[ad_1]

GBP/USD – Prices, Charts, and Analysis

- Bank of England hikes interest rates by 25 basis points

- Interest rate vote split 6 (0.25%) – 3 (0.50%)

- Sterling tumbles on a weaker outlook.

The Bank of England (BoE) today raised interest rates by 0.25% to 1%, taking the UK Base Rate to the highest level in 13 years. The members of the Monetary Policy Committee voted by a majority of 6-3 with the minority voting for a 0.50% increase. At the last meeting in March, the committee voted 8-1 to raise rates by 0.25% with one member, Sir Jon Cunliffe, voting to keep rates unchanged.

The vote split was a surprise for the market with few forecasters looking for three 0.50% rate hike calls. In another shock, the BoE said that inflation could rise to ‘around 10% this year’ with price pressures expected to ease in 2023 and be close to target in 2024. UK growth is also seen slowing sharply.

British Pound Forecast – The Bank of England is Walking a Tightrope

For all market-moving economic data and events, refer to the DailyFX calendar

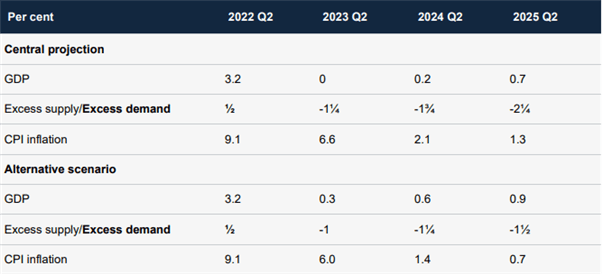

The latest MPC updates show the central bank’s central projections of growth at 3.2% in Q2 and flat growth in Q2 2023 with CPI inflation hitting 9.1% in the same time period before falling back to 6.6% in Q2 2023.

Quantitative Tightening

The MPC said on quantitative tightening (qt), that it ‘reaffirms that the decision to commence sales will depend on economic circumstances including market conditions at the time, and that sales would be expected to be conducted in a gradual and predictable manner so as not to disrupt the functioning of financial markets’. So further passive tightening – no reinvestment of maturing bonds – but no active selling of bonds yet.

The British Pound fell back below 1.2500 after the release with markets now starting to look more closely at the worsening economic outlook for the UK. GBP/USD tumbled by around 100 pips and is close to printing a new two-year low.

GBP/USD 5 Minute Price Chart – May 5, 2022

Retail trader data show 81.47% of traders are net-long with the ratio of traders long to short at 4.40 to 1. The number of traders net-long is 7.49% lower than yesterday and 3.48% lower from last week, while the number of traders net-short is 7.87% lower than yesterday and 3.58% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link