[ad_1]

Bonds issued by highly rated banks and U.S. financial institutions were under pressure on Monday after the sudden collapse of Silicon Valley Bank and Signature Bank sparked concerns about the banking system.

Bonds issued by banks and financial companies, like their stock prices, were some of the biggest movers on Wall Street on Monday.

Debt issued by Charles Schwab Corp.

SCHW,

PNC Financial Services Group

PNC,

and Synchrony Financial

SYF,

was particularly hard-hit among investment-grade corporate bond issuers, according to MarketAxess data.

“You get the first disruption of the event. It is a shock,” said Wendy Watt, a portfolio manager at Dupont Capital, speaking of the two regional bank failures since Friday. “Then everyone tries to figure out if it is an individual shock or something that could be systemic.”

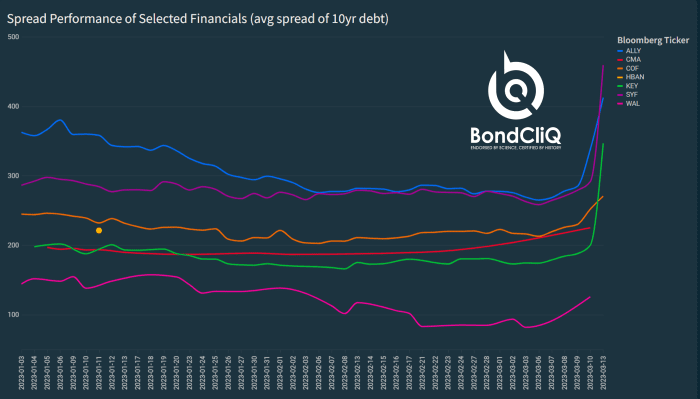

Here’s a visual look at the spread on 10-year bonds of seven financial companies on Monday compared with the start of the year, from BondCliQ, showing a big upward swing since Friday.

A look at the sharp moves in financial company debt since two big regional banks failed.

BondCliQ

Spreads are the extra level of compensation above a risk-free rate, like Treasurys, that investors require to invest in bonds that lack government guarantees. That level often increases when markets get choppy or investors become more concerned about potential default risks.

The above chart shows the spread on 10-year corporate bonds issued by Ally Financial

ALLY,

quickly topping 400 basis points above the Treasury rate, up from below 300 basis points to start the year.

See: Biden says Americans can have confidence that banking system is safe

Watt said spreads on bonds issued by big banks only were about 10 basis points wider on Monday, but that a gloomier backdrop was developing for regional banks, particularly those who saw a “creep in their mandate” in recent years into more exotic corners of finance.

On Monday, SVB Financial Group

SIVB,

the parent of the failed Silicon Valley Bank, saw its 2.1% coupon bonds due May 2028 quoted at a weighted average spread of 1,582 basis points above Treasurys, according to MarketAxess.

On a price basis, the bonds were pegged at about 45 cents on the dollar, according to MarketAxess, down from 84 cents on the dollar in early March. Wall Street broadly considers bonds distressed once prices fall below 70 cents on the dollar.

Silicon Valley Bank, a lender to the Bay Area’s “clubby” world of tech startups, venture-capital and private-equity firm, failed on Friday. It was heavily invested in rate-sensitives mortgage-backed securities that it was forced to sell at a loss as its base of deposits began to decline.

Crypto-friendly Signature Bank

SBNY,

was closed Sunday, with the Treasury Department, Fed and Federal Deposit Insurance Corp. quickly stepping in to ensure all deposits of both banks would be made whole. The Fed on Sunday also rolled out a new lending facility to help banks meet withdrawal requests, without having to sell securities at a loss.

Read: Regional banks are seeing flight of deposits to too-big-to-fail megabanks

Crypto assets, bonds, stocks and other financial assets have been dealt a sharp blow by the Federal Reserve’s tighter monetary policies, including its rapid pace of interest-rate hikes in the past year to fight high inflation.

Investors looking for safety in bonds pushed the 10-year Treasury yield

TMUBMUSD10Y,

back down to 3.515% on Monday, a part of its biggest three-session yield drop since March 2020, when the Fed was rolling out a series of emergency lending facilities to help shore up financial markets.

Stocks ended mostly lower Monday, with the S&P 500 index

SPX,

down about 0.2%, the Dow Jones Industrial Average

DJIA,

0.3% lower and the Nasdaq Composite Index

COMP,

up 0.5%.

Many companies, including those in the financial industry, were able to borrow cheaply in the past few years after the Fed slashed its policy rate to almost zero in an effort to keep credit freely flowing during the pandemic.

Low-yielding bonds have come back to bite as inflation has remained stubbornly high and interest rates have climbed. Still, Watt doesn’t anticipate another Lehman Brothers moment to unfold, referring to the contagion that gripped the global banking system after the lender failed in 2008 under the weight of its subprime mortgage and related derivatives holdings that turned toxic.

“I think the tool shed and the government’s playbook is a lot larger than it was prior to the Lehman default,” she said, pointing to efforts by regulators on Sunday to shore up confidence in banks and customer deposits, but also its pandemic-era program of buying corporate debt.

The Fed can also say, “Let’s bring back ‘buy corporate bonds’ again,” she said. “They can step back in and tighten the market back up.”

Read: Banking industry jitters could mean more pain for stocks by dragging out Fed’s battle with inflation

[ad_2]

Source link