[ad_1]

German CPI Overview:

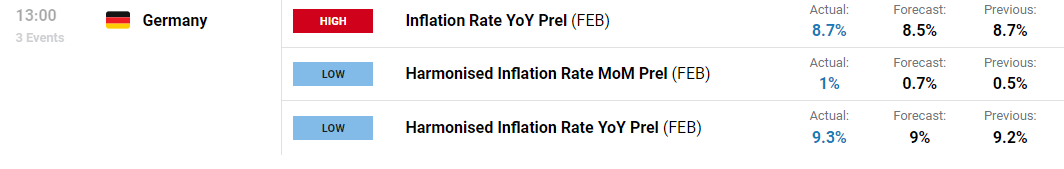

- German CPI Preliminary (Feb) unchanged at 8.7%, missing expectations of 8.5%

- Harmonized inflation (incl food and energy) rises to 1% (MoM) as food costs remain elevated.

- EUR/USD rises with hawkish expectations for the ECB

German inflation unchanged as CPI shows no sign of easing

German CPI data for February has been released, with the figures beating expectations on both an annual and month-on-month basis. As the YoY inflation rate remains unchanged at 8.7%, harmonized inflation (including food and energy) rate has risen to 9.3%.

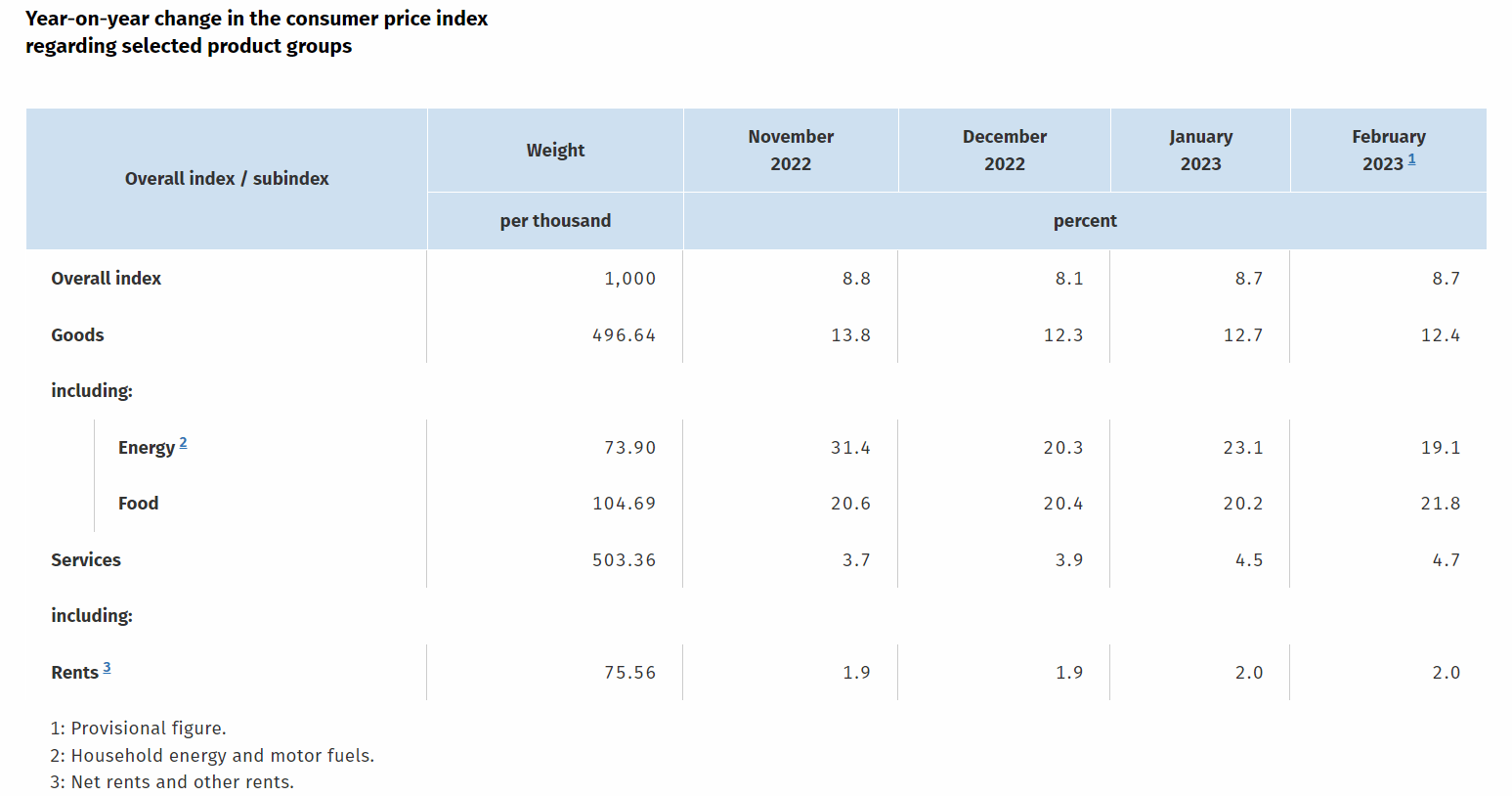

The data that measures the change in the prices of goods and services over a predetermined period suggests that price pressures could remain elevated for longer.

Source: German Federal Statistics

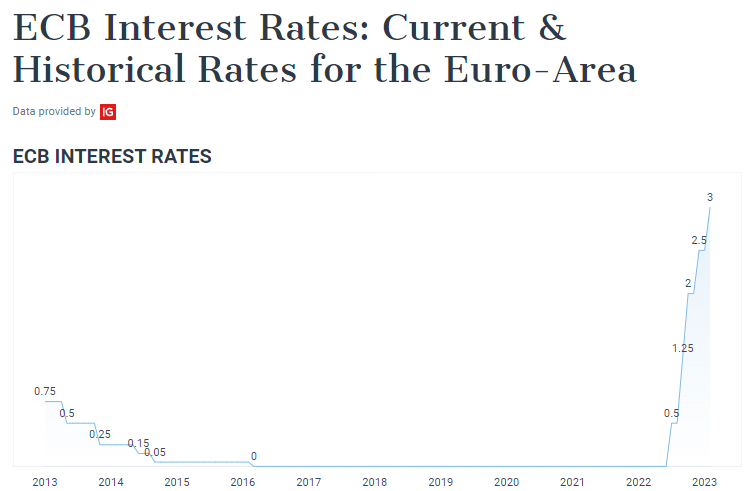

While the ECB (European Central Bank) planned to raise rates by an additional 50 basis-points later this month (16 March), the recent readings from Spain, France and Germany poses an additional threat to the European growth outlook.

Under ‘normal’ circumstances, higher interest rates reduce consumer spending, driving inflation lower. However, in the aftermath of the Coronavirus pandemic, ballooned balanced sheets and the conflict in Ukraine has forced policymakers to take a more aggressive approach. For the central bank monetary policy remains focused on achieving ‘full employment’ while maintaining price stability.

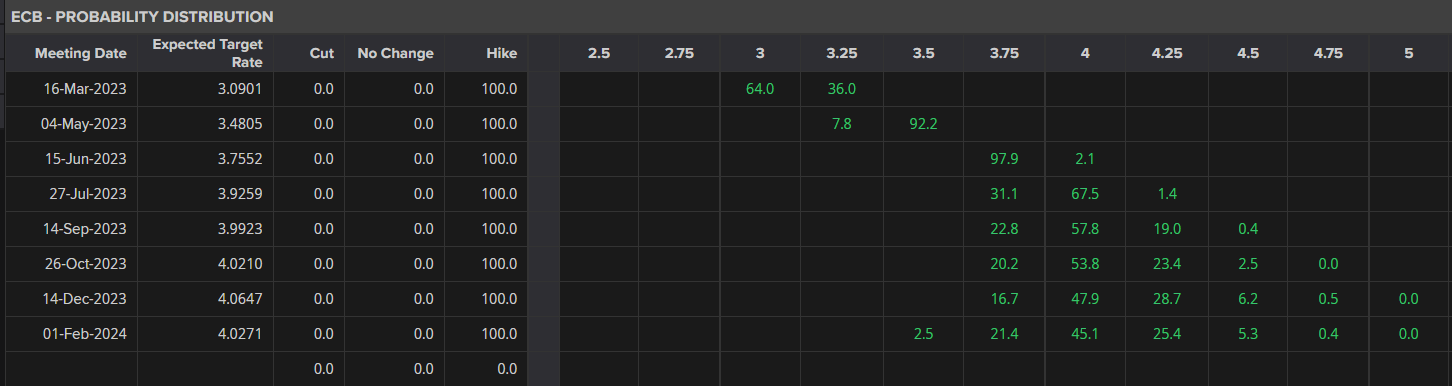

With ECB president Christine Lagarde stressing the commitment to tame inflation through additional rate hikes, market participants are now expecting terminal rates to reach 4% by July (currently at 2.75%).

Source: Refinitiv

With Eurozone inflation on deck (released 2 March at 10:00 GMT), the repricing of information has supported German yields, pushing the two-yields to their highest levels since 2008.

In response to the latest forecasts, EUR/USD has risen, with investors now anticipating that the ECB will remain more hawkish for longer than its Federal Reserve counterpart.

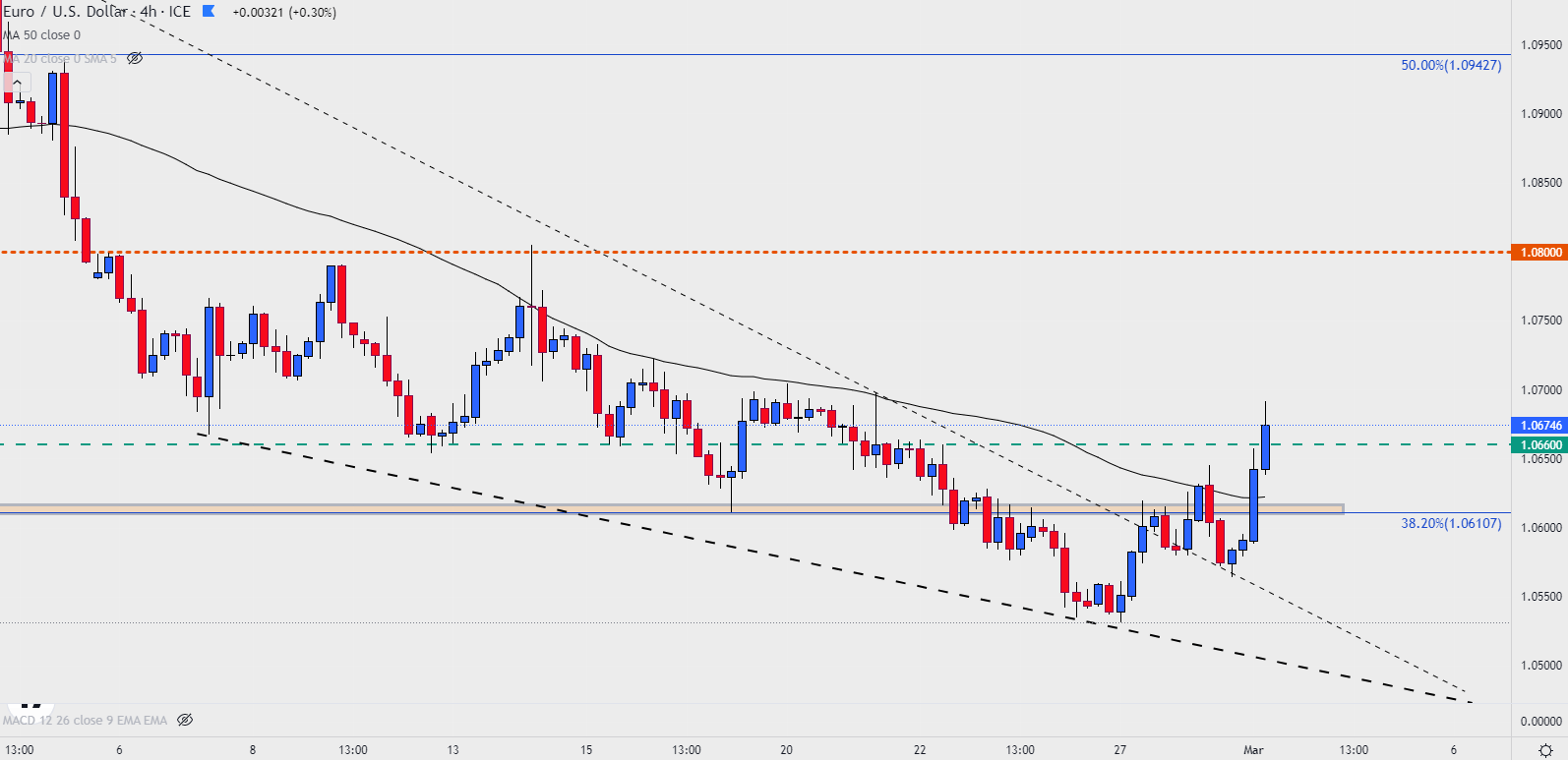

EUR/USD Price Chart

Chart prepared by Tammy Da Costa using TradingView

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link