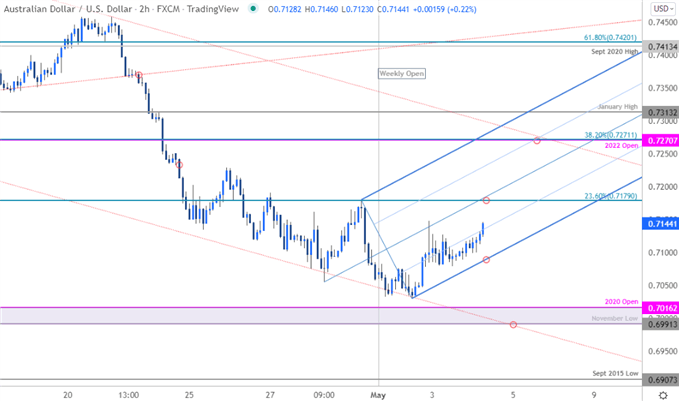

Australian Dollar Price Chart – AUD/USD 120min

Notes: A closer look at Aussie price action shows AUD/USD eyeing a test of the weekly opening-range highs with a newly identified pitchfork formation off the lows possibly in play here. Initial resistance eyed around the median-line near 7179 backed by key resistance at the 2020 yearly open / 38.2% retracement at 7270/71– look for a larger reaction there IF reached. Ultimately a breach / close above 7313 would be needed to invalidate the broader downtrend. Support now rests along the lower parallel (currently ~7100) with critical support steady at the November low / 2020 yearly open at 6991-7016– a break / weekly close below this threshold would be needed to mark trend resumption. Note that such a scenario would likely fuel another bout of accelerated Aussie losses with initial support objectives eyed at the September 2015 low at 6907.

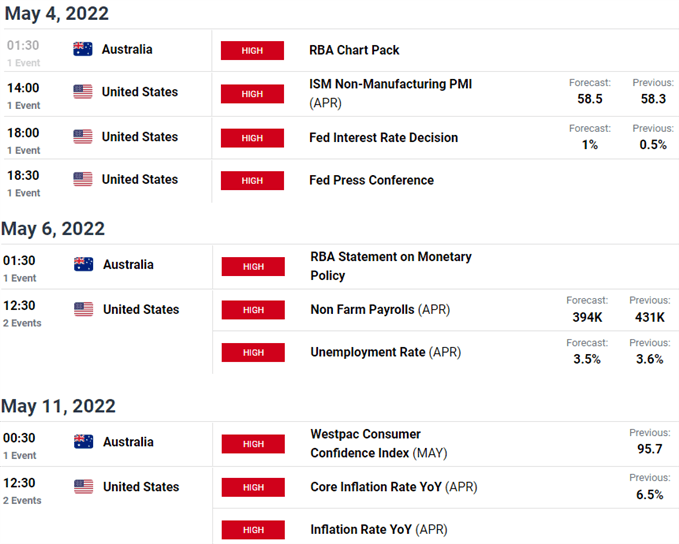

Bottom line: The Australian Dollar has rebounded off downtrend support with an embedded structure giving guidance to this near-term recovery. From at trading standpoint, losses should be limited by 7100 IF Aussie is heading higher on this bounce – be on the lookout for an exhaustion high ahead of 7270 IF the broader downtrend is to be respected. Keep in the FOMC interest rate decision is on tap today with US Non-Farm Payrolls (NFP) slated for Friday. Expect volatility and stay nimble early in the month. Review my latest Australian Dollar Weekly Price Outlook for a closer look at the longer-term AUD/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

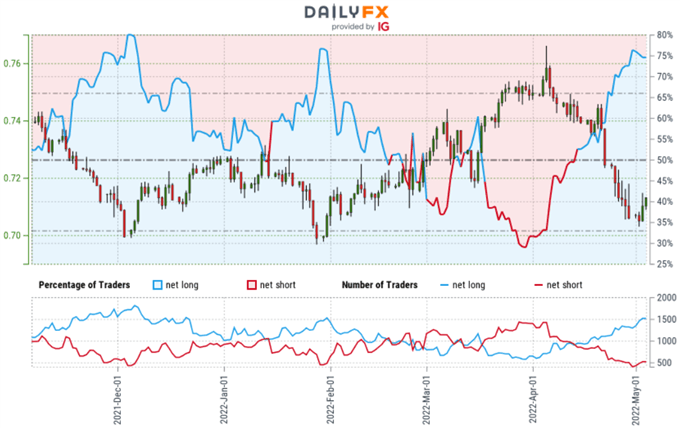

Australian Dollar Trader Sentiment – AUD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long AUD/USD – the ratio stands at +2.59 (72.14% of traders are long) – typically a bearish reading

- Long positions are0.39% lower than yesterday and 16.18% higher from last week

- Short positions are17.00% higher than yesterday and 3.47% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Trader are less net-long than yesterday but more net-long from last week. The combination of current positioning and recent changes gives us a further mixed AUD/USD trading bias from a sentiment standpoint.

Australia / US Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Active Technical Setups

– Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link