[ad_1]

Bitcoin (BTC), Ethereum (ETH) – Prices, Charts, and Analysis:

- Spot BTC and ETH ETFs in Hong Kong are imminent, according to sources.

- Bitcoin halving is set for this week.

- Prices rebound after heavy weekend sell-off.

Download our Q2 Bitcoin Technical and Fundamental Reports Below

Recommended by Nick Cawley

Get Your Free Bitcoin Forecast

Bitcoin and Ethereum are pushing higher in early European turnover on rumored news that the Hong Kong Securities and Exchange Commission has given the green light to multiple applicants for spot BTC and ETH exchange-traded funds (ETFs). China Asset Management (HK) Ltd, one of the companies seeking approval, put out an announcement on its website earlier today:

However, at the time of writing, there has been no official comment on any approval stories, or announcements, by the HK SEC.

While the HK media stories are grabbing market attention today, the Bitcoin halving event will dominate headlines later this week. According to the latest mining data, there are 683 blocks left to be mined before mining rewards are cut by 50%. The estimated halving date is seen early morning on Saturday 20th.

The cryptocurrency was hit hard over the weekend after Iran carried out a series of strikes against Israeli territory. The attack, in response to Israel’s attack on Iran’s consulate in Syria at the start of the month, saw in excess of 350 drones and missiles launched by Iran. According to the Israel Defence Force (IDF), ‘99%’ of these ‘threats’ were successfully intercepted. With the cryptocurrency sector being the only market open over the weekend, traders used the sector’s liquidity to hedge risk. Bitcoin hit a low of $60.6k as news of the impending strike filtered through, while Ethereum hit a multi-week low of $2,845. In the altcoin space, losses of 25% or more were seen, sparking multiple liquidation stories. Prices across the board are pushing higher today, but the weekend’s losses will take some time to fully recover.

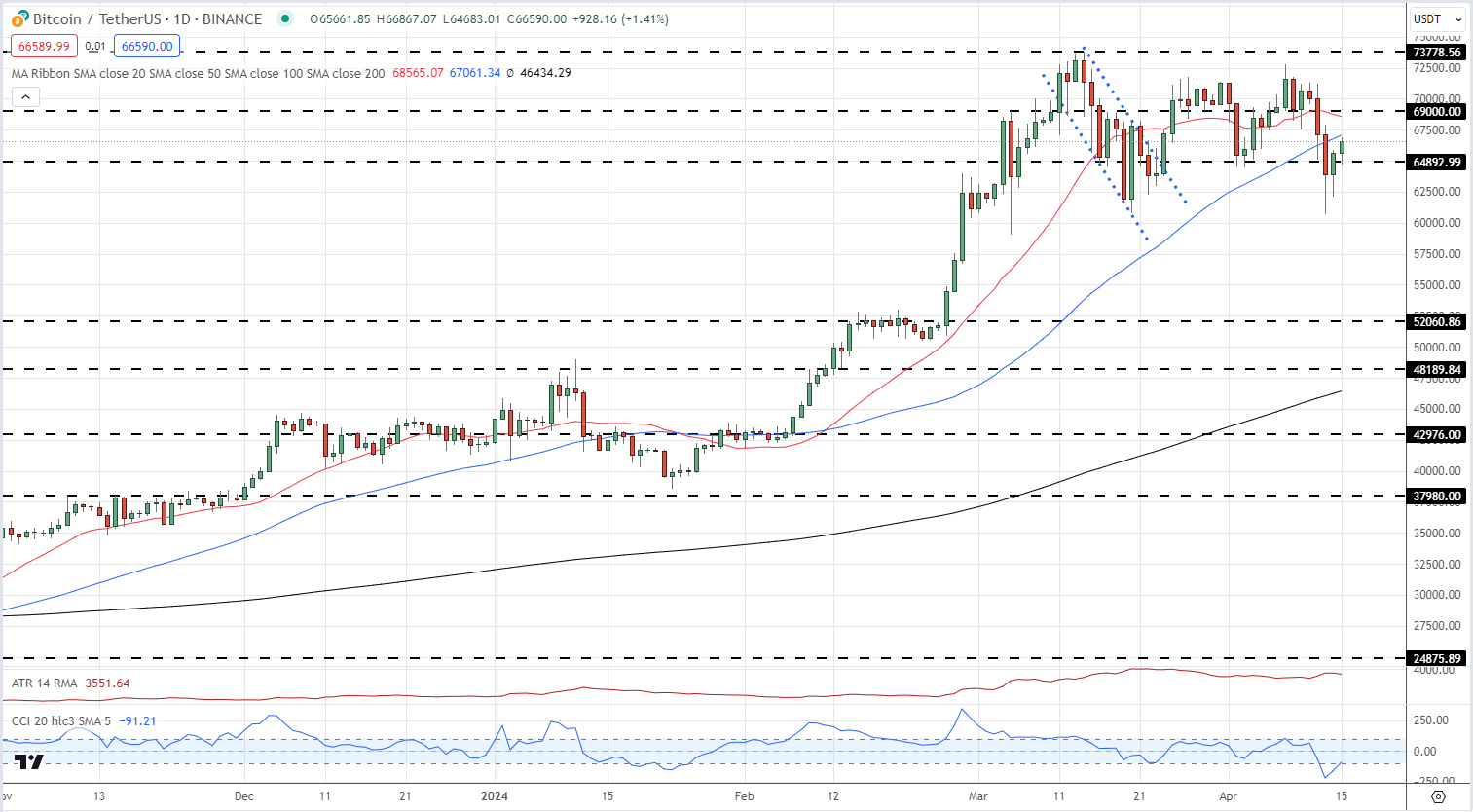

The weekend sell-off saw Bitcoin fall below both the 20- and 50-day simple moving averages for the first time since late January. Both of these will need to be recovered convincingly, along with a prior resistance-turned-support level at $69k, before Bitcoin can make a fresh attempt at the mid-March $73.78k all-time high.

Bitcoin Daily Price Chart – April 15th, 2024

Learn how to trade cryptocurrencies with our complimentary guide

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

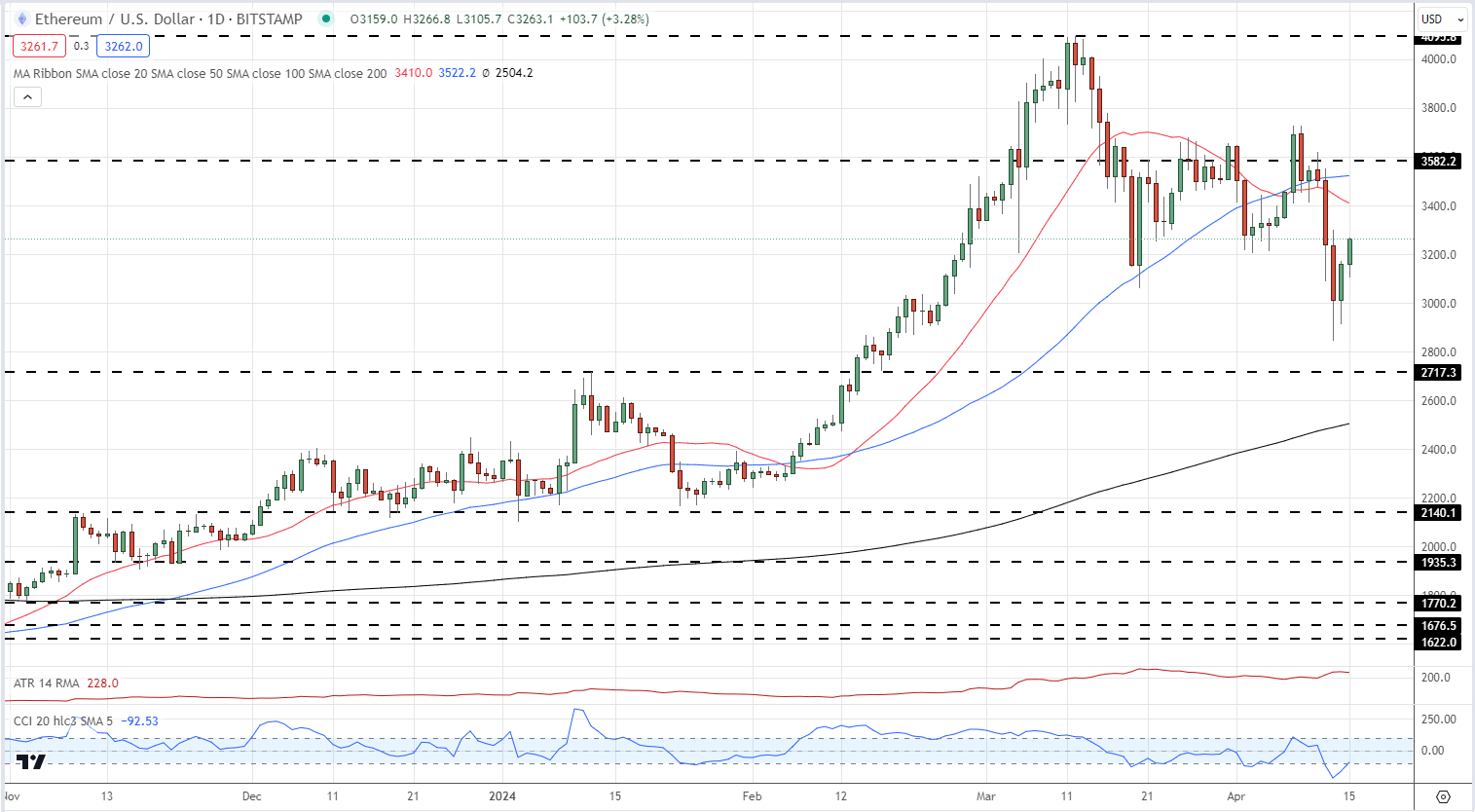

Ethereum is over 3% higher today after making a multi-month low of $2,845 on Saturday. Ethereum must reclaim both the 20- and 50-day moving averages before $ 3,582 comes back into play. Above here, the April 8th/9th double high at $3,728 comes into focus.

Ethereum Daily Price Chart – April 15th, 2024

All charts via TradingView

What is your view on Bitcoin and Ethereum – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.

[ad_2]

Source link