[ad_1]

Roughly a month after the banking crisis, the coast may be clearing for companies to start dipping a toe into debt markets again, with news of Walmart’s $5 billion debt deal.

As MarketWatch’s Joy Wiltermuth reports, strong demand from investors helped ease the retail giant’s borrowing costs, though she adds that after a decade of ultralow rates, rising borrowing costs will eventually pinch corporate profits.

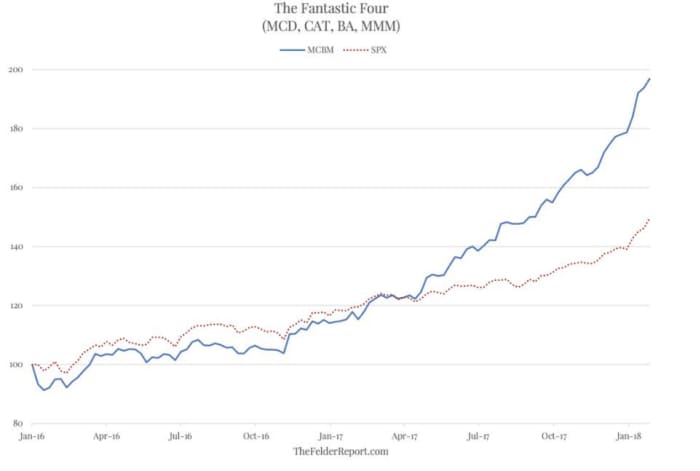

Onto our call of the day from the founder of Felder Investment Research and blogger at The Felder Report, Jesse Felder, who has scratched the surface of stock performances for four popular blue-chip companies and found…a lot of debt.

Felder dubbed those stocks — McDonald’s

MCD,

Caterpillar

CAT,

Boeing

BA,

and 3M

MMM,

— the “Fantastic Four,” because in the two years leading up to the start of 2018, they “dramatically” outperformed the broader market and big tech names, though their underlying businesses didn’t seem to merit that.

Here’s his chart, showing the “Four’s” performance versus the S&P 500

SPX,

since early 2016:

Felder said he was initially puzzled over the fact falling aggregate sales for the four didn’t stop stock and collective valuations from soaring. “After forming a range of about 1.5 to 2-times enterprise value [market cap plus total debt] -to-revenues, these stocks as a group saw this ratio soar to unprecedented heights in the back half of the 2010s,” he said.

But then a look at their balance sheets revealed that they collectively had taken on over $100 billion in new debt to finance buybacks of roughly the same amount.

“In essence, it was just a massive equity-for-debt swap and all that new debt-financed demand for those shares explained how valuations soared even as business conditions stagnated,” Felder said. “Even as share counts fell, market cap rose due to all the buying they were doing; add in all the new debt on the balance sheet and enterprise values were soaring even faster than the share price.”

Aggregate net debt and stock buybacks for the ‘Fantastic Four’

The main beneficiaries of this “financial engineering” were top executives, granted billions of dollars worth of options-based compensation, said Felder, who added that they personally sold shares as their companies were buying back. He says it’s more proof to him that buybacks are “thinly-veiled stock price manipulation schemes,” as opposed to more transparent tender offers.

“Because the majority of their compensation comes in the form of options, executives have a huge incentive to engage in manipulation and statistics show they do, in fact, pursue such policies,” said Felder.

Meanwhile, he cautions that those blue chips could face trouble down the line amid elevated interest rates — much higher than when those equity-for-debt swaps were taken. That’s as valuations remain extreme and underlying business trends aren’t any more exciting, he argues.

Felder makes clear that he isn’t labeling McDonald’s, 3M, Deere or Boeing as “distressed” companies.

“However, that doesn’t mean that rapidly rising interest expenses eating up more and more operating income can’t represent the sort of structural headwind to profits that would inspire a reversion in valuations in the group back closer to historical norms,” he said.

And the real pain could fall on investors who, unlike executives, haven’t taken advantage of the buyback-driven lift to stocks and sold billions of dollars worth of shares, said Felder.

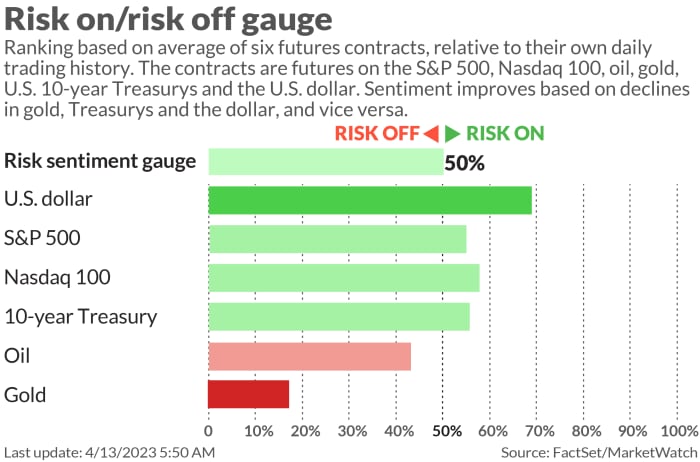

The markets

Stock futures

ES00,

NQ00,

are edging north after gains faded for equities on Wednesday, post the Fed minutes. Bond yields

TMUBMUSD02Y,

TMUBMUSD10Y,

are mostly steady, while oil prices

CL.1,

hover at November highs. Bitcoin

BTCUSD,

is holding steady at just over $30,000.

Read: What is Ethereum’s Shanghai upgrade? Here’s how it might affect the price of ether.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Delta Air Lines

DAL,

has reported an earnings miss. Friday will see a bank-led kickoff of first-quarter earnings reporting season, featuring JPMorgan

JPM,

Wells Fargo

WFC,

Citi

C,

and First Republic

FRC,

among others.

Amazon.com

AMZN,

says its AWS cloud business is facing short-term headwinds amid cautious company spending. Shares are up 0.5% in premarket.

Sportsman’s Warehouse stock

SPWH,

is down 16% in premarket after the sporting good retailer forecast a sharp sales fall and surprise loss for the current quarter.

Harley shares

HOG,

are down 4% after news CFO Gina Goetter is leaving the motorbike maker for Hasbro

HAS,

Alibaba stock

BABA,

is up about 1.6% in premarket, following a report SoftBank sold most of its stake in the China tech giant.

Investors with short positions — selling stocks they don’t own — on AMC Entertainment

AMC,

and GameStop

GME,

could be in trouble, says analyst.

China’s exports unexpectedly jumped 14.8% in March, the first gain in six months.

Producer prices are due at 8:30 a.m., alongside weekly jobless claims.

Best of the web

Beer sales are stuck between a Kid Rock and a hard seltzer.

Amazon workers’ serious-injury rates still double those of other warehouse workers, study shows.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

BUD, |

Anheuser-Busch InBev |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

BBBY, |

Bed Bath & Beyond |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

NIO, |

NIO |

|

BABA, |

Alibaba |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

MULN, |

Mullen Automotive |

Random reads

The internet is smitten with Snoopy’s real-life doppelgänger

New York’s first rat czar will earn $155k a year.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link