[ad_1]

The rotation into technology stocks and other pandemic winners as banking jitters rattled markets in March makes it difficult to tell if investors think the U.S. economy looks headed for a recession or not.

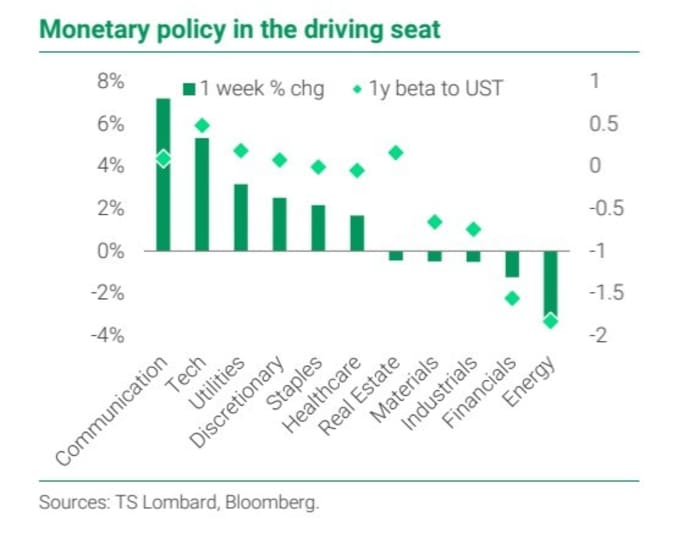

TS Lombard’s strategists Skylar Montgomery Koning and Andrea Cicione said the move into rate-sensitive stocks like tech and communications (see chart) looks misguided, in a Wednesday client note.

Pressure on energy, financials and more reflects investor concerns that monetary policy will sink the U.S. economy into a recession

TS Lombard

While investors appeared less worried about a full-blown banking crisis unfolding than a week ago after regulators in the U.S. and Europe stepped in to shore up confidence in the banking system, the TS Lombard team said the subsequent rally in technology stocks is “largely ignoring” the pressure of tighter lending standards on the U.S. economy.

“The main implication of banking-sector distress is the accelerated tightening of lending standards that was already under way, squeezing the economy and weighing on growth,” the TS Lombard team wrote.

The financial sector of the S&P 500 index

SPX,

was up 2.9% for the week through Wednesday afternoon, according to FactSet, even though shares of First Republic Bank

FRC,

were 33.9% lower for the same stretch.

Concerns about a potential U.S. recession, the TS team argued, has been reflected in recent downward pressure in commodity markets, with energy commodities down about 10% and industrial metals down roughly 3% in the past week-and-a-half.

Prices for the U.S. benchmark West Texas Intermediate crude

CL00,

were higher Wednesday, but still 8.6% lower in March, according to FactSet.

Meanwhile the TS team pointed to communication and technology stocks that have gained more than 5% over the same stretch, as investors consider the possibility of “deep” interest-rate cuts from the Fed in the second half of this year, but not the likely impact a recession would have on earnings and growth.

Technology stocks boomed during the easy-money days of 2020 to 2021 as a bazooka of monetary and fiscal support was fired off to help stabilize households and the economy. They were hit hard last year as the Fed began to raise rates at the quickest pace in decades.

Against that backdrop, Treasury yields, including the benchmark 10-year rate

TMUBMUSD10Y,

for the economy have climbed, up 3.6% on Wednesday from a 1-year low of 2.3%.

The tech-heavy Nasdaq Composite Index

COMP,

was up 3.6% in March through Wednesday, but up 13.4% on the year, outperforming the two other main stock indexes, according to FactSet.

[ad_2]

Source link