[ad_1]

BTC/USD & ETH/USD Technical Outlook

- BTC rolling over hard from top of channel, lower side likely to break at some point soon

- ETH has been stronger, but with 1700 looking set to break momentum could accelerate lower

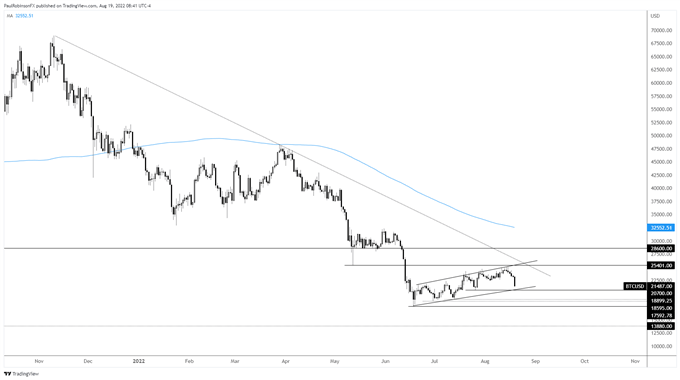

BTC/USD is coming off the top of a channel that is taking on the shape of a bear-flag formation within the context of the continued unwind of speculative excesses. The sharp turn lower this week is coming just as risk sentiment turns just slightly, which in my view is a testament to just how weak cryptos are.

The next level of support within the channel/bear-flag is the lower trend-line off the lows and a low within the structure at 20700. A break below there is seen as kicking off the next wave of selling. Minor support clocks in around 19000/18600, but the major level to watch is the June low at 17592.

A breakdown below that level is seen as likely towards the 2019 high at 13880. Even with that as support it is expected that at some point BTC/USD goes well below the 10k mark. The selling at some point will go from swift down-moves to more of a grind lower as residual selling becomes the theme.

For now, taking it one step at a time and focusing on the bottom of the channel/bear-flag and seeing whether that will hold in the near-term or is ready to break on this move.

BTC/USD Daily Chart

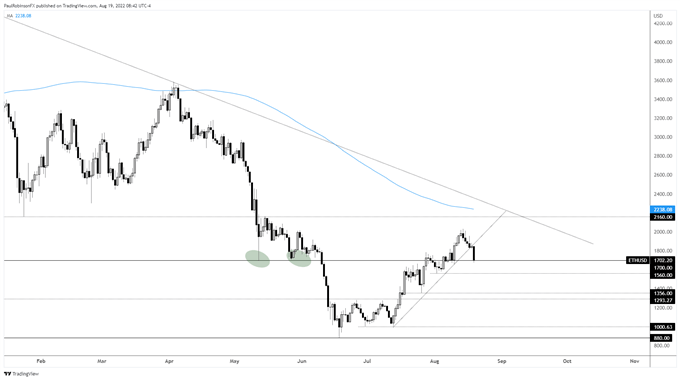

ETH/USD has fared better than BTC/USD, but is expected to get hit hard in the next down-move. It was able to cross over the important 1700 mark, but that is in jeopardy of failing now as the turn lower begins.

The first minor level of support clocks in at 1560, followed by 1356, 1293, and 1000. The 880 low will likely become the focus as soon as this fall, and like BTC/USD is anticipated that price will fall much further than the June low.

ETH/USD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link