[ad_1]

Exchange-traded funds focused on bank stocks are bouncing as investors appear to be wading back into the beleaguered banking sector amid strong trading volume in the ETFs.

The SPDR S&P Regional Banking ETF

KRE,

was up around 2.8% Tuesday afternoon, while the SPDR S&P Bank ETF

KBE,

gained 2.4% and the Invesco KBW Bank ETF

KBWB,

rose 2.8%, according to FactSet data, at last check.

Shares of the ETFs are rebounding after the sudden collapse of regional banks in recent days sparked an industry selloff, with investors anxious about whether more failures could follow the forced closures of California’s Silicon Valley Bank and New York’s Signature Bank. The U.S. government intervened, backstopping depositors to shore up confidence in the banking sector amid systemic risk concerns.

“Regional bank shares are climbing higher as if there’s an ‘all clear’ signal throughout the market,” said Quincy Krosby, chief global strategist for LPL Financial, in emailed comments Tuesday. “The intense selling pressure had the ‘sell now and ask questions later’ feeling, but questions remain whether there are risks still embedded on balance sheets, particularly if depositors continue to demand funds.”

Moody’s Investors Service said in a note dated March 13 that it changed its outlook on the U.S. banking system to “negative” from “stable,” reflecting “the rapid deterioration in the operating environment following deposit runs” at Silicon Valley Bank, Silvergate Bank, and Signature Bank as well as the failures of Silicon Valley Bank and Signature Bank.

“Although the Department of the Treasury, Federal Reserve and FDIC announced that all depositors of SVB and Signature Bank will be made whole, the rapid and substantial decline in bank depositor and investor confidence precipitating this action starkly highlight risks in U.S. banks’ asset-liability management (ALM) exacerbated by rapidly rising interest rates,” Moody’s said in the note.

‘Record’ trading volume

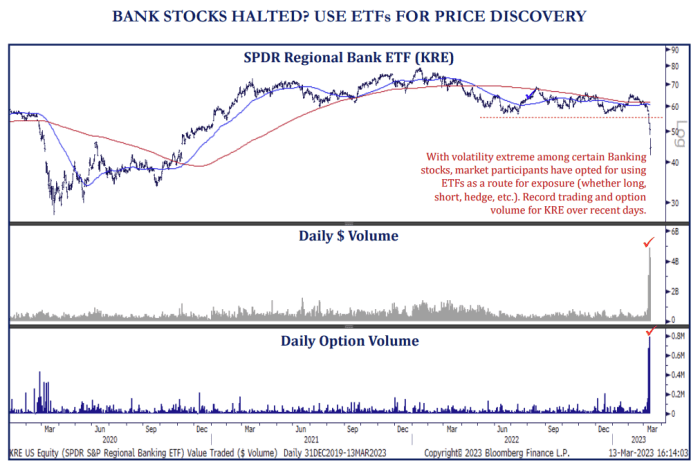

Bank ETFs have seen above-average trading volume in recent days amid “immense volatility” in the banking sector, where trading in a “bunch of stocks” such as First Republic Bank was halted on concern over plunging shares, according to Todd Sohn, an ETF strategist with Strategas.

“You’re basically using the ETF as a price discovery vehicle,” and to express investment views on the banking sector in a time of uncertainty, Sohn said by phone Tuesday.

The SPDR S&P Regional Banking ETF in particular has stood out for “record trading and option volume” over recent days, according to Sohn. Traders engage in options contracts for the right to buy or sell securities at an agreed upon price by a specified date.

STRATEGAS NOTE DATED MARCH 14, 2023

Investors and traders may be using the SPDR S&P Regional Banking ETF to make long or short bets or to hedge their positions, Sohn said. The fund saw $257 million of inflows Monday, the largest since March 2022, he said. On Friday, the day Silicon Valley Bank collapsed, the ETF had a “tiny” inflow of around $2.5 million, he added.

Meanwhile, financial stocks were among the strongest performers of the S&P 500 on Tuesday afternoon, with the Financial Select Sector SPDR Fund

XLF,

up 1.6%, according to FactSet data, at last check. That compares with a 1.2% gain for the S&P 500 index

SPX,

in Tuesday afternoon trading.

“In this headline driven market, much depends on the banking sector stocks to see the kind of inflows to suggest that the worst is truly over,” said Krosby.

State regulators closed Silicon Valley Bank on Friday, and on Sunday they shut down Signature Bank. The U.S. government intervened on Sunday, with the Treasury Department, Federal Reserve and Federal Deposit Insurance Corp. announcing that all depositors in the two institutions would be made whole. The Fed also created the Bank Term Funding Program, offering loans to banks to help them meet the needs of all their depositors.

First Republic Bank

FRC,

was surging Tuesday afternoon, up around 29%, according to FactSet data, at last check. First Republic said Sunday that it has “further enhanced and diversified its financial position through access to additional liquidity from the Federal Reserve Bank and JPMorgan Chase & Co.”

Shares of JPMorgan

JPM,

which on Monday was the largest holding of the Invesco KBW Bank ETF, were up 1.3% in Tuesday afternoon trading. So far this week, JPMorgan has edged down 0.5%, compared with plunge of around 50% for First Republic shares, FactSet data show, at last check.

[ad_2]

Source link