[ad_1]

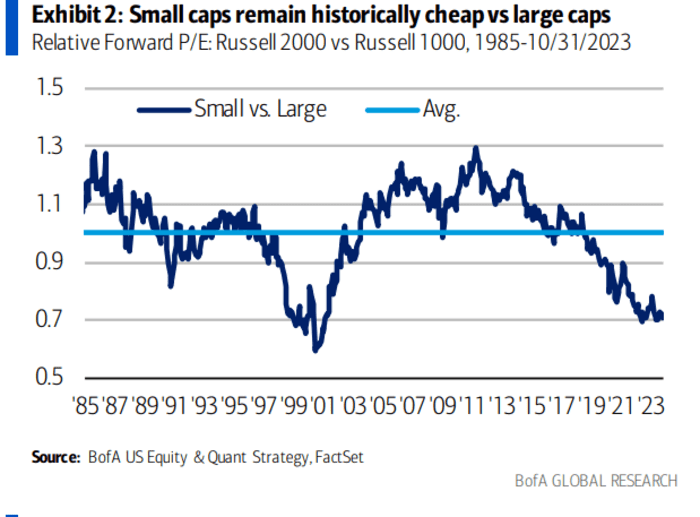

Small-cap stocks have hit their cheapest level in 14 months, making them much cheaper than their large-cap peers, according to BofA Global.

While that doesn’t necessarily mean battered small-cap stock prices will rise soon, it can point to better returns for the segment in the longer-term, analysts at the bank wrote, in a Monday client note.

Small-cap stocks have significantly underperformed their large-cap peers so far this year, with the Russell 2000

RUT,

a small-cap benchmark made up of the 2,000 smallest companies by market capitalization in the Russell 3,000

RUA,

losing 3.1% year-to-date, versus a 15% gain of the large-cap benchmark S&P 500

SPX,

and a 32% return of the tech-heavy Nasdaq Composite

COMP,

according to FactSet data.

With a recent equity selloff, the price per earnings ratio of the Russell 2000 fell to 12.3, a 14-month low, according to BofA Global.

BofA Global Research

Meanwhile, small-caps remain the cheapest size segment by market capitalization, trading at a 19% discount to historical averages, while midcap stocks are trading at a 4% discount, according to BofA Global. Large-cap stocks were trading at a 12% premium to historical averages, while megacap stocks, represented by Russell Top 200

XX:RT200,

were trading at a 18% premium, their data showed.

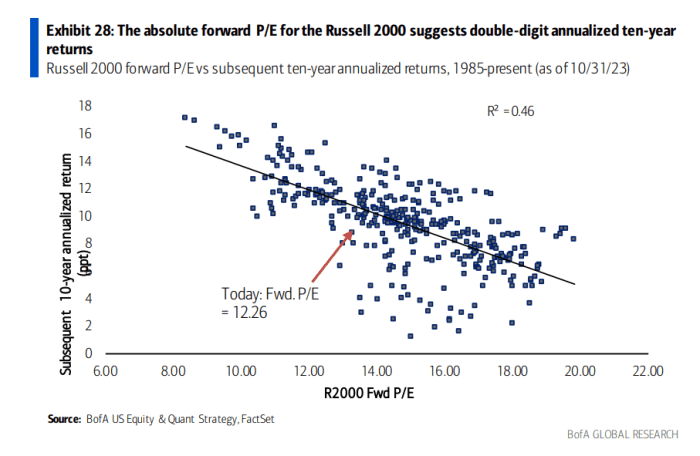

The relatively low valuation of small-cap stocks doesn’t necessarily mean their prices will rise soon, as valuation tends to be a poor short-term timing indicator, but it has more explanatory power over the long term, according to the analysts.

Read: Tempted to go bargain-hunting for small-cap stocks? Why you might want to wait.

Over the next decade, the Russell 2000’s price per earnings ratio implies a 12% annualized return, versus a 7% gain per annum for the Russell 1000, the analysts noted.

BofA Research

[ad_2]

Source link