[ad_1]

POUND STERLING TALKING POINTS

- Key UK and U.S. economic data later this week.

- BoE speakers inf focus today.

- Short-term upside may be on the cards.

GBP/USD FUNDAMENTAL BACKDROP

Last week’s rollercoaster ride for FX markets is unlikely to extend through to today as the Juneteenth holiday in the U.S. should come with lower market volatility. Through the Asian session, price action on GBP/USD has been muted with no significant news/announcements from the weekend.

Earlier this morning the UK’s Treasury Minister Simon Clarke did mention that they do no expect a recession which may have given rise to cable’s marginal rise shortly after the statement.

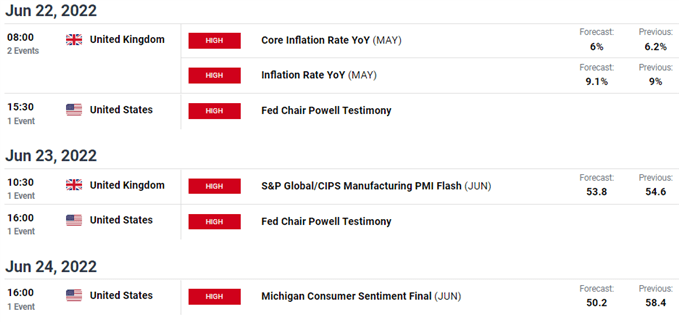

A reminder of the upcoming events this week include inflation data for the UK on Wednesday (see calendar below) along with fed Chair Jerome Powell’s testimony. Both could influence GBP/USD as well as the current central bank (Bank of England (BoE) and Fed) narratives. A stronger inflation print may well prompt the BoE to hike by 50bps in August which they have left open for consideration (mentioned in last week’s BoE rate decision).

Later today, we do have the BoE’s Mann and Haskel speaking with discussions around last week’s rate decision and associated risks being addressed.

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Despite the many fundamental headwinds facing the pound against the dollar, the fact that sterling has held above 1.2200 post-FOMC shows the markets unexpected confidence in GBP. I think short-term, a lot hinges in the CPI print on Wednesday which could propel cable to subsequent resistance targets should actual data exceed expectations.

Key resistance levels:

- 1.2400

- 20-day EMA (purple)

Key support levels:

- 1.2200

- 1.2080

- 1.1934 (swing low)

HESITANT IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 74% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term mixed bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Source link